Fourth quarter (Q4) 2023 outlook: Summary

Higher macro and market volatility, along with greater dispersion, creates an environment rich with opportunities for active trading. We think the key to success for hedge funds is to identify these opportunities early, manage liquidity, increase nimbleness and to be macro-aware. In our view, high quality, active hedge funds need to be a larger component of asset owners’ portfolios in this investment regime.

Strategy highlights

- Equity market neutral: Historical data suggests that equity market neutral managers perform best in higher interest-rate regimes. Returns are partially a function of dispersion in equity markets, and higher rates help separate the winners from the losers.

- Discretionary global macro: The opportunity set is attractive for dynamic managers with expertise forecasting and interpreting economic data, cross-asset relationships, and the policy paths that remain a driving force in markets.

- Insurance-linked securities (ILS): Despite recent tightening, the forward-looking yield environment across most risk segments remains attractive.

Macro themes we are discussing

The US Federal Reserve (Fed) marked an investment regime shift in March of 2022 by raising interest rates and the cost of capital. Since then, all stakeholders have been in a constant state of adjustment and recalibration. We do think that central banks have a big hurdle to tame inflation to their stated target levels. As we look at the world today, we see real cash rates at very attractive levels, the cost of capital rising to even higher levels for companies, governments expanding their debt levels, increasing costs for consumers, and intensified geopolitical tensions. We expect the cost of capital to remain high for the foreseeable future as central banks keep the cost of funding elevated to keep inflationary pressures at bay. The resultant investment climate is one of increased market volatility across all asset classes, more divergent security performance, and investors shortening their time horizon.

Equity market neutral hedge funds are positioned well, in our view to capture security dispersion in a responsible, risk-oriented, non-directional approach. We continue to overweight global macro discretionary managers for all the reasons mentioned above but want to highlight that manager selection is of upmost importance in this regime. Insurance-linked securities are one of the most idiosyncratic investments to pick up excess yield while offering diversification to portfolios.

Q4 2023 outlook: Strategy highlights

Equity market neutral

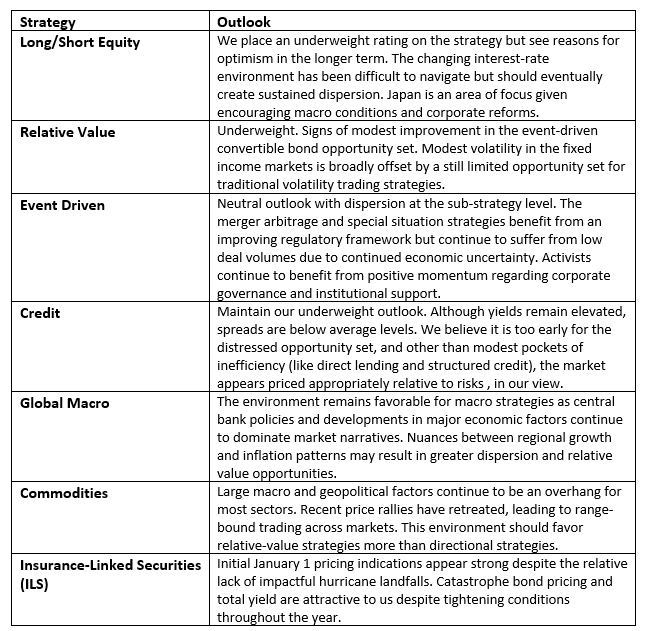

Rates have risen higher and faster than just about any market participant would have predicted two years ago. That transition has been difficult for certain assets and investment strategies, but history suggests that higher prevailing rates create attractive opportunity sets for hedge funds. The table below demonstrates that hedge funds, and long/short equity in particular, perform better in higher rate regimes, which tend to separate winners from losers. In a low-rate environment, weaker companies can more easily secure financing, that financing is less impactful to the bottom line, and customers may be less discerning given their own financing situations. With rates now significantly higher than they have been for the past decade plus, those weaker companies will start to shift to risk management mode while the stronger companies can seize opportunities and profit. We believe equity market neutral managers are well suited to capitalize on this setup as returns are very much a function of dispersion.

