The second machine age is well underway—from automation of cognitive tasks to the rise of artificial intelligence (AI)—and with it, the economic impacts of innovation that measure beyond gross domestic product (GDP). Innovation advances business practices, services, and products, and when it permeates the economy, innovation increases productivity, and spurs economic wealth creation. But not all innovation will ultimately be successful or create value. I recently discussed investing in innovation as part of our “What Our Managers Think” series with Aram Green, Managing Director at ClearBridge Investments, and Matt Moberg, Senior Vice President with Franklin Equity Group.

- We think the most likely case is that the inflation we are experiencing today is transitory. Current inflation tailwinds may fade later in the year as supply-chain detangling allows production and supply to finally meet demand, demand from fiscal stimulus slows, China’s economy decelerates, and the long-term structural factors that kept pricing—innovation and its productivity gains—continue. Inflation may, however, continue to look worrisome for the near to intermediate future as demand is strong and supply-chain issues crimp production.

- Investing in innovation requires intuitive and fundamental knowledge of the underlying technology, how it will be implemented, and as Matt discussed, the trajectory, both in terms of duration and magnitude, of its growth.

- Growth stocks, because of the longer duration of their earnings, can be very sensitive to rising interest rates and potential inflation. However, rising interest rates can be an advantage when an innovative company is competing for capital. Awareness and caution about potential long-term inflation are important investor considerations.

- Innovation is one of the most inefficient parts of the equity market in large part because we have found innovative companies to be one of the most misunderstood parts of the market. Matt believes the most common areas that are misunderstood are either the pace of change (disruption) or the duration (length of time) that the innovation will last.

We’re experiencing accelerated new product development with launches occurring faster than ever before, which is creating a new global economy.

Read more below from the roundtable:

Stephen: There’s a lot of talk now about growth stocks, particularly being very sensitive to rising interest rates. Matt, how do you think about potential risks with inflation and rising interest rates?

Matt: Well, the first thought, as it pertains to rising interest rates, is that it’s healthy from the standpoint that we want competition for capital. We want there to be many places to deploy capital, and we don’t necessarily want over-investment in some of these brand-new markets that are just starting to develop, because we want them to be extremely profitable…The second piece to that is we continue to think we are in a deflationary environment over the long term, and that is due to innovation.

Last year, we saw a lot of productivity gains. We’ve seen that there were 7% more units shipped with 2.5% fewer employees.1 That is productivity. In the US, we are seeing movement, moving out to suburbs and low-cost states, etc. Housing prices on aggregate are rising, but what’s really going on is people are actually moving to lower-cost regions and that movement will be deflationary.

And then, you have some capital assets that are being utilized in ways that never were before. So, with companies like Airbnb or VRBO, we are starting to see more hotel rooms can be added to a city without using any capital at all. Same for rideshare services like Uber or Lyft, in which the utilization rates of a national or international auto fleet actually start to increase in a way that’s actually meaningful… I think a good analogy would be the truck driver…A 30-year-old truck driver today is experiencing higher wages, experiencing bottlenecks right now in the ports as we’re reopening the economy, and business right now for that long-haul truck driver is really good. But over the long term, over a 10-year period, my guess is that truck drivers are still concerned about automated driving and what technology is going to do to their jobs.

So, we sort of view it from a short-term basis and the long-term basis. In the long term, we still think the level of technology is very deflationary, but we acknowledge that right now during stimulus and during this reopening period, we’re going through an inflationary period.

Stephen: Matt, just as you were saying that, it reminded me of discussions we have had about how you look at risk management, particularly in really volatile times. Could you both just talk a little bit about how you think about risk management in the portfolios?

Matt: When investing in innovation, we are trying to look for asymmetric return, which is when upside is basically unlimited, and we try to limit the downside. When we think about risk parameters, we try to think about things from that angle and seek to reduce exposure to companies which are not performing as well as we are expecting. We are looking for fundamentals to continue to improve and even add to our portfolio holdings as they continue to improve.

We are looking for companies that we think are executing and growing well in excess of GDP for these long-term time horizons: five-, seven-, 10-year time horizons…And what can often happen, is most of these businesses, if they start to fail or if they’re not able to sort of hook, then we see them decline precipitously. So, and from that perspective, we’re much less likely to try to average down given that 10-year time horizon; we try not to average down on cost. And so, those are some ways in which we try to add some risk controls into the portfolio.

Aram: We de-risk the business across three key pillars. The first is the business model, really understanding all the intricacies of the business model itself, understanding what capital needs to be redeployed back into the business, what sort of modes or intellectual property barriers there might be to competition. Then, we look at the balance sheet to understand and make sure that there is proper capital adequacy, not only for today’s environment, but for maybe choppier waters ahead. And then we spend time understanding management, management’s incentives, their track record, and what their game plan is. How they plan on out-executing competitors under a range of different market environments? And then, only then, do we look at valuations. So, we really have to understand that business first and that’s where we spend the bulk of our time before turning to valuation.

Stephen: Markets are at a high level, P/E ratios are at a high level, inflation is now a concern, especially with growth stocks. So, how do you feel comfortable with current valuations?

