Benefits play a significant role in recruiting and retaining a talented workforce.

By gaining a deeper understanding of employee desires, employers can effectively create loyalty and attract top talent.

Franklin Templeton’s 2024 “Voice of the American Workplace” survey found it is more important than ever for employers to optimize resources and tailor benefits to meet workers’ needs. While compensation and health benefits are important to workers, the survey revealed that what workers are looking for may not be in sync with what employers think.

Bridging the perception gap provides an opportunity for a better alignment of benefits and needs.

Conducted in partnership with The Harris Poll, our fourth annual survey was rebranded as “Voice of the American Workplace” because it now includes the views of both employers and workers.

Benefits matter

Most employers agree benefits are a pivotal tool for attracting top talent, fostering a positive workplace culture and for building employee loyalty.

Employers are facing some challenges, including supporting work-life balance, managing turnover and meeting rising employee expectations.

(right click on chart to enlarge)

This survey found that 91% of employers experienced turnover of more than 10% in their workforce, and 57% experienced turnover of more than 20% in 2023. Voluntary terminations (including workers quitting, accounted for half of the turnover). The survey also found employee expectations are on the rise across all areas, with compensation taking the lead. However, 80% of employers said they are struggling to meet this desire for increased compensation.

To attract and retain talent, employers have boosted benefit packages, even if costs appear to be unsustainable. Most employers (70%) stated they recently increased the number or quality of their benefits, and 65% noted their benefits are “quite competitive.”

However, 80% of employers said their organization is struggling with managing the increased cost of providing benefits, and 68% have had to increase their insurance premiums in the last 12 months.

(right click on chart to enlarge)

What this means for businesses: Our takeaway is that employers need to implement strategies that focus on employee retention and satisfaction. This could involve offering competitive compensation packages and creating a positive work environment that values employee well-being and work-life balance. By prioritizing employee satisfaction and addressing their increasing expectations, employers may be able to mitigate turnover and create a more engaged and productive workforce.

Financial stress is top concern among workers

