For a variety of reasons, the US defined contribution (DC) industry can be reasonably described as risk averse. Decisionmakers, from plan sponsors to consultants, generally seek to avoid any decision that might be perceived as risky, whether it’s plan design, investment choices or manager selection. In addition, ERISA’s standard of prudence (often referred to as the “prudent expert” standard), frequently is interpreted as “doing what everyone else is doing.” This is, of course, in addition to all of the important responsibilities of a fiduciary, such as regular meetings, thorough documentation, investment policies, and hiring experts.1

So, when it comes to a topic like alternative investments in DC plans, the first reaction for many DC decisionmakers is reflexive avoidance. Even before the investment case is made, or specific asset classes are considered, the reaction is often, “That sounds risky, I’ll wait until others have blazed that trail. We don’t want to be first.”

Institutional investors such as defined benefit (DB) plans, endowments and foundations have long enjoyed the benefits of alternative assets, including real estate. In fact, the average institutional investor allocates 10.1% to private commercial real estate.2 By comparison, Large US DC plans are dramatically underweight to alternative investments with just a 0.26% allocation within their target-date and balanced funds as of 2020.3

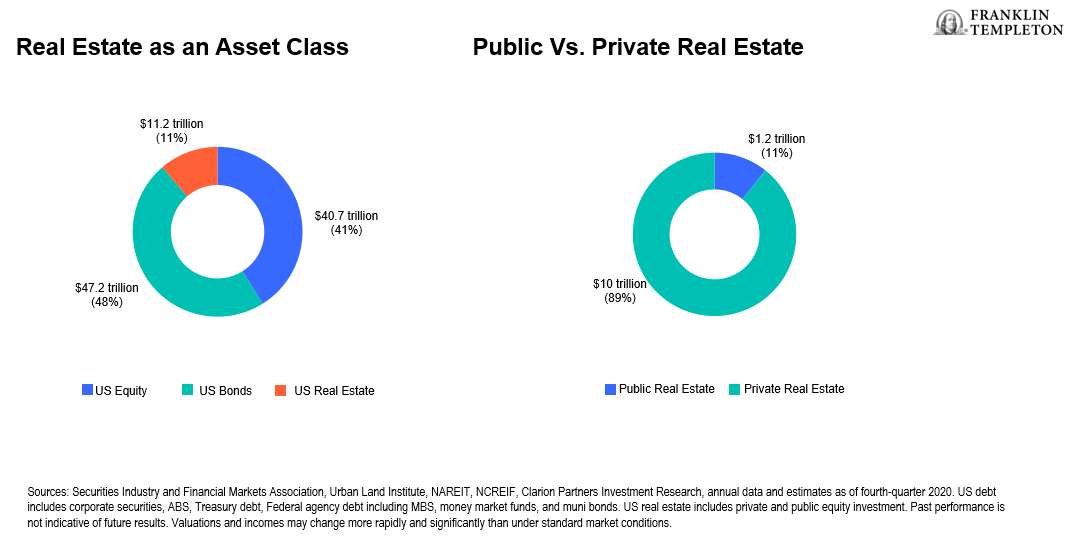

The underweight is true even compared to other nations’ daily valued DC systems, such as Australia’s Superannuation funds, which allocate over 11% to private assets, including real estate.4 Furthermore, real estate is the third-largest investable asset class and represents 11% of US investable assets. Of all investable US real estate, $10 trillion (89%) is private commercial real estate, while $1.3 trillion (11%) is listed real estate investment trusts (REITs).5

Why Commercial Real Estate in a Multi-Asset Portfolio?6

US DB plans have utilized private real estate for all of the reasons one might expect: private real estate can be a powerful diversifier, generally produces stable, income-based returns, and has inflation-hedging properties. And there’s no reason why DC plan participants shouldn’t enjoy these benefits, as well. Private real estate can be easily accessed through a professionally managed portfolio, such as a target-date fund (TDF), managed account or white-label, multi-manager portfolio (such as a real asset fund), providing participants with the same advantages that large institutional investors already experience.

