Key takeaways:

- With roughly 82% of its population vaccinated, Japan’s COVID-19 inoculation rate is among the highest of G7 nations.

- The yen’s tumble to two-decade lows may propel exports and help quicken a rebound for its inbound travel and tourism sector as Japan eases pandemic border restrictions.

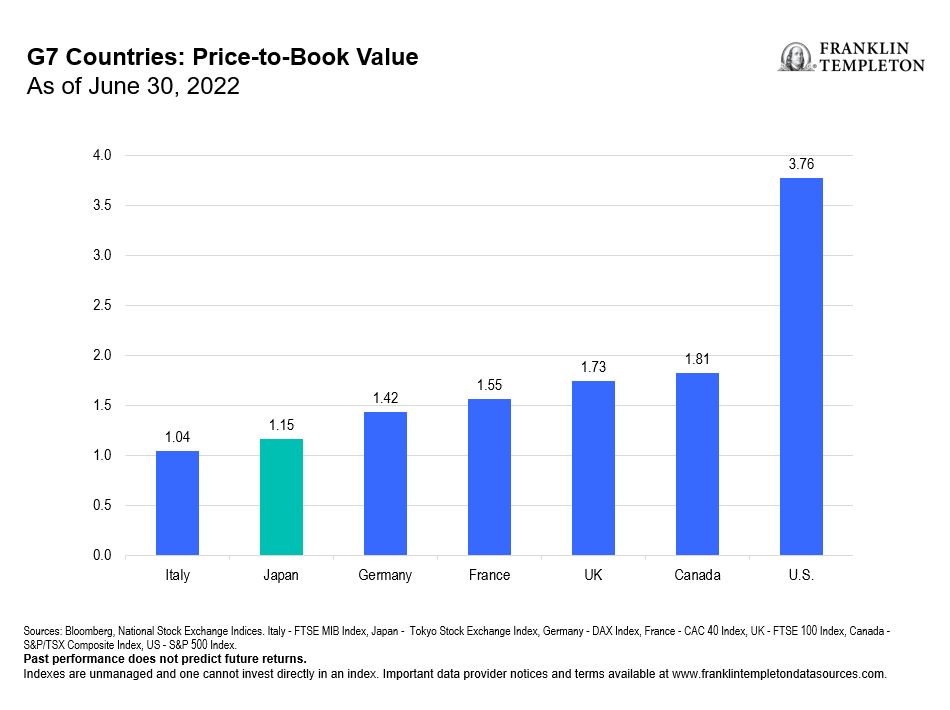

- Japanese equities are quite undervalued relative to many other developed nations and we believe Japan’s market is worth a closer look as a slice of investor portfolios.

It’s a somewhat suspenseful time for Japan-watchers like ourselves as we try to gauge what’s next for the world’s third-largest economy. Nearly a decade since the Bank of Japan (BoJ) set its 2% inflation target, the country finally hit its mark in late May. Although prompted by higher energy prices rather than domestic demand, inflation may still help psychologically jolt consumers from a long-held deflationary mindset. Can the aftermath of former Prime Minister Shinzo Abe’s tragic demise, and the subsequent electoral victory for his ruling coalition, also mark a turning point in Japan’s politics and policy? Even in this infamously greying society, there are silver linings for its economy and for investors wanting to increase exposure to Japan at this time.

Momentum in Asia

While global markets have mostly been bathed in red of late, we’ve seen some positive momentum in Asia. China’s market showed signs of improvement in June, though the near-term outlook for its stocks is one of cautious optimism. Meanwhile, Japanese equities this year have fared notably better than most of its developed market peers.

For the near term, it seems Japan’s export prices may remain negatively impacted by ongoing supply chain constraints and higher costs for raw materials. However, we believe a further relaxing of pandemic restrictions in China—its main trading partner—should offer tailwinds from significantly pent-up demand. US Treasury Secretary Janet Yellen and Japanese Finance Minister Shunichi Suzuki agreed this month to work together to improve financial stability and manage volatility in currency markets. Back in January when Japan and the United States publicly reaffirmed their relationship, they went as far as calling it “stronger and deeper than at any time in its history.”

Roughly 82% of Japan’s population is now vaccinated, marking one of the highest COVID-19 inoculation rates among G7 nations. With the yen now at a fresh 24-year low against the US dollar, this export-driven market may be poised for a boost not only from its manufacturing sector, but also from rebounding tourism. The attractive exchange rate should help encourage back to Japan mainland Chinese visitors, which made up the largest single group of travelers pre-pandemic.

In our analysis, valuations for Japanese equities are currently attractive relative to those of other developed markets. On a price-to-book ratio, the Tokyo Stock Exchange Index is trading just under 1.2x book value, suggesting its equities are now better valued when measured against other G7 countries.

Structural reforms

There has been much recent analysis over Abe’s signature economic plan dubbed “Abenomics,” which yielded mixed results. The country’s longest-serving prime minister is credited for propelling Japan’s corporate governance practices further in line with global standards. Eight years ago, his administration implemented key measures to attract more foreign investment, requiring such improvements as increased risk-management disclosures and independent external directors. His successors continued to nudge such reforms along and twice revised Japan’s Corporate Governance Code, first in 2018 and again last summer to better promote diversity, especially in terms of women in leadership roles.

