With National 529 Day last month and graduation season underway, the cost of education is at the top of many people’s minds. Not to mention the tough environment that we are experiencing right now, with inflation, market volatility, and geopolitical issues creating uncertainty. Given these challenges, many people are considering financial adjustments, new approaches, or reassessing goals. Staying focused despite the day-to-day distractions of the market is never easy, especially during periods of economic uncertainty.

We have found that investors who seek the guidance of a trusted financial professional and remain committed to their investment plans, even when it’s tempting to head to the sidelines, are better positioned to realize their short- and long-term goals.

That being said, we think these challenging times present a good reminder to:

- Not let emotions drive your decisions

- Understand your tolerance for risk

- Consider the big picture

- Stay the course

- Work closely with a trusted financial professional

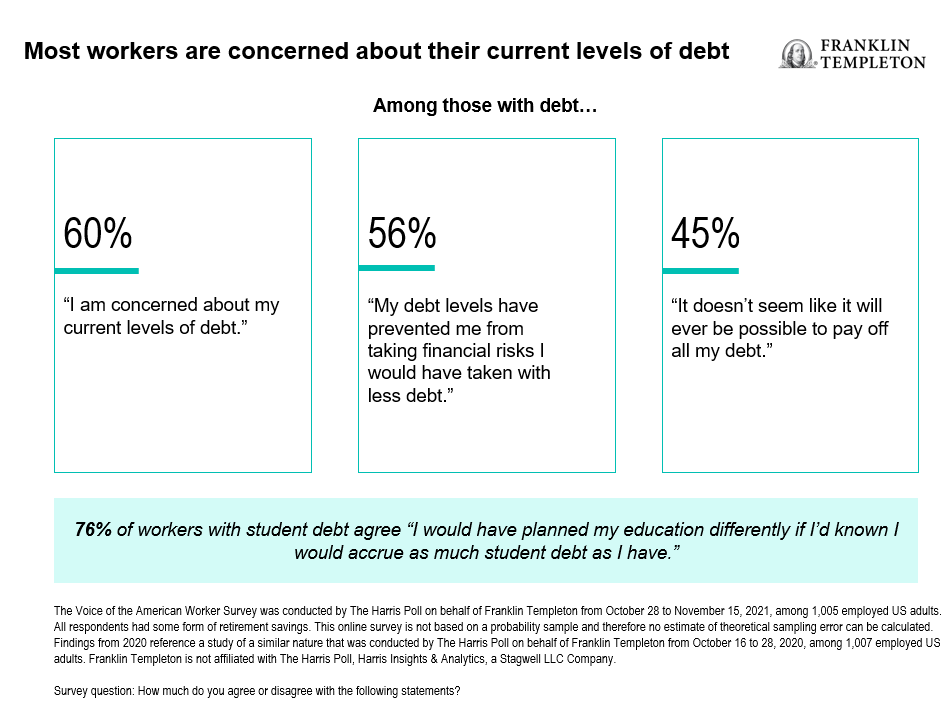

In terms of saving for education, we think it’s important to think of it the same way you’d think about saving for retirement. Student loan debt continues to rise, topping out at more than $1.7 trillion.1This debt burden has caused people to reflect—in our latest “Voice of the American Worker (VOTAW) Survey,” 76% of workers with student debt stated, “I would have planned my education differently if I’d known I would accrue as much student debt as I have.”2 On top of that, less than 1% of college students receive enough grants and scholarships to cover costs, and about 54% of education funding comes from parents.3

Among employees who currently carry debt responding to our VOTAW Survey, majorities say their levels of debt are impactful on their lives, jobs, and decision-making.4

But let’s think beyond scholarships/grants and parents when it comes to the funding equation. Family and friends can be a big help when it comes to saving for education. You can open a college savings plan (otherwise known as a 529 plan) for that nephew who is graduating from kindergarten this month, or contribute to your granddaughter’s existing 529 account to help her celebrate moving on to middle school. If you are a parent of a young child, consider requesting contributions from friends and family to a 529 plan on his or her behalf as graduation gifts or in place of physical presents or money that may otherwise be spent on frivolous toys. Many 529 plans have gifting platforms that will make saving for college even easier.

Now, back to determining how to get these savings started. Even if you don’t have a lump sum of money to put away at this moment (and many people don’t), starting small can still be beneficial. Setting aside an amount each month to invest is a good habit to get into—and an important first step.

A good rule of thumb would be to approach saving for college the same way you’d tackle any long-term personal goal: create a plan, stay the course, make it a habit, and don’t panic. Leverage the 529 vehicle created for this purpose—providing a tax-advantaged savings benefit for future education costs.

For some people, this may even be a good time to increase their education savings contributions to leverage the power of compounding and get into the market while prices are a bit depressed.