Further, because a number of intrepid souls have blazed the trail, it means plans considering adding private real estate today will not be first or doing something new. The array of plan providers, such as custodians, recordkeepers, managed account providers and glide path managers, have all considered private real estate allocations, determined appropriate allocations and worked through operational issues that might arise. Most of the products available in the DC market today (there are over a dozen), have daily valuation, regular liquidity, and DC plan-friendly vehicle designs, such as using collective investment trusts to house the private real estate stakes. Today, assets in private real estate (not REITs) in 401(k) plans currently exceed $37 billion and are utilized in over 14,000 plans.7

In addition, the regulatory and litigation (and legislative) environment has turned more friendly to the use of alternative assets in DC plans (for example, see the Department of Labor’s information letter on the fiduciary implications of using alternatives in professionally managed structures from June of 2020, Intel’s victory in its lawsuit regarding the use of alternatives in its TDFs, and several legislative efforts to codify the appropriateness of using a wide array of asset categories in an ERISA plan, even a participant-directed plan such as a 401(k)).

Finally, it bears asking: is the worry about being “first” a primary factor for plan fiduciaries? Given that more than 14,000 plan sponsors have already incorporated private real estate in their plans, to the tune of tens of billions of dollars, perhaps we should consider using private real estate on its merits—especially in a market environment like today, with reduced expectations for returns on a traditional 60/40 portfolio and stubbornly high inflation.

Perhaps instead of worrying about “being first”—or even early—the greater worry should be about what participants may be missing by not having access to an asset class with the risk and return characteristics of private real estate.

DC plans represent almost $10 trillion of tax-advantaged assets set aside for multi-decade horizons, to meet retirement obligations far in the future—just like defined benefit plans. DC plans are governed by ERISA and overseen by fiduciaries—just like defined benefit plans. DC plans utilize professionally managed asset allocation solutions, with investment policies and expert advice—just like defined benefit plans.8

Since the obligation to save and invest for retirement has been largely transferred to individuals, isn’t it time more investors in DC plans have access to the same sophisticated investment toolbox used for decades in defined benefit plans? We certainly think so!

WHAT ARE THE RISKS?

All investments involve risks, including the possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stocks historically have outperformed other asset classes over the long term but tend to fluctuate more dramatically over the short term.

The risks associated with a real estate strategy include, but are not limited to various risks inherent in the ownership of real estate property, such as fluctuations in lease occupancy rates and operating expenses, variations in rental schedules, which in turn may be adversely affected by general and local economic conditions, the supply and demand for real estate properties, zoning laws, rent control laws, real property taxes, the availability and costs of financing, environmental laws, and uninsured losses (generally from catastrophic events such as earthquakes, floods and wars).

Investments in alternative investment strategies are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Depending on the product invested in, an investment in alternative investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

Diversification does not guarantee a profit or protect against a loss.

There is no assurance that any estimate, forecast or projection will be realized.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the author and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this presentation has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Franklin Distributors, LLC. Member FINRA/SIPC. Prior to July 7, 2021, Franklin Templeton Distributors, Inc., and Legg Mason Investor Services, LLC served as mutual fund distributors for Franklin Templeton.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute

____________________________________

1. The Employee Retirement Income Security Act of 1974 (ERISA) is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry to provide protection for individuals in these plans.

2. Source: Preqin Investor Outlook: Alternative Assets H2 2022.

3. Source: CEM Benchmarking Inc., 2020.

4. The Association of Superannuation Funds of Australia Limited, August 2022.

5. Sources: Securities Industry and Financial Markets Association, Urban Land Institute, NAREIT, NCREIF, Clarion Partners Investment Research, annual data and estimates as of fourth quarter 2020.

6. Sources: Securities Industry and Financial Markets Association, Urban Land Institute, NAREIT, NCREIF, Clarion Partners Investment Research, annual data and estimates as of fourth-quarter 2020. US debt includes corporate securities, ABS, Treasury debt, Federal agency debt including MBS, money market funds, and municipal bonds. US real estate includes private and public equity investment. Past performance is not indicative of future results. Valuations and incomes may change more rapidly and significantly than under standard market conditions.

7. Source: National Council of Real Estate Investment Fiduciaries (NCREIF) NFI-Daily Priced Annual Report, December 31, 2021.

8. Source: Investment Company Institute, March 31, 2022.