In our opinion, however, change can be sluggish in Japan and far more of a shift is needed. The code stopped short of setting any specific targets, and Japanese women continue to lag the global average (27%) in their share of managerial roles (12%), according to the International Labor Organization.1 But pre-pandemic, the government was successful in enacting legislation to expand childcare, reform the tax code to reward dual earners, and improve parental leave policies. We are encouraged by Japan’s recent efforts to expand immigration policies for foreign workers toward solving labor issues as well as for continued reforms to encourage and advance women toward meaningful careers.

Abe’s legacy also left a mark on the ways in which some corporates interact with investors and the market in general. Shareholder returns, both in terms of dividends and share buybacks, are indicators of such positive developments. According to Nikkei Asia, Japanese firms are planning for stock buybacks to double to US$32 billion—its highest level in 16 years and one which may help bolster market confidence.2

Japan has long grappled with demographics that can pose a drag on growth. But as the International Monetary Fund (IMF) puts it, Japan is a “laboratory from which other countries are beginning to draw lessons.”3 This includes Japan’s key contributions to artificial intelligence (AI) and automation as the world’s top industrial robotics maker.4 Despite global supply hurdles, pandemic-induced demand for integrated robotics has spiked over the past two years.

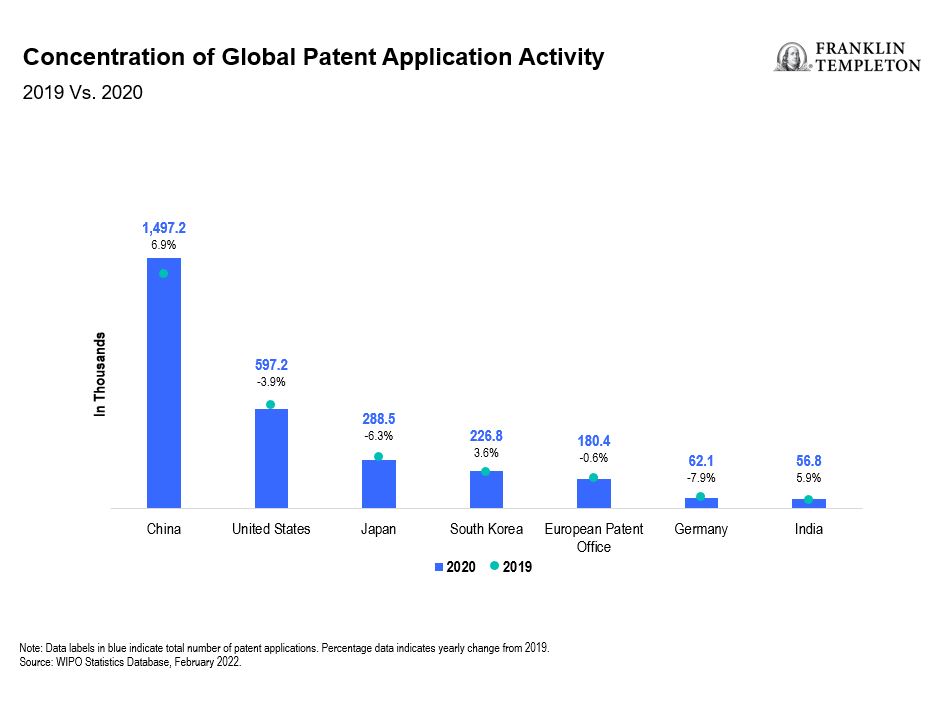

Japan has also consistently ranked high among more than 100 economies assessed for the World Economic Forum (WEF) Global Competitiveness Index and has remained a top competitor in global patent activity. While Japan’s venture capital (VC) space may still be chasing after not only Silicon Valley but also Europe, its VC landscape got a boost last year amid the crackdown in China’s tech sector. There is now growing support for strengthening Tokyo’s startup ecosystem, better fostering entrepreneurship and embarking on a paradigm shift in policies to promote overall economic revitalization.

WHAT ARE THE RISKS?

All investments involve risks, including the possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. To the extent a strategy focuses on particular countries, regions, industries, sectors or types of investment from time to time, it may be subject to greater risks of adverse developments in such areas of focus than a strategy that invests in a wider variety of countries, regions, industries, sectors or investments.

ETFs trade like stocks, fluctuate in market value and may trade above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns. ETF shares may be bought or sold throughout the day at their market price on the exchange on which they are listed. However, there can be no guarantee that an active trading market for ETF shares will be developed or maintained or that their listing will continue or remain unchanged. While the shares of ETFs are tradable on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

__________

1. Source: International Labor Organization, “Gender equality in the workplace remains elusive,” January 10, 2020.

2. Source: NIKKEI Asia, “Japan stock buybacks double to $32bn, highest in 16 years,” June 5, 2022. There is no assurance that any estimate, forecast or projection will be realized.

3. Source: Hong, Gee Hee, Schenider, Todd, “Shrinkonomics: Lessons from Japan, International Monetary Fund, March 2020.

4. Source: International Federation of Robotics, “Japan is World’s number one Robot Maker,” March 10, 2022.