US President Joe Biden inked the Inflation Reduction Act (IRA) into law on August 16. Contrary to the bill’s name, we expect minimal impact on near-term inflation, which we see as peaking soon but slower to normalize. We see this bill as a colossal step for the United States in the battle against climate change. As an aside, we also view this as an incremental win for human capital. In one large survey designed to measure climate anxiety in young people, 45% of respondents (aged 16-25 years) said their lives and functioning were negatively impacted by their feelings of climate change on a daily basis.1 As COVID-19 risks diminish and life returns to a new normal, this climate legislation may be a morale boost, specifically in the growing group that ranks climate change as a top concern. In this note, we focus on the renewable energy aspects of the IRA, resulting investment opportunities, and our outlook on long-term growth, valuations and risk.

Investment Opportunities

This legislation will likely be transformative over the long term as it is the largest government-led investment in clean energy in US history. Overall, there will be US$369 billion spending allocated toward climate and energy programs, with significant investment implications.2

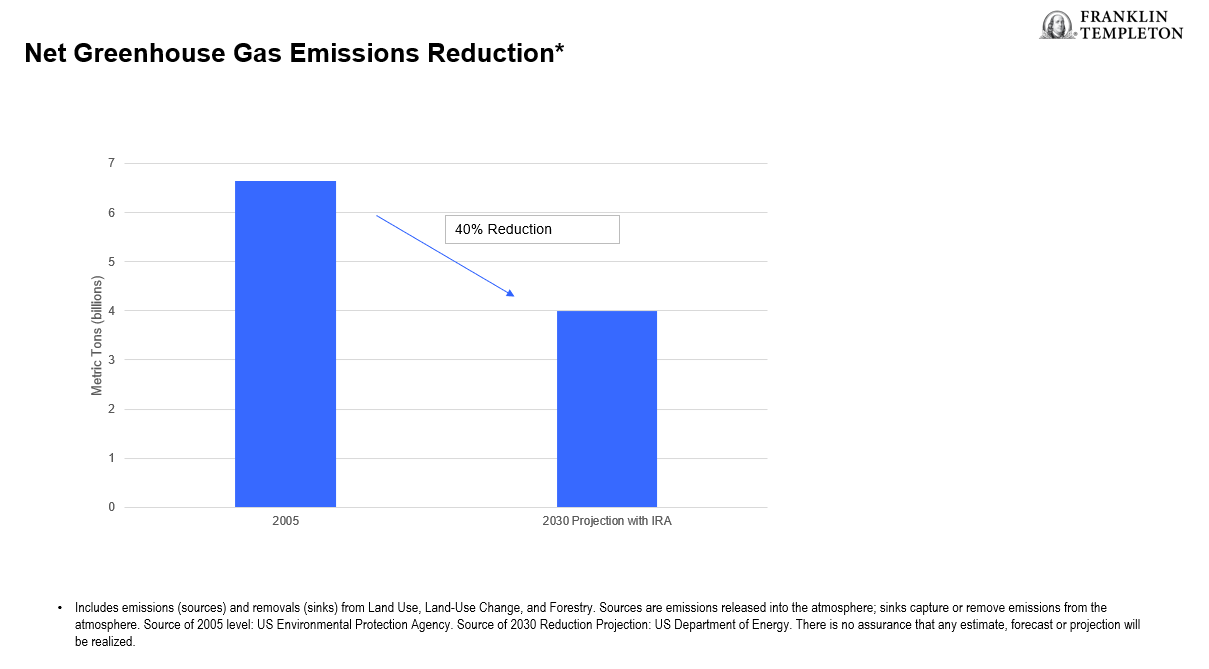

The US goal is to achieve a 50%-52% reduction in greenhouse gas emissions (from 2005 levels) by 2030. The disparity between our current emissions and the end-goal is significant, but the latest forecasts show the IRA could help close this gap by nearly two thirds, cutting annual emissions by an additional one billion metric tons.3,4

This legislation incentivizes the transition to renewable energy with longer-lasting tax and manufacturing credits that could change how companies and consumers make capital allocation decisions. In general, we see the following as likely winners:

- Utilities that have sizeable leads in alternative power generation will extend leads, and those with negligible exposure will be incentivized to enter.

