by Franklin Templeton Investment Solutions

Where Are We Now?

In order to estimate the path forward for the Federal Reserve (Fed), risk assets, and the continued expansion of the United States (US) economy, it is first important to understand the path forward for labor force participation. Looking over the coming months, the number of workers returning to the labor force will determine how many job openings can be filled and how quickly wage growth will retreat from its lofty levels. Wage inflation, a symptom of an otherwise tight labor market, bleeds into corporate earnings and our outlook for risk assets. Here, we’ll explore the various contributing factors to the participation rate, what we can expect going forward, and implications for both the Fed and risk assets.

As the US workforce continues its path toward recovery from the COVID-19 pandemic, we find ourselves in an economy with spiking wage inflation, an abundance of unfilled jobs, and a Fed that is still noticeably accommodative. These metrics are all at least partially caused by slack in the labor force participation rate (the percent of the population neither currently employed nor actively seeking work). Though the US unemployment rate has improved to 4.2% as of November 2021, we have often seen the participation rate’s recovery lag that of the unemployment rate over previous cycles.

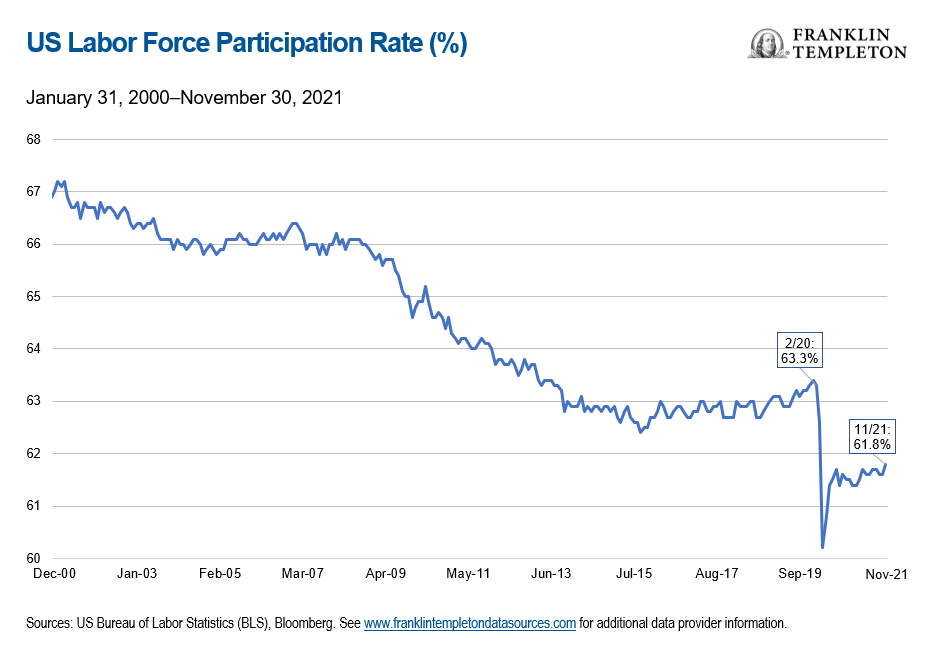

Even prior to the COVID-19 outbreak in early 2020, the labor force participation rate in the United States had been in a structural downtrend for decades. However, the pandemic brought about a significant drop below the historic trend, with limited signs of recovery over the past 20 months (see Exhibit 1).

Exhibit 1: Labor Force Participation Remains Subdued

The decline in US labor force participation has been driven by many factors, including:

- Early retirement

- COVID-related exits

- Childcare prioritization

- A shift toward younger workers leaving the workforce and moving back in with their families

- Workers deterred from accepting jobs requiring an in-office presence (preferring to stay remote)