Exhibit 1: Interest-Rate Regime Effects on Returns of Hedge Funds (monthly returns, annualized) (right click to enlarge)

Discretionary global macro

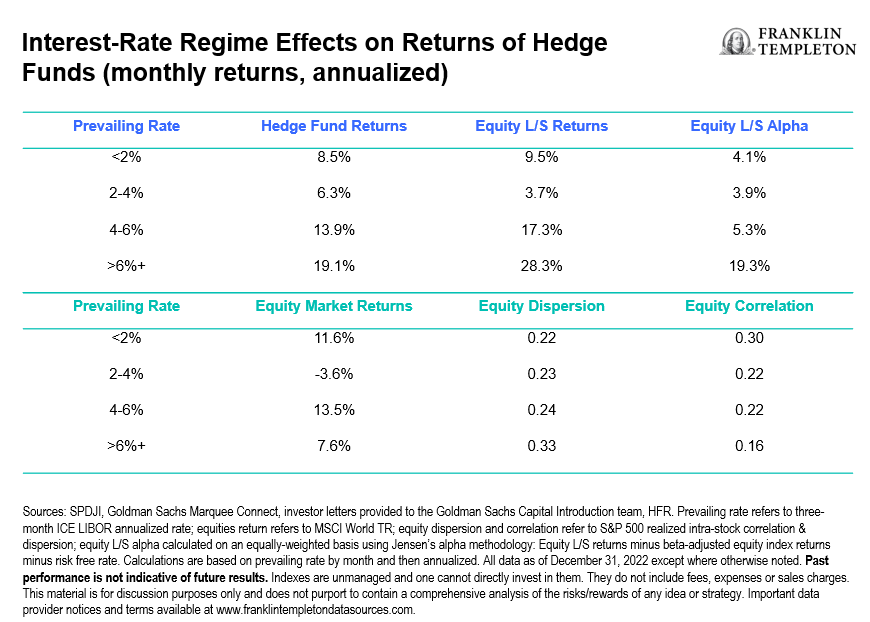

Cross-asset correlations are a key consideration in most portfolio construction and risk management techniques. Many modern investors have implicitly or explicitly built in an assumption of negative correlation between equities and government fixed income over the last few decades. However, this dynamic has recently flipped, with the two asset classes no longer offsetting each other’s risks, and instead, seemingly compounding risk within a portfolio. Investors may need to seek diversification elsewhere, whether through allocations to other asset classes or to tactical trading strategies with no structural long or short biases.

Macro managers, who tend to focus on these types of big-picture cross-asset relationships as a matter of course, and who can shift dynamically between longs and shorts, may be facing an attractive trading environment and may also provide a source of much-needed diversification for broader portfolios. To the extent hawkish central bank policy is a contributing factor to this new correlation dynamic, we believe those managers with the expertise to evaluate policy paths may be well-suited to capture the opportunity set.

Exhibit 2: Rolling Five-Year Stock-Bond Correlation (right click to enlarge)

Insurance-linked securities (ILS)

