Student loan forgiveness

US President Joe Biden’s student loan forgiveness plan will forgive up to $10,000 per borrower, and for Pell Grant recipients, up to $20,000. The plan is eligible for individual borrowers with income up to $125,000 or households with income up to $250,000. Overall, the debt forgiveness plan would reduce student loan balances by around $400 billion (1.6% of gross domestic product) if all borrowers eligible for the program enroll.1 On the surface, this plan appears inflationary since it lowers the debt levels of US consumers, which has prompted many to think of this as Biden’s new version of fiscal stimulus.

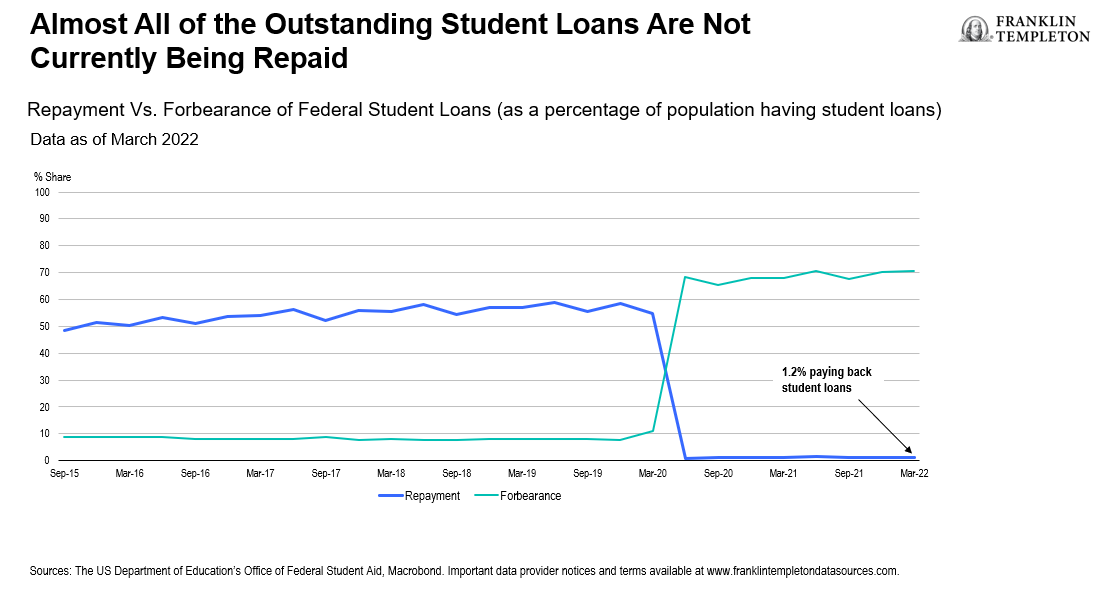

However, we believe this is far from reality. The Congressional Budget Office estimates that $10,000 student debt cancelation would hold a 0.13x fiscal multiplier,2 compared to COVID-19 relief measures, which held a 0.4x-0.9x multiplier. Given that the student loan forgiveness has a much lower fiscal multiplier, we expect the impact on consumer spending will not be nearly as powerful as the fiscal stimulus payments that were issued during the COVID-19 pandemic. Moreover, the benefits from the loan forgiveness will be extended out over time as consumers will pay their reduced monthly repayments going forward. Those who have had their monthly payments eliminated entirely from the loan forgiveness will not see a significant effect on spending, given almost all of the student loan borrowers have not been making monthly payments since the enactment of loan forbearance during the COVID-19 pandemic.

Furthermore, student loan forgiveness influences savings and longer-term financial planning rather than near-term consumption habits. For example, surveys were conducted by the Brookings Institution and Social Policy Institute to assess how certain levels of student debt forgiveness would alter household behaviors.3 Their findings suggest that most student debt holders will use forgiveness to increase savings, rather than increase spending, which lowers the effect on inflation. Consumers will enjoy greater freedom to reduce other debt, given that outstanding student loans currently account for only 10% of total household debt.4

One could argue there is a deflationary impact from Biden’s plan, as it ends the student loan repayment moratorium. Since the beginning of the COVID-19 pandemic, there has been a freeze on repaying these loans, but that will end in January 2023. As the chart below shows, roughly 1.2% of all student debt borrowers have been repaying their loans. This will dramatically increase when the moratorium ends and force cash outflows upon consumers in the midst of persistently high inflation (leaving less money to spend on goods and services). The deflationary impulse from this resumption of payments will likely more than offset any potential inflationary aspects to loan forgiveness.

Overall, the inflationary effect of the student loan forgiveness plan is likely to be subdued.

