As we reach the mid-year mark, which is a time when we thought we would have more clarity on economic trends, inflation, geopolitical pressures and central bank biases, we arguably have more uncertainty and a wider range of reasonable outcomes. Active asset managers, of which hedge funds are the most agile and dynamic, need to be a larger component of asset owners’ portfolios for the foreseeable future.

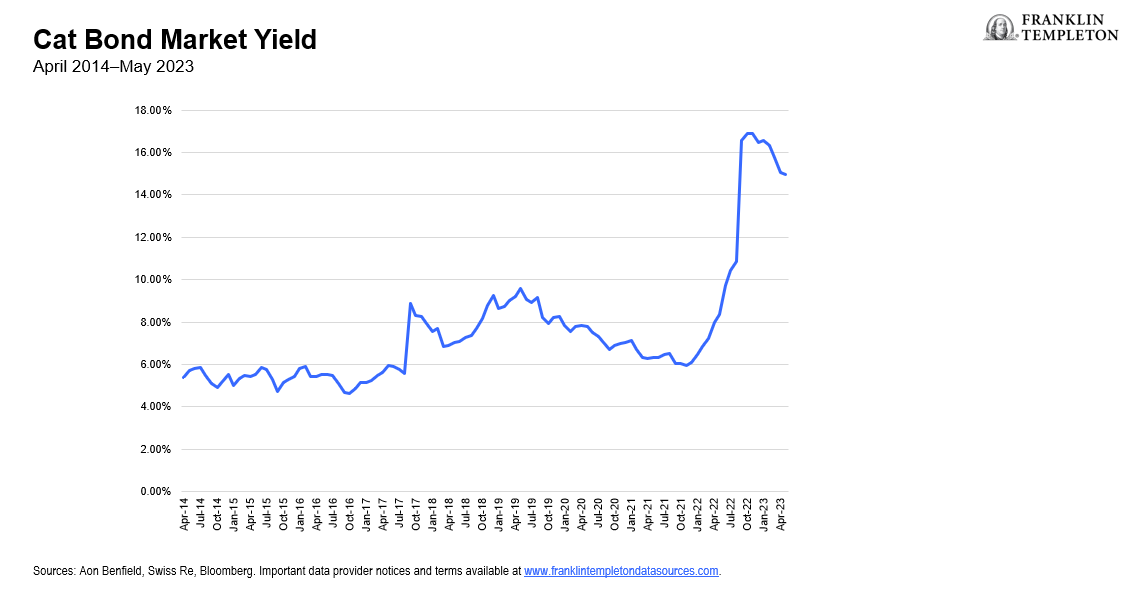

Strategy highlights

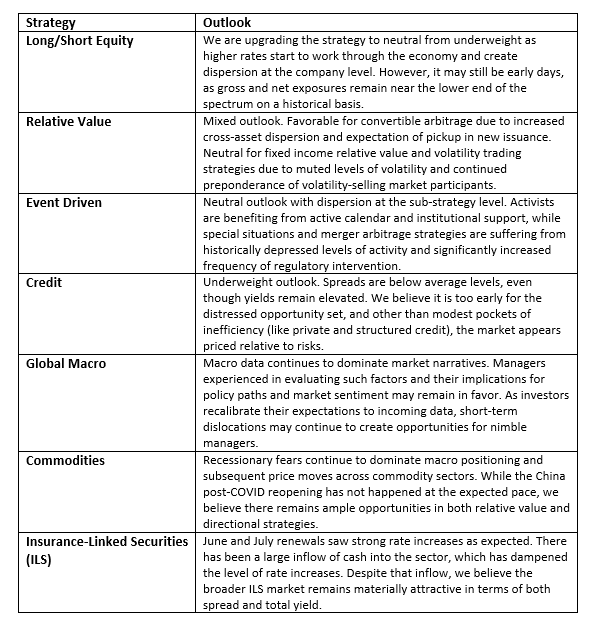

- Equity market neutral: Single stock correlations are low on a historical basis, suggesting a favorable environment for equity market-neutral strategies for picking winners and losers.