Aram: We believe that investors should not get vertigo when looking at stocks with high multiples. A low multiple or a high multiple isn’t a good predictor of whether a stock or investment is cheap or expensive. Oftentimes, we find that companies with low multiples are cheap for a good reason. There’s something structurally broken about the business, it’s laden with debt, various other reasons. Likewise for a company that has a high multiple, we really need to understand all the fundamental dynamics of a business before looking at those multiples. And the way that we approach it includes looking at the addressable market for which this company fits, making sure that there’s that product or service fit, spending time to understand the unit economics and the returns of the business in today’s market environment, as well as future market environments, and spending a lot of time de-risking the business to understand the visibility and the durability of the growth and returns out of the business.

And a big element of that is understanding the ESG [Environmental, Social and Governance] risks, as well, because that could seriously derail an investment if there’s underlying misalignment between investors and the company or management team in terms of how their incentives [are structured], where the company is deploying capital, and other environmental or social risks that are underlying the business service or product. And so, it’s always all of those elements to understand, and de-risk that helps you unfold where the opportunity is, and to put that multiple into context…

There always are areas or specific companies that are overvalued where there is risk in buying a specific investment at a high multiple that isn’t properly discounting some of those things that are underneath the surface. We think it’s important to have a balance in the portfolio, being spread out across a range of different industries and sectors, as well as having some companies that are very high multiple for good reason, as well as having more moderate multiples, but again, are appropriately valued based upon those criteria that we discussed earlier.

Stephen: Matt, where are you most excited about innovation and the future and opportunities right now?

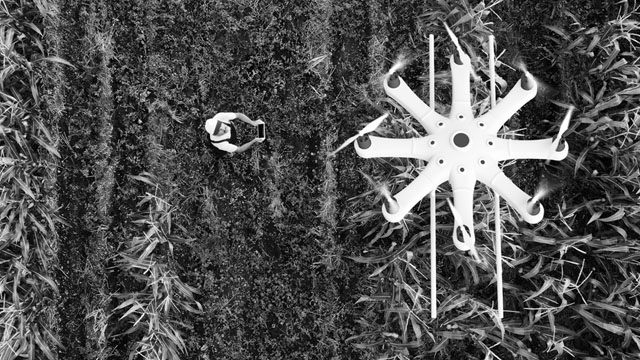

Matt: We’ve developed five platforms in an effort to try to explain and distill all the change that’s going on in the marketplace. They’re also things that we think will change over time. But we think that where there’s a lot of innovation happening is in disruptive commerce, in genomic advancements, intelligent machines—which is really AI [artificial intelligence] applied to our physical lives—in finance, and then within exponential data. I think what’s interesting about them [these platforms] is they really have different moments in which we think that they are going to hit… [The platforms] illustrate how much change is happening across the entire economy…E-commerce just inflected positively; payments are inflecting positively right now. COVID-19 has really helped with vaccines and a lot of that is based on gene sequencing and genomics, etc.

We’re going through a period of unprecedented change. In our opinion, it’s very similar to what happened over 100 years ago in the second industrial revolution, where there was so much change going on throughout the economy, with absolute new leaders, where we see businesses that are now five times the size we have ever seen before, and they have those profits to back them up. Therefore, we feel like we’re just going through this period of unprecedented change and it makes us very enthusiastic about the future.

Stephen: I just want to throw each of you a quick question, the same question for each of you. But first you, Aram: What are you concerned about right now? What keeps you up at night?

Aram: I think if you’re not worried about inflation right now, then you’re kind of missing something. What worries me is the talk out of the Federal Reserve [Fed] right now. The Fed seems to have an insensitivity or lack of acknowledgement that we’re seeing broad-based inflation and we’re having a hard time getting people back to work as the stimulus checks continued to roll into their accounts. That’s a problem and there’s definitely some of that that is temporary, but it’s really hard to see how much is temporary versus much more structural given the big changes in policy in Washington. That has me worried because it’s been a very long time since we’ve seen something like that. And, once the Fed gets behind, it’s very hard to catch up. So, I’m not, we’re not ignoring it. We’re definitely paying attention to it.

Matt: When we think about inflation, we think about, are these big changes in the economy? Is e-commerce going to continue to grow? Are there still going to be advancements in genomics? Are there still going to be advancements in EV [electric vehicles] and automated driving? We think from our research that these things are still marching forward, they are going to change our economy, and that leaves us with a lot of different investing opportunities. When we think out three-, five-, 10-years, we’re actually very, very positive.

The last thing I would say is, and this is really embedded in our philosophy, but we just really approach the markets with this deep humility. I would not tell you that we saw COVID-19 coming, and there are many other things that have happened in the market that we didn’t necessarily see coming. And so, from that perspective, we just simply always have to have our mind open to the change that’s happening in the economy and the change that’s happening in society and we’re always trying to layer in this humility of understanding that we don’t know everything. Ultimately, it’s the unknown that we think about a lot; how are we going to deal with these different scenarios? So, I would say, that’s what keeps me up most at night.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

What Are the Risks?

All investments involve risks, including possible loss of principal. Stocks historically have outperformed other asset classes over the long term, but tend to fluctuate more dramatically over the short term. Investments in fast-growing industries like the technology and healthcare sectors (which have historically been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement or regulatory approval for new drugs and medical instruments. Small- and mid-capitalization companies can be particularly sensitive to changing economic conditions, and their prospects for growth are less certain than those of larger, more established companies.

Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

Past performance does not guarantee future results.

________________________________

1. Source: Barron’s, “Why the Post-Pandemic Future Could Be Bright: Productivity Gains Could Be Here to Stay,” by Matthew C. Klein, January 8, 2021.