We recently wrote about potential opportunities to be found in US small cap and emerging market stocks. These areas of the market have historically been more volatile than developed market mid- and large-cap stocks,1 but we find them compelling at this time.

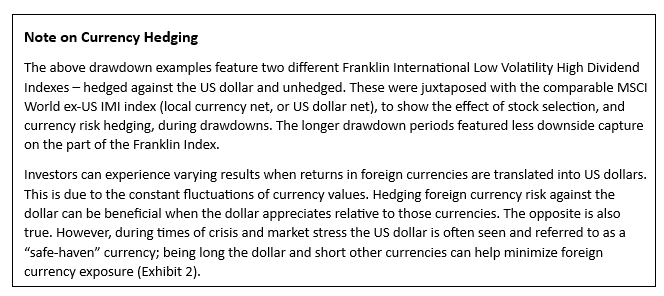

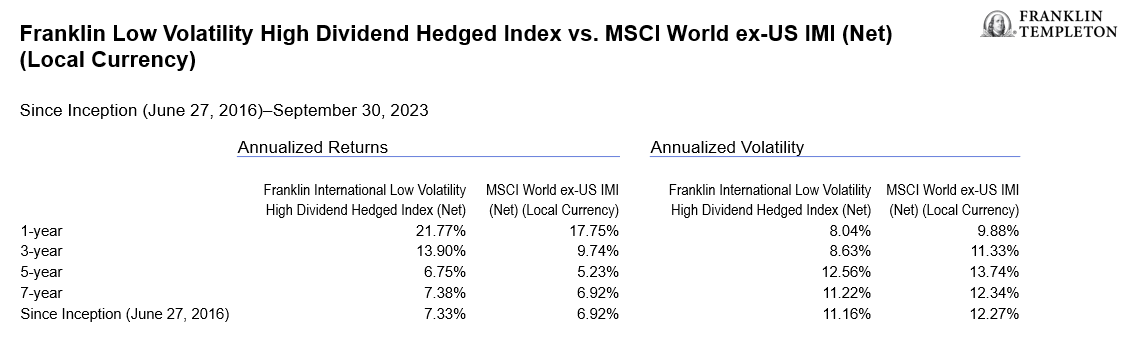

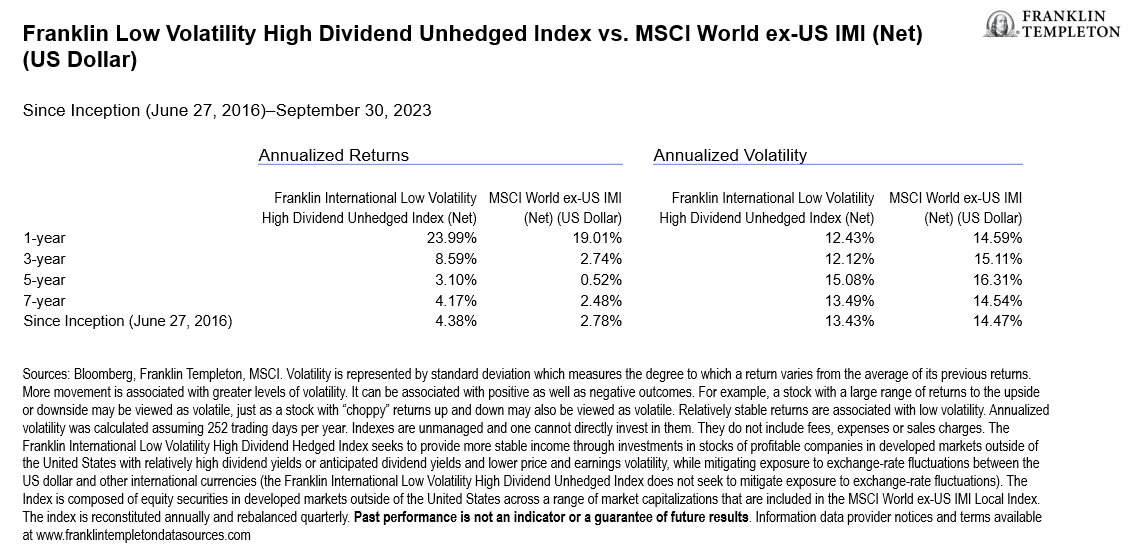

As a rule, we have always been selective in our risk budgeting; this is perhaps even more important when the macro environment is as uncertain as it is today. At the asset allocation level, we still prefer a defensive posture. And with a less-sanguine view on international developed markets in general, it may make sense to favor defensive equities, which could also help neutralize risk from other portfolio selections. There are certain factors we prefer to help buttress relative performance should things turn south, or even trudge sideways. These include the low volatility and high, sustainable dividend factors. Further, hedging foreign currencies against the US dollar can help improve returns when the dollar appreciates (relative to those foreign currencies).