- Increased household savings and government stimulus packages

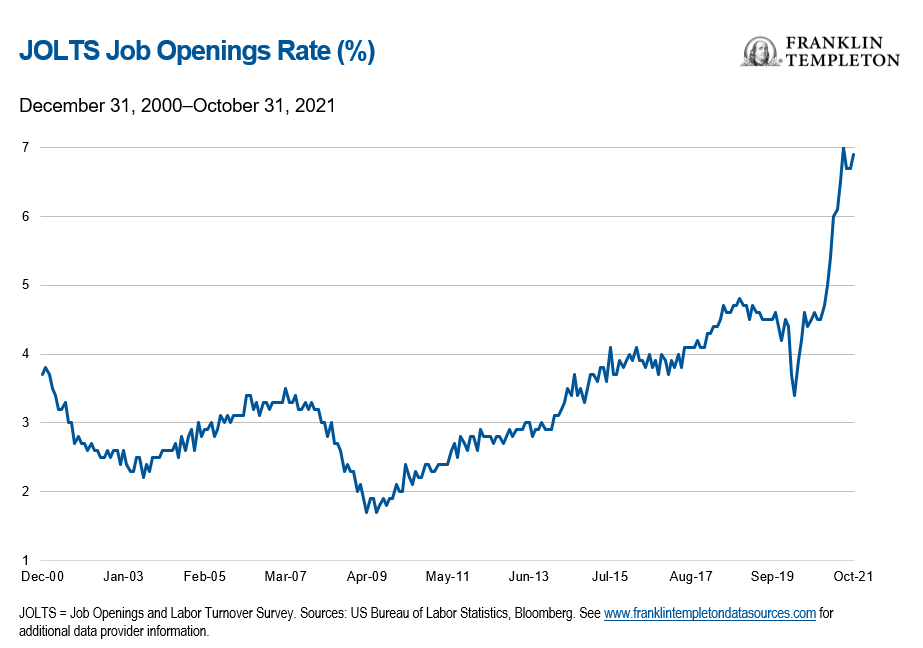

Even as wages climb, job openings spike (see Exhibit 2), and unemployment rates fall, incentivizing people to reenter the workforce has thus far proved difficult, and the participation rate remains suppressed.

Exhibit 2: Job Openings Hit Historic Highs

Where Are We Headed?

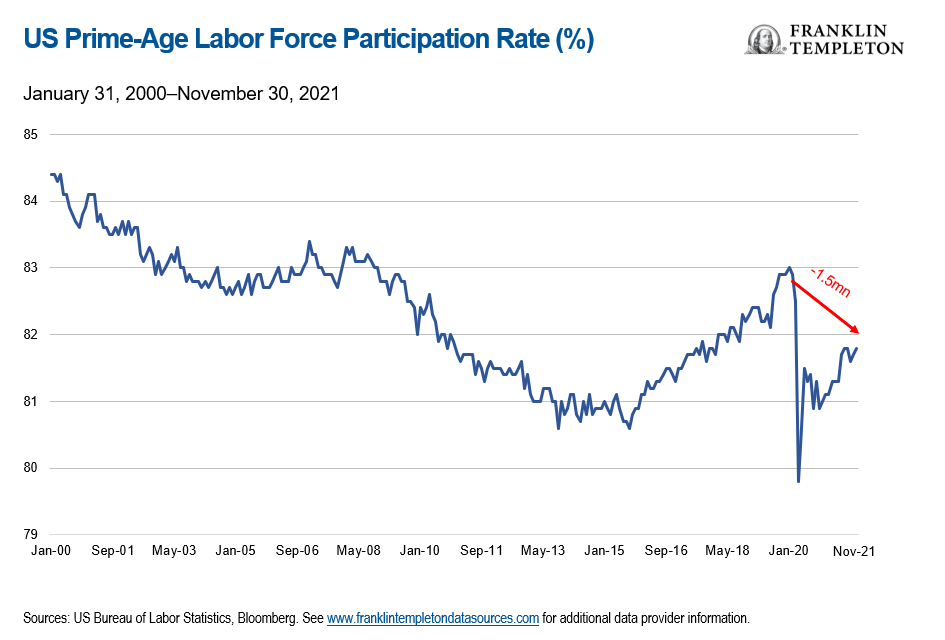

While we don’t expect many early retirees to reconsider their job prospects, there is reason to believe that a large swath of prime-age workers (aged 25-54) who have exited the job market over the past two years could be poised to reenter as wages climb higher. For context, we have 3.6 million less workers today than we did in February 2020, according to the US Bureau of Labor Statistics—1.5 million of which still fall into the prime-age camp (see Exhibit 3). However, the outlook for the remaining two million workers is foggier. Early retirees are highly unlikely to return to the workforce. Childcare and COVID-19 concerns will force longer-term exits for some segments of the prime-age working group. We don’t expect a full return to 63.3% participation rate over the near term.

Exhibit 3: Prime-Age Workforce Drawdown

Looking forward, we expect a particularly exaggerated rebound in participation for low-educated, prime-age workers, as upward wage pressure continues to be strongest among lower-paying and leisure/hospitality jobs. As the US private sector broadly prepares to set aside more capital over the coming year for continued wage gains, and we learn to grapple with the likely endemic state of COVID, the opportunity cost for prime-aged workers to sit on the sidelines will only grow.