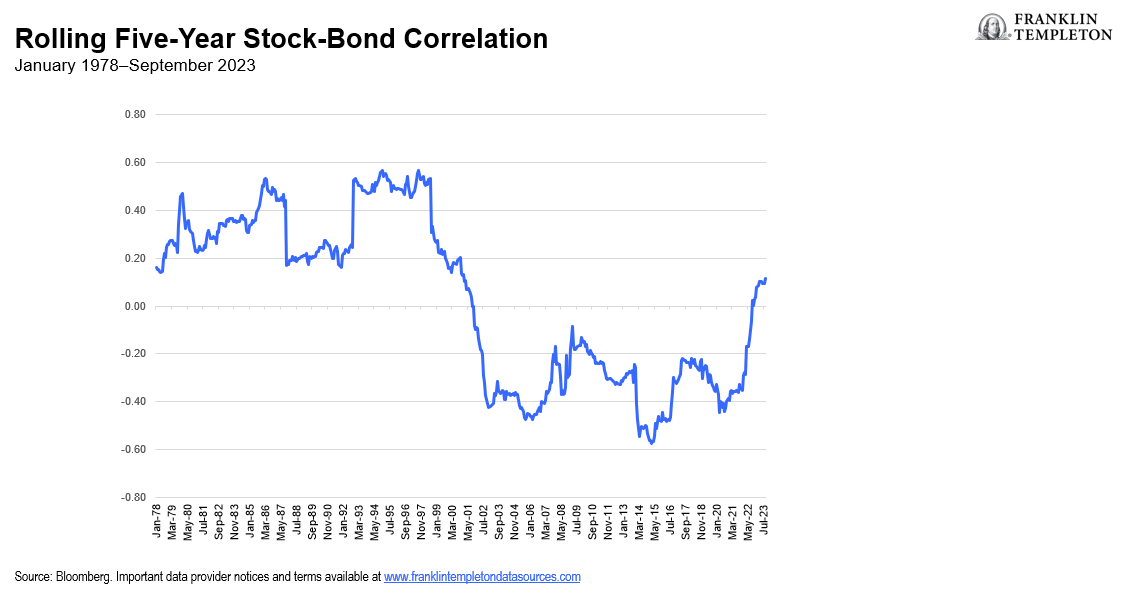

The focus of most ILS managers has shifted to the January renewals as we move through the end of a relatively unimpactful hurricane season (at the time of this writing). There remains a supply and demand dislocation within the broader insurance and reinsurance markets. This dislocation, while not as pronounced as last year in the immediate aftermath of Hurricane Ian, is likely large enough for spread and pricing levels to remain elevated. Given the increase of demand for risk transfer and relative lack of capacity in traditional reinsurance markets, we expect to see several sponsors and cedants utilize the catastrophe bond market to transfer retrocessional and reinsurance risk. In response to loss trends and challenging reinsurance markets, many cedants have materially shifted their portfolios since the start of 2022. In some instances, cedants retained higher levels of risk in 2023 given the severe supply and demand dislocations ahead of last year’s renewals. This will likely lead to pent-up demand for reinsurance from these cedants at higher price levels and cleaner risk from a structural perspective.

Exhibit 3: Guy Carpenter US Property Rate On Line (ROL) Index (right click to enlarge)

WHAT ARE THE RISKS?

All investments involve risks, including possible loss or principal. Investments in alternative investment strategies and hedge funds (collectively, “Alternative Investments”) are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Financial Derivative instruments are often used in alternative investment strategies and involve costs and can create economic leverage in the fund’s portfolio which may result in significant volatility and cause the fund to participate in losses (as well as gains) in an amount that significantly exceeds the fund’s initial investment. Depending on the product invested in, an investment in Alternative Investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. There can be no assurance that the investment strategies employed by K2 or the managers of the investment entities selected by K2 will be successful.

The identification of attractive investment opportunities is difficult and involves a significant degree of uncertainty. Returns generated from Alternative Investments may not adequately compensate investors for the business and financial risks assumed. An investment in Alternative Investments is subject to those market risks common to entities investing in all types of securities, including market volatility. Also, certain trading techniques employed by Alternative Investments, such as leverage and hedging, may increase the adverse impact to which an investment portfolio may be subject.

Depending on the structure of the product invested, Alternative Investments may not be required to provide investors with periodic pricing or valuation and there may be a lack of transparency as to the underlying assets. Investing in Alternative Investments may also involve tax consequences and a prospective investor should consult with a tax advisor before investing. In addition to direct asset-based fees and expenses, certain Alternative Investments such as funds of hedge funds incur additional indirect fees, expenses and asset-based compensation of investment funds in which these Alternative Investments invest.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of September 30, 2023, and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

The information in this document is provided by K2 Advisors. K2 Advisors is a wholly owned subsidiary of K2 Advisors Holdings, LLC, which is a majority-owned subsidiary of Franklin Templeton Institutional, LLC, which, in turn, is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN). K2 operates as an investment group of Franklin Templeton Alternative Strategies, a division of Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.