Key Points

- Incredible volatility in credit markets: This year has seen significant volatility in credit markets given the tumultuous macroeconomic backdrop and hawkish Federal Reserve (Fed). This period is unique given valuation levels.

- History not necessarily a playbook: Investment-grade bonds, bank loans, and high yield bonds could perform differently now than in prior risk-off periods due to asset class-specific developments.

- Recession fears emerging: On top of this, recession fears have been sparked. There are reasons to believe, should the United States enter a recession, it may be mild. While we do not think one is likely in the next 12 months, it is a risk particularly in 2023 and worthy of close attention. For more specifics on inflation, yield-curve inversion, corporate fundamentals and profitability, please read below.

This time is different?

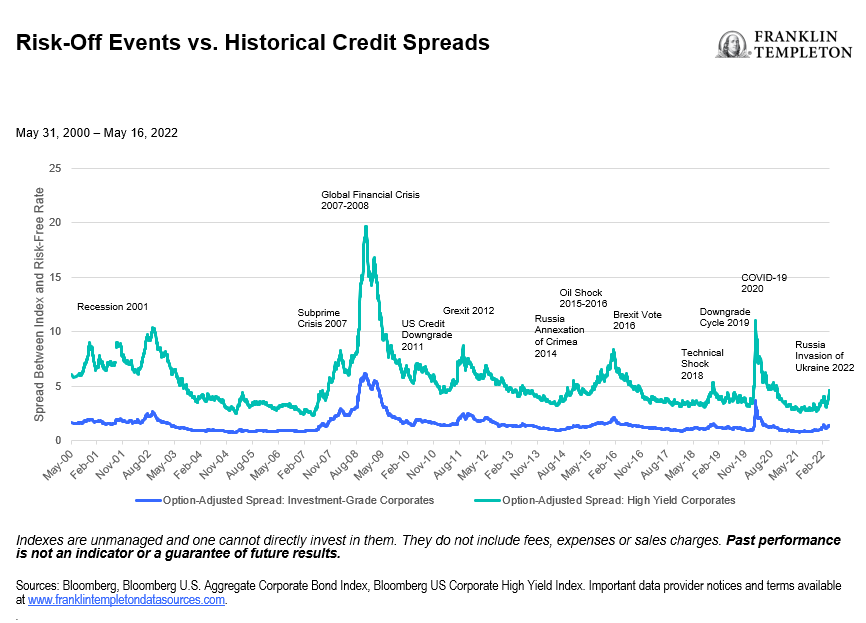

We can begin to include 2022 into the pantheon of very unique periods for the broader credit markets, such as investment grade, high yield, and leveraged loans, along with previous periods such as the global financial crisis (GFC) in 2008 and the global pandemic that started in 2020, where volatility was heightened. Given the macroeconomic backdrop—a war that we haven’t seen the likes of for at least five decades, the world’s second largest economy (China) going through a COVID lockdown once again, and global inflation levels that have also not been seen for at least four decades now—it isn’t hard to understand why.

While the volatility in US credit year-to-date has not been quite as dramatic as both the GFC and the beginning of the COVID-19 pandemic, we really haven’t seen a selloff like this in the broader US fixed income market for quite some time. The selloff is due to the view that the Fed will need to raise interest rates quickly and furiously to rein in inflation by slowing down growth meaningfully, putting the risk of recession on the table.

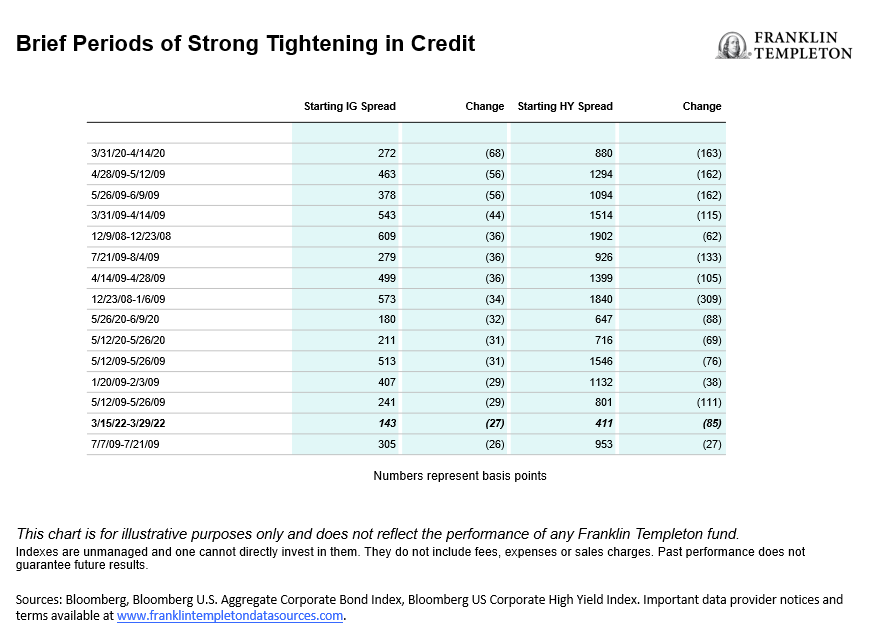

In March, we saw both credit spread widening and subsequent dramatic spread tightening,1 all within the same month, reminiscent of some of the months we saw during both the GFC and pandemic. What made March unique relative to those periods was that it came at a time when spreads were much closer to their historical tights than wides, as credit valuations remain elevated with investors still searching for yield and with the healthy liquidity that remained in the credit markets. It is possible this is a glimpse of things to come for the remainder of the year.