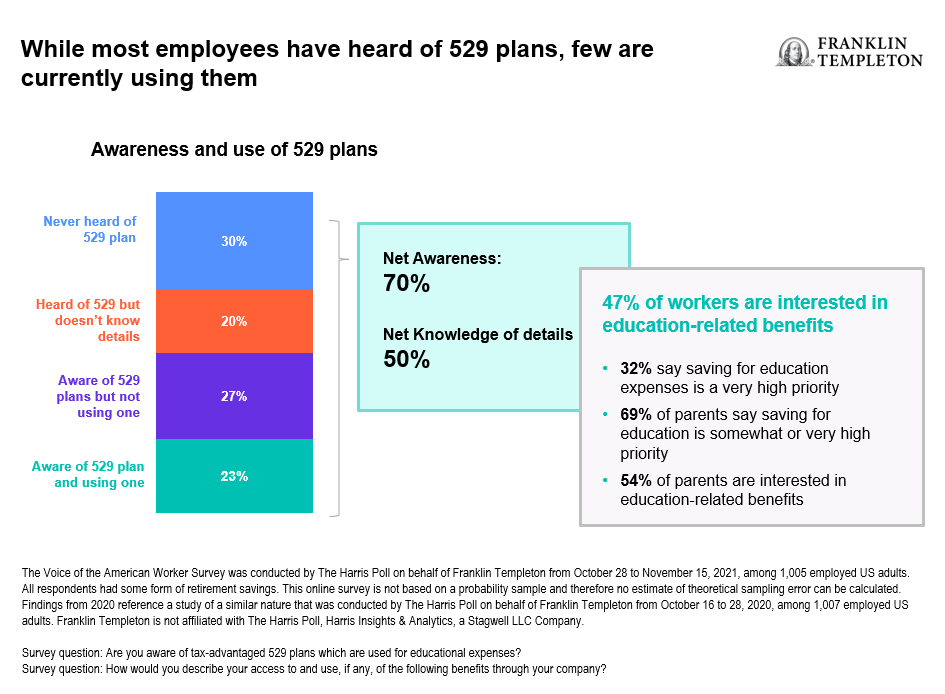

Another finding of our VOTAW Survey was that seven in 10 employees are aware of 529 plans, but only 50% know the details of the program and 23% are currently making use of it. Meanwhile, 47% of workers said they were interested in education-related benefits from their employer.5

529 plans are a great way to invest for future education costs, and there are many options across the country to choose from. Depending on the plan you choose, there are various portfolio investment choices available. You can build your own portfolio from single investment options of exchange-traded funds and mutual funds, like what you would find on a menu of retirement funds from your employer. There are objective-based or risk-based portfolios that align with the saver’s tolerance for risk. And there are age-based portfolios which are the most popular options in 529 plans. They move along a set asset allocation glidepath as the beneficiary celebrates their next birthday or gets closer to their enrollment year.

In terms of the specific investments that are under the hood in a 529 program, most diversified asset classes are often represented. These days, you can even find plans that have product offerings focused on sustainability and environmental, social and governance (ESG). Whatever your interest and risk tolerance, there are many options that may fit your needs.

Because it can get confusing, and investing in various asset classes and risk tolerances does get complex, working with a financial professional is a sensible option. Financial professionals take a holistic planning approach with clients to see their whole financial picture, which is helpful when considering other goals like retirement, emergency savings, health savings accounts—even a vacation fund—and how they stack up to existing investments, debts, and assets. Professional money management helps give individuals a better understanding of the best investment allocation approach based on their overall individual needs, with added education and guidance along the way.

While there are many options out there, consider reviewing the Franklin Templeton 529 College Savings Plan and learn what is new with the plan.

WHAT ARE THE RISKS?

Any information, statement or opinion set forth herein is general in nature, is not directed to or based on the financial situation or needs of any particular investor, and does not constitute, and should not be construed as, investment advice, forecast of future events, a guarantee of future results, or a recommendation with respect to any particular security or investment strategy or type of retirement account. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.

Investors should carefully consider the 529 plan’s investment goals, risks, charges and expenses before investing. To obtain the Investor Handbook, which contains this and other information, talk to your financial professional or call Franklin Distributors, LLC., the manager and underwriter for the 529 plan at (800) DIAL BEN / 342-5236 or visit franklintempleton.com. You should read the Investor Handbook carefully before investing and consider whether your, or the beneficiary’s, home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in its qualified tuition program.

Franklin Templeton’s 529 College Savings Plan is offered and administered by the New Jersey Higher Education Student Assistance Authority (HESAA); managed and distributed by Franklin Distributors, LLC., an affiliate of Franklin Resources, Inc., which operates as Franklin Templeton.

Investments in Franklin Templeton’s 529 College Savings Plan are not insured by the FDIC or any other government agency and are not deposits or other obligations of any depository institution. Investments are not guaranteed by the State of New Jersey, Franklin Templeton, or its affiliates and are subject to risks, including loss of principal amount invested. Investing in the plan does not guarantee admission to any particular primary, secondary school or college, or sufficient funds for primary, secondary school or college.

Franklin Templeton, its affiliates, and its employees are not in the business of providing tax or legal advice to taxpayers. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties or complying with any applicable tax laws or regulations. Tax-related statements, if any, may have been written in connection with the “promotion or marketing” of the transaction(s) or matter(s) addressed by these materials, to the extent allowed by applicable law. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax professional.

The Voice of the American Worker (VOTAW) Survey was conducted by The Harris Poll on behalf of Franklin Templeton from October 28 to November 15, 2021, among 1,005 employed US adults. All respondents had some form of retirement savings. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Findings from 2020 reference a study of a similar nature that was conducted by The Harris Poll on behalf of Franklin Templeton from October 16 to 28, 2020, among 1,007 employed US adults. Franklin Templeton is not affiliated with The Harris Poll, Harris Insights & Analytics, a Stagwell LLC Company

© 2022 Franklin Distributors, LLC. Member FINRA/SIPC.

___________________

1. Source: Education Data Initiative, May 2022.

2. The Voice of the American Worker (VOTAW) Survey 2021 was conducted by The Harris Poll on behalf of Franklin Templeton from October 28 to November 15, 2021, among 1,005 employed US adults. All respondents had some form of retirement savings. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Findings from 2020 reference a study of a similar nature that was conducted by The Harris Poll on behalf of Franklin Templeton from October 16 to 28, 2020, among 1,007 employed US adults. Franklin Templeton is not affiliated with The Harris Poll, Harris Insights & Analytics, a Stagwell LLC Company.

3. Source: Sallie Mae and Ipsos. How America Pays for College 2021.

4. Source: VOTAW Survey.

5. Ibid.