A challenging macro environment

From a macro standpoint, there are reasons to be cautious throughout international markets. Uncertainty abounds when trying to forecast central bank policymaking.

For instance, determined to cool inflation (which has been sticky in services), the European Central Bank raised interest rates in September, despite a dismal growth outlook. The eurozone manufacturing Purchasing Managers’ Index (PMI) level is very low compared to the world’s (43.5 vs. 49.1).2

The story is a bit different in Japan, as the Bank of Japan has expressed conviction that inflation is transitory and has so far avoided raising rates. But with inflation high and stickier than anticipated, it may have to tighten over the coming quarters. This is unfortunate timing, as Japan’s manufacturing PMI is at a seven-month low and currently in contractionary territory (48.5).3

For more information on our regional outlooks, please refer to our Allocation Views. In general, many central banks will look to keep rates high if inflation stays elevated and economies do not fall into recession. Should recessions materialize, central banks would have room to ease monetary policy. However, recessions are generally an unfavorable environment for stocks. We find ourselves questioning whether disinflation and/or policy easing would be a more potent driver of stock prices than the growth outlook.

Why low volatility and high dividends? Why now?

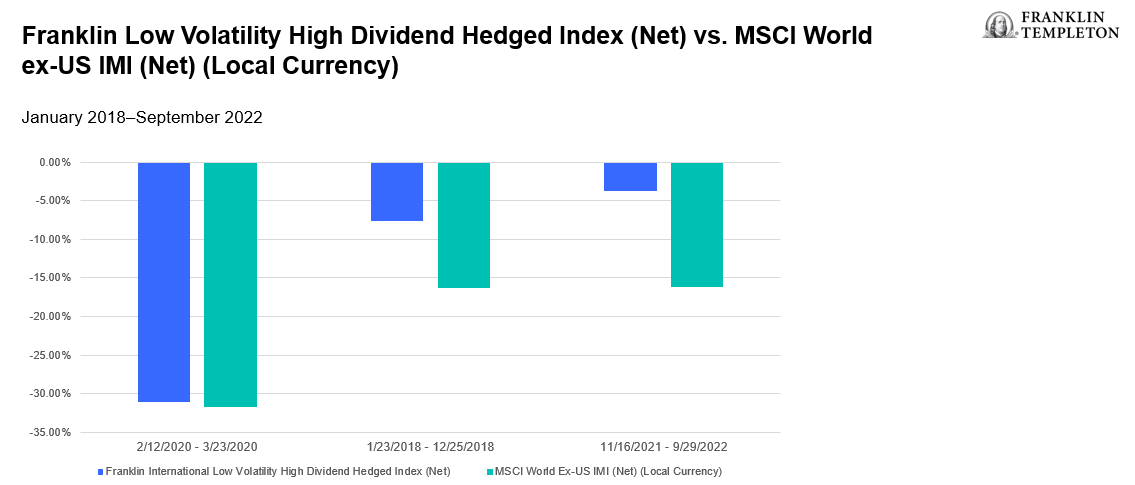

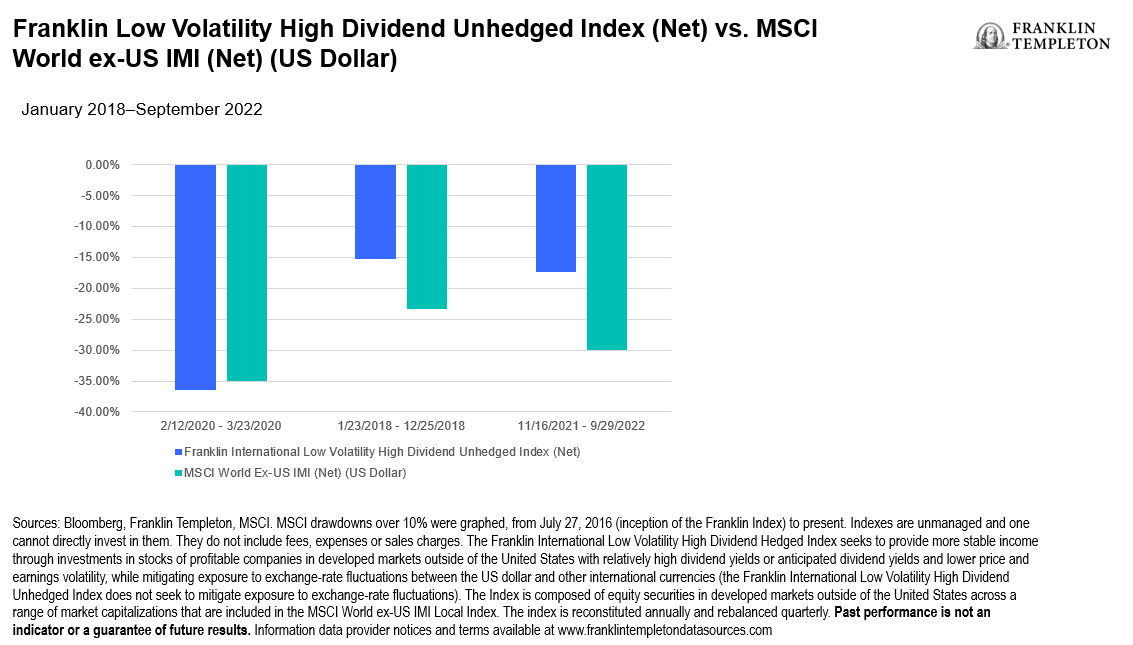

We think a combination of the low volatility and sustainably high dividend factors proves to be a helpful screening tool for equities, particularly when the macro environment is as uncertain as it is now.

We advocate for a dividend process that includes a focus on earnings and profitability. This increases the likelihood that a high dividend yield can be sustained, in essence providing an assessment of company fundamentals.

The low volatility factor, when applied to price, does not give direct insight into the fundamentals of a company. But when earnings volatility is screened (both realized earnings and analyst forecasts), another stability component is incorporated which we believe can improve the odds of lower drawdowns in declining markets.