Relative performance of various credit asset classes in risk-off periods

As we think about unique risk-off periods, we should look back to history. In the past, investment grade has tended to outperform across credit in both recessionary and non-recessionary risk-off periods. In non-recessionary periods, this stronger relative performance from investment grade has been followed by bank loans and then high yield. Historically bank loans were of a higher credit quality than high yield, while a meaningful portion of the loan investor base has consisted typically of longer-term (buy and hold) investors (in the form of collateralized loan obligations or CLOs), and the assets on the loans are usually secured. These characteristics have bestowed a lower volatility profile to the asset class.

In periods of rising rates, loans would tend to also outperform, since the interest paid is usually variable (rising as rates also increase), essentially providing a low (“practically” zero duration profile). Loans then should seemingly outperform in the current environment. But when we peek under the hood, we find that bank loans could be more vulnerable later in a downturn (particularly if the Fed were to commit a policy error in combating inflation), given the sector’s secular migration toward lower credit quality issuers and much weaker covenants/credit agreements than in the past, due to the robust issuance of private equity LBO deals in recent years. Hence, for loans, this time could be different.

Thoughts on credit and the economic outlook

This year seems like a critical inflection point, where in hindsight, investors will have insight into whether we were still mid- or late- (business) cycle. Only time will tell if the Fed is able to engineer a soft landing, or whether this cycle will be much shorter than previous ones, given the series of extreme and/or unprecedented events mentioned above. It is precisely these unchartered waters that makes the future so hard to predict.

In a very recent credit investor survey, investors have become decidedly more bearish. Not surprisingly, inflation and recession rank at the top of perceived investor risks, which we are deeply focused on as well. Relatedly, we are paying close attention to the high price of oil (a key input cost for companies and consumers alike).

Given the strength of the economy, a downturn or recession might not occur anytime soon; a US recession in the next 12 months is not our base case. Coinciding with this view, the credit markets are not pricing in recession at all looking out over 12 months. As Exhibit 2 illustrates, yields are still relatively tight relative to the Treasury. But we think this mindset could change as we get closer to 2023. A recession could come as soon as 18 months from now, given a potent mixture of the Fed tightening financial conditions and inflation levels not seen in quite some time that necessitate economic slowdown.

Credit investing often is a game of musical chairs, collecting coupons and staying risk-on as long as you possibly can to outperform before getting more defensive and jumping into a chair before the music stops.

Our latest thoughts on some of the more topical areas for 2022:

- Inflation: For now, inflation is the big risk and will be the key theme for earnings season, given its impact on corporate profitability and household consumption. We would note that in the period of higher inflation from the 1970s to 1990s, peak levels of the Consumer Price Index almost always caused earnings per share to come down meaningfully.

- Yield-Curve Inversions: The yield curve has gotten a lot of focus given its historic ability to forecast both recession and credit spread widening. The yield curve, however, may have less of a signaling effect given the stronger presence of foreign buyers and the erratic nature of term premiums today. We would note that inversions for both the nominal yield curve and real yield curve by itself have no impact on credit spreads. What causes spreads to widen is typically the ensuing economic slowdown and economic data trending downward.

- Corporate Fundamentals: Credit fundamentals remain strong across the board for investment grade, high yield, and bank loans, with most metrics back to pre-pandemic levels. However, these metrics will likely get weaker over the course of the year if growth slows. Should this occur, likely side by side with increasing input costs and interest expense, credit metrics could retrack back toward pandemic levels. The impact will be different for every sector and investment-grade companies will likely be better positioned, followed by high yield, and lastly loans.

- Profitability: With inflation at the forefront and the likelihood of higher input costs for many companies, earnings before interest, taxes, depreciation, and amortization (EBITDA) margins will be a key focal point for credit investors, who tend to focus more on cash flow than earnings. For high yield, EBITDA margins look very healthy to us, relative to history. We are back to pre-pandemic levels as profitability has yet to be fully impacted by higher costs, so there’s still a fair amount of cushion and why we still think recession isn’t in the near-term horizon.

If the business cycle were to be shorter (if we are currently late-cycle), a hard landing or recession could be in the cards. However, given that the pandemic let a lot of the air out of the tires for the economy with regard to risk taking, as it pushed some companies into default and forced most companies toward financial prudence, it would not be unreasonable to think that any recession this time around could be more mild, given the lack of excesses now relative to other cycle peaks. This has likely resulted in fewer asset bubbles this time around. We would note though that the strong secular growth of both private credit and private equity, as a surrogate for bank lending and for the public markets, bears watching as we think about systemic risk in any potential downturn further out. Only time will tell if this period we are entering into will be as memorable and volatile as both the GFC or the global pandemic, but we are certainly off to a good start. Investors may need to hold on to their seats in the event it’s a wild ride.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Investments in lower-rated bonds include higher risk of default and loss of principal. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value.

Floating-rate loans and debt securities tend to be rated below investment grade. Investing in higher-yielding, lower-rated, floating-rate loans and debt securities involves greater risk of default, which could result in loss of principal—a risk that may be heightened in a slowing economy. Interest earned on floating-rate loans varies with changes in prevailing interest rates. Therefore, while floating-rate loans offer higher interest income when interest rates rise, they will also generate less income when interest rates decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton. The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

_____________________________________

1.Credit spreads often refer to the difference between yields of a specific sector, such as investment-grade corporates or high yield corporates, to the yield of a risk-free security of a comparable duration. US credit spreads often compare corporate bonds to the US Treasury. When credit spreads are tight, the difference in yield between the corporate bond sector and Treasuries (or other risk-free measure) is relatively small. This indicates the perception of overall strong economic health. Wide spreads suggest perceived economic risk.