- Fossil fuel companies with a credible transition plan to renewables. Examples include those far along in business lines like air carbon capture and storage or capturing carbon from high intensity areas like chemicals, cement and steel production.

- New companies that are creating novel technologies to assist in carbon capture, and venture-backed companies in industries like wind and solar equipment, battery systems and storage and rare-earth materials.

- A gradual shift in consumer behavior toward electric vehicles and solar panels could accelerate consumption over time.

- We see positive implications for multi-industry companies that sell into the grid, infrastructure, and electric battery markets.

We recognize the cost of the energy transition is high, but the goal of the new law is to influence the market to adopt renewables. It should hasten the day when new clean tech costs match, then fall below, traditional methods.

Multi-asset perspective

Taking a step back and looking at the IRA as a whole, we think this is a positive for US economic growth and equity valuations. Valuation implications are challenging to pinpoint, but we believe this could lower risk over a 10–15-year horizon as risks like physical climate damage diminish. There are modest earnings-per-share offsets; the legislation includes a corporate minimum tax of 15% for companies with income over US$1 billion per year and a 1% excise tax on share buybacks. This could incentivize higher dividend payments and/or capital expenditures (which are used to maintain or grow a business).

At a higher level, we utilize a growth, inflation, rates, and valuation framework when determining asset allocations, and specifically, we see a modest boost to growth through increased spending on clean energy, higher job formation and increased capital spending with longer lived incentives. We expect slightly higher equity valuations in the industries previously highlighted as “winners,” from higher growth and a lower weighted average cost of capital.

Fixed Income markets should see increased issuance in the many types of environmental, social and governance (ESG)-related bonds, including green bonds, social bonds, sustainability bonds, sustainability-linked bonds, transition bonds, SDG-linked bonds and maybe even blue bonds. We think inflation is peaking now but will remain elevated until the second half of 2023. In the meantime, we see a Federal Reserve (Fed) committed to a course of monetary tightening to bring inflation under control. As Fed Chair Powell stated, “The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed…”5The markets are hungry for a policy pivot, but we remain patient. We’re watching second-derivative inflation indicators like supply chain bottlenecks and demand destruction closely.

The rise and fall of COVID-19 leaves the world an unprecedented, increasingly complex place. Back to the IRA, we have conviction that it will be positive for long-term growth and offers potential to lower risk premiums over time.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline.

Investing in the natural resources sector involves special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector—prices of such securities can be volatile, particularly over the short term. Real estate securities involve special risks, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments affecting the sector.

The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio. Franklin Templeton and our Specialist Investment Managers have certain environmental, sustainability and governance (ESG) goals or capabilities; however, not all strategies are managed to “ESG” oriented objectives.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton. The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of the publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the Income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance.

All investments involve risks, including possible loss of principal. Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute

__________________________________

1. Source: C. Hickman, E. Marks, et. al. (2021). Climate anxiety in children and young people and their beliefs about government responses to climate change: a global survey. The Lancet Planetary Health 5(12), E863-E873.

2. Source: US Department of Energy. Office of Policy. The Inflation Reduction Act Drives Significant Emissions Reductions and Positions America to Reach Our Climate Goals, August 2022.

3. Source: Jenkins, J.D., Mayfield, E.N., Farbes, J., Jones, R., Patankar, N., Xu, Q., Schivley, G., “Preliminary Report: The Climate and Energy Impacts of the Inflation Reduction Act of 2022,” REPEAT Project, Princeton, NJ, August 2022.

4. Source: US Department of Energy. Office of Policy. The Inflation Reduction Act Drives Significant Emissions Reductions and Positions America to Reach Our Climate Goals, August 2022.

5. Source: “Reassessing Constraints on the Economy and Policy.” Symposium sponsored by Federal Reserve Bank of Kansas City. Jackson Hole, Wyoming. August 26, 2022.