Implications for the Fed

We’ve increasingly heard over the past few Federal Open Market Committee press conferences that the Fed’s tightening criteria boxes are being checked. Wages are rising across all demographics, with many low-income sectors seeing the largest percent increases. During the last cycle in 2017-2018, when we were at comparable levels of unemployment and wage growth, the Fed had already finished its taper, begun tightening its balance sheet, and was multiple hikes into its tightening cycle—all against the backdrop of lower growth levels than we’re seeing today.

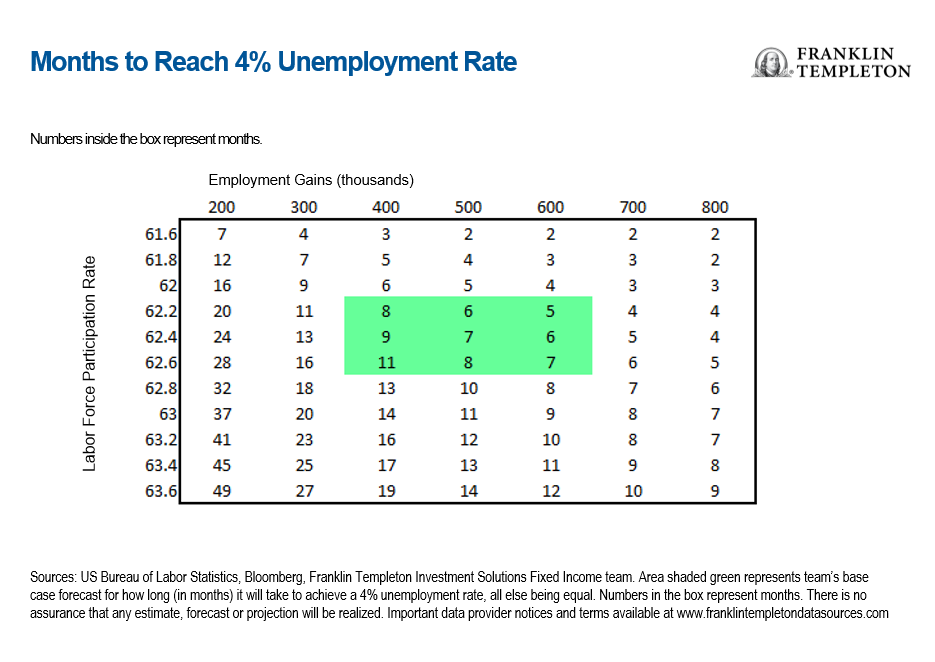

In our base-case expectations for the Fed, we will likely need another nine+ months for us to be in a similar monetary policy position (see Exhibit 4). Should the Fed continue to view a 4% unemployment level as consistent with its interpretation of “full employment,” we expect that an increase in the labor force participation rate within the range of 62.2%-62.6% will be consistent with these levels.

As the labor force participation rate likely recovers over the coming months, we expect the Fed will have ample flexibility to conclude its taper and eventually raise interest rates multiple times over the coming year.

Exhibit 4: Months to 4% Unemployment Rate for a Given Labor Force Participation Rate

Implications for Multi-Asset Markets

Many of the inflationary pressures currently facing the US economy can be attributed to the surge in durable goods demand that resulted from COVID-19 lockdowns. Inflation driven by high demand has unique implications for a multi-asset portfolio—namely, a moderately supportive environment to take risk in assets like equities and high yield credit.

As we expect the Fed to accelerate its taper and hike rates over the next 6-12 months on the back of further labor market tightening, longer-duration assets are likely to suffer. As such, within fixed income we disfavor longer-dated sovereign debt, while we prefer sectors including bank loans and high yield corporate credit that pair strong fundamentals with minimal duration risk.

Likewise, not all industries are created equal within the US equity market, and companies across all sectors are having a difficult time attracting new talent. Should we see labor force participation rates fail to materially improve over the coming months, corporate margins could be meaningfully squeezed. Nonetheless, to this point, we have seen corporates broadly pass through rising input costs with ease to their consumers. Within a cross-asset portfolio, we favor equities as rising wage pressures are, to this point, not enough of a threat to offset a healthy profit margin backdrop.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Investments in lower-rated bonds include higher risk of default and loss of principal. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. Special risks are associated with investing in foreign securities, including risks associated with political and economic developments, trading practices, availability of information, limited markets and currency exchange rate fluctuations and policies.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.