This approach could result in stocks that exhibit a “smoother ride,” with underlying companies that appear to be well-managed and financially sound. Over time, the aim for equities of this type of defensive exposure is to outperform on a relative basis, should market cap indexes drop, while providing meaningful income.

Exhibit 1A and 1B: International Low Volatility, High Dividend Stocks Have Outperformed in Down Markets (right click to enlarge)

Exhibit 2: Currency Hedging Produced Stronger Returns During These Downturns (right click to enlarge)

Exhibit 3A and 3B: Annualized Return and Volatility Profile (right click to enlarge)

We believe that combining companies with high dividends—and the earnings to back them up—with those that have exhibited low volatility over time can be a useful way to lower the risk of an investor’s equity sleeve and produce appealing income. This can potentially help balance out the volatility of other equity exposures, such as US small caps and emerging markets—a sort of bar-belled approach that maintains equity exposure and can provide the additional benefit of income potential.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Equity securities are subject to price fluctuation and possible loss of principal. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Dividends may fluctuate and are not guaranteed, and a company may reduce or eliminate its dividend at any time.

Diversification does not guarantee a profit or protect against a loss.

Active management does not ensure gains or protect against market declines.

Before investing, carefully consider a fund’s investment objectives, risks, charges and expenses. You can find this and other information in each prospectus, or summary prospectus, if available, at www.franklintempleton.com. Please read it carefully.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

_________

1. As measured by standard deviation, using the Russell 2000 (for US small caps), MSCI Emerging Markets Index, and MSCI World Index as proxies. Inception dates of the Russell 2000 Index and MSCI Emerging Markets Index were utilized to determine the comparison time period. The standard deviation of the Russell 2000 Index versus the MSCI World Index was calculated from March 31, 1986 – September 30, 2023. The standard deviation of the MSCI Emerging Markets Index versus the MSCI World Index was calculated from June 30, 1988 – September 30, 2023.Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

2. Source: S&P Global.

3. Ibid.