Inflation Reduction Act (IRA)

In addition to the student loan forgiveness, Biden has signed into law the Inflation Reduction Act (IRA). The IRA includes some large provisions aimed at establishing a minimum corporate tax rate, prescription drug price reform, IRS tax enforcement, Affordable Care Act subsidy extensions, and energy security and climate change investments. The effects on consumer spending, however, are modest at best.

The IRA will take many years to ultimately come to fruition and start to impact the US economy. Regarding inflation, the impacts in the near-term will be minimal.

Reducing Medicare costs will be beneficial for consumers, but unlikely to provide a significant inflationary or deflationary impact given that prescription drugs account for approximately 1% of spending in the US Consumer Price Index (CPI).5 Biden’s tax credits for US consumers who purchase electric vehicles (EVs) will take significant time to gain momentum; most of the electric vehicles sold in the United States are not yet eligible for the tax credit due to production requirements for certain vehicle materials to be built in the United States. There are income caps as well for these EV tax credits; they will be available only to individuals making less than $150,000, and joint households with income of less than $300,000.

Finally, the IRA increases the total federal tax credit from 26% to 30% off solar energy investments; this increased credit is extended through 2032 before being reduced and later phased out into 2035. While this could potentially save consumers money through tax savings and lower energy expenses from using more solar over electricity, US solar-panel systems generally cost between $10,000 to over $25,000 after the pre-IRA 26% federal tax incentive.6Although the IRA tax incentives have risen to 30%, renewable energy up-front prices are still quite large, and consumers may have a tough time affording these costs in the current economic environment.

Our team will continue to monitor the long-term impacts resulting from the IRA but believe in the near-term any inflationary impacts from the bill will be minor. In the longer-term, the ensuing decline of switching costs for households to use renewable energy should entice more consumer demand. However, we believe this will be a longer and more gradual process that will take place more heavily toward the end of the IRA’s time horizon of 10 years.

Outlook

Overall, both the student loan forgiveness plan and IRA are unlikely to have significant effects on inflation. Student loan forgiveness will benefit consumers as time passes and monthly payments are reduced, but now payments will have to be paid back starting January 2023. This will happen as roughly 45% of borrowers will have their debts fully canceled, according to Biden,7 still leaving a plethora of borrowers on the hook for repayments starting again after the end of this year. The IRA inflationary initiatives will take years to come to surface, face difficulty achieving, and impact CPI items that are not of significant weight. We still foresee inflation remaining elevated into 2023, as the consumer faces a challenging environment of negative real wage growth combined with an aggressive Federal Reserve.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. The positioning of a specific portfolio may differ from the information presented herein due to various factors, including, but not limited to, allocations from the core portfolio and specific investment objectives, guidelines, strategy and restrictions of a portfolio. There is no assurance any forecast, projection or estimate will be realized. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Investing in the natural resources sector involves special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector—prices of such securities can be volatile, particularly over the short term. Real estate securities involve special risks, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments affecting the sector.

Investments in infrastructure-related securities involve special risks, such as high interest costs, high leverage and increased susceptibility to adverse economic or regulatory developments affecting the sector. Alternative investments include private equity, commodities, hedge funds and property. They may be difficult to sell in a timely manner or at a reasonable price. It may be difficult to obtain reliable information about their value. The value of derivatives contracts is dependent upon the performance of an underlying asset. A small movement in the value of the underlying can cause a large movement in the value of the derivatives, which may result in gains or losses that are greater than the original amount invested. Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results. Diversification does not guarantee profit or protect against the risk of loss.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton. The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of the publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the Income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal. Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction. Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute

_________________

1. Source: J. Briggs, A. Phillips. Goldman Sachs Economic Research. US Daily: Student Debt Relief: The Headlines Are Bigger Than The Macroeconomic Impact, August 25, 2022.

2. The fiscal multiplier measures the impact that an increase in fiscal spending will have on a nation’s economic output (GDP). The fiscal multiplier takes into account the marginal propensity to consume, which measures the increase in consumer spending (rather than saving) resulting from increases in the income of an individual, household, or society.

3. Source: S. Roll, J. Jabbari, M. Grinstein-Weiss. Brookings Institution. Student debt forgiveness would impact nearly every aspect of people’s lives. May, 2021.

4. Source: Federal Reserve Bank of New York. Center for Microeconomic Data. Household Debt and Credit Report. Q2 2022.

5. US Consumer Price Index (All Items). Source: U.S. Bureau of Labor Statistics. Offices of Prices & Living Conditions. December 2021.

6. Range based on purchase price of 6 kilowatt and 10 kilowatt systems. Purchase price varies by location, kilowatt capacity, product type, and other factors. Source: J. Marsh. How much do solar panels cost in 2022? EnergySage, April 2022.

7. Source: President Biden. Press announcement of student debt loan forgiveness. August 24, 2022.