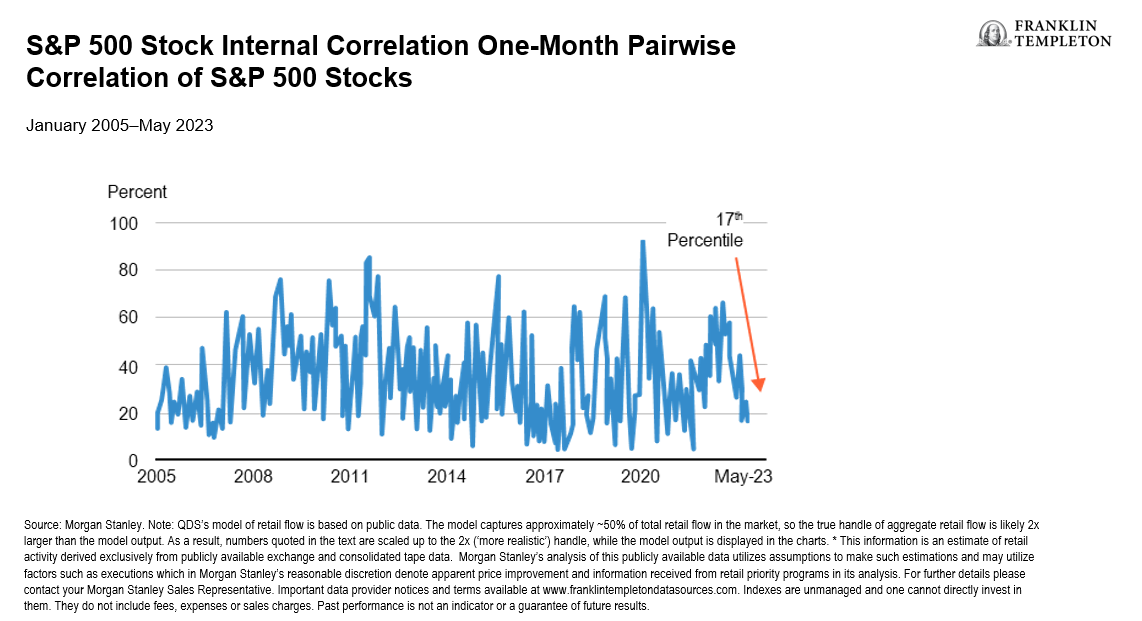

- Discretionary global macro: Managers are closely following inflation trends, differences in regional data, and the potential impact of hawkish policy on economic growth, among other key macro indicators.

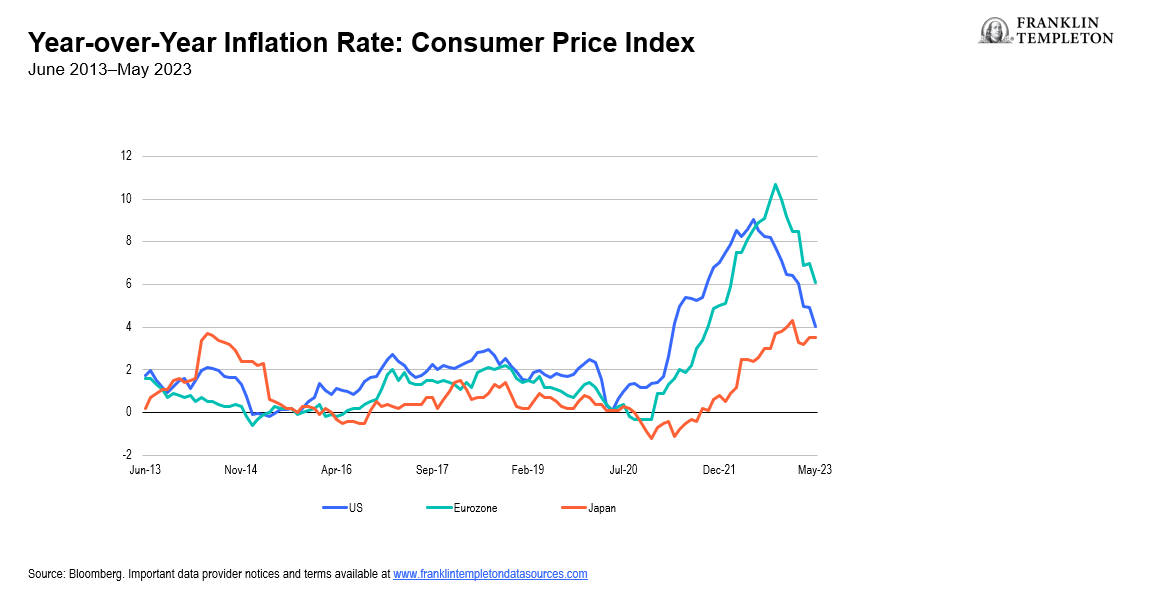

- Insurance-linked securities (ILS): While spreads have tightened from all-time highs in late 2022, the forward-looking outlook remains attractive to us. Total yields remain elevated following the June 2023 renewals which saw continued tighter reinsurance capital and higher money market rates.

Macro themes we are discussing

As we reach the mid-year mark, which is a time when we thought we would have more clarity on economic trends, inflation, geopolitical pressures and central bank biases, we arguably have more uncertainty and a wider range of reasonable outcomes. The Federal Reserve (Fed) remains laser-focused on inflation and stated that there may very well be two rate hikes in the pipeline, even as inflation inputs are showing signs of relief. The recession timeline continues to be pushed down the road as signs of economic robustness pop up. One must ask if a recession will come at all, or, if it does, to what magnitude.

The technology sector has been the leader of overall market strength, though we are beginning to see signs of breadth expansion, which is healthy for the bull’s risk appetite. Over the next earnings cycle, we are expecting to see a moderation in technology sector strength and for market breadth to continue to expand. Market participants will likely be focused on earnings, commentary around earnings, and corresponding market reactions for market clarity. We believe that artificial intelligence (AI) is a game-changer in the long run. However, there has been a rush of “hot money” into this theme, and a liquidation in the space would provide a more attractive buying opportunity.

We think the Fed will lead the global rate cycle. Chair Jerome Powell and team remain very data-driven. While recent inflation and employment numbers look promising, they are not conclusive, which leaves the disinflation versus inflation debate ongoing. We think that investors need to think of future returns and risk distributions as being wider and having fatter tails to both the upside and downside. Active asset managers, of which hedge funds are the most agile and dynamic, need to be a larger component of asset owners’ portfolios for the foreseeable future.

Q3 2023 outlook: Strategy highlights

Equity market neutral

While volatility at the single stock level has been modestly above historical averages, the equity market has been trading broadly uncorrelated, as demonstrated in Exhibit 1. The one-month pairwise correlation between stocks as of June 2023 is in the 17th percentile going back to 2005. This suggests that equity market-neutral managers can capitalize on the dispersion among stocks as the market differentiates between winners and losers. Over the past decade plus, excess central bank liquidity and low credit costs supported directionality for most assets, suppressing dispersion. Market neutral strategies may now be on the verge of medium-to-long term tailwinds given a new central bank policy regime.

Exhibit 1: S&P 500 Stock Internal Correlation. One-Month Pairwise Correlation of S&P 500 Index Stocks (right click on chart to enlarge)

Discretionary global macro

Markets continue to focus on economic data releases, especially those, like inflation, that have a strong influence on policy paths. While off the peaks, inflation rates generally remain above most central bank targets, including in the closely followed G3 economies. Despite elevated inflation globally, different rates of change across regions are likely to influence differences in policy implementation and asset price performance, creating relative value opportunities for those following the data developments. Some market participants appear to be preparing for a policy shift later this year should inflation rates continue to cool in the United States and eurozone, but many macro managers expect central banks to keep rates higher for longer (at least compared to recent years). Managers may find a higher frequency of trading opportunities as markets adjust to incoming data.

Exhibit 2: Year-over-Year Inflation in G3 Economies (right click on chart to enlarge)

Insurance-linked securities (ILS)

The catastrophe (cat) bond market yield remains at historically attractive levels as we move into hurricane season. The broader market reset following Hurricane Ian in 2022, along with higher rates, combines to create an attractive entry point for the asset class. While the cat bond market spread has consistently tightened over the last eight months, it remains at levels not seen since the immediate aftermath of Superstorm Sandy in October 2012. New cat bond issuance has been robust thus far in 2023, and by all indications, this will likely be a record-setting year of new deals in the market. While we would not be surprised to see the spread tighten more throughout the year, absent any significant natural catastrophe activity, we believe forward looking prices and spreads will stabilize at higher levels than prior to Hurricane Ian.

Exhibit 3: Cat Bond Market Yield (right click on chart to enlarge)

WHAT ARE THE RISKS?

All investments involve risks, including possible loss or principal. Investments in alternative investment strategies and hedge funds (collectively, “Alternative Investments”) are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Financial Derivative instruments are often used in alternative investment strategies and involve costs and can create economic leverage in the fund’s portfolio which may result in significant volatility and cause the fund to participate in losses (as well as gains) in an amount that significantly exceeds the fund’s initial investment. Depending on the product invested in, an investment in Alternative Investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. There can be no assurance that the investment strategies employed by K2 or the managers of the investment entities selected by K2 will be successful.

The identification of attractive investment opportunities is difficult and involves a significant degree of uncertainty. Returns generated from Alternative Investments may not adequately compensate investors for the business and financial risks assumed. An investment in Alternative Investments is subject to those market risks common to entities investing in all types of securities, including market volatility. Also, certain trading techniques employed by Alternative Investments, such as leverage and hedging, may increase the adverse impact to which an investment portfolio may be subject.

Depending on the structure of the product invested, Alternative Investments may not be required to provide investors with periodic pricing or valuation and there may be a lack of transparency as to the underlying assets. Investing in Alternative Investments may also involve tax consequences and a prospective investor should consult with a tax advisor before investing. In addition to direct asset-based fees and expenses, certain Alternative Investments such as funds of hedge funds incur additional indirect fees, expenses and asset-based compensation of investment funds in which these Alternative Investments invest.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

The information in this document is provided by K2 Advisors. K2 Advisors is a wholly owned subsidiary of K2 Advisors Holdings, LLC, which is a majority-owned subsidiary of Franklin Templeton Institutional, LLC, which, in turn, is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN). K2 operates as an investment group of Franklin Templeton Alternative Strategies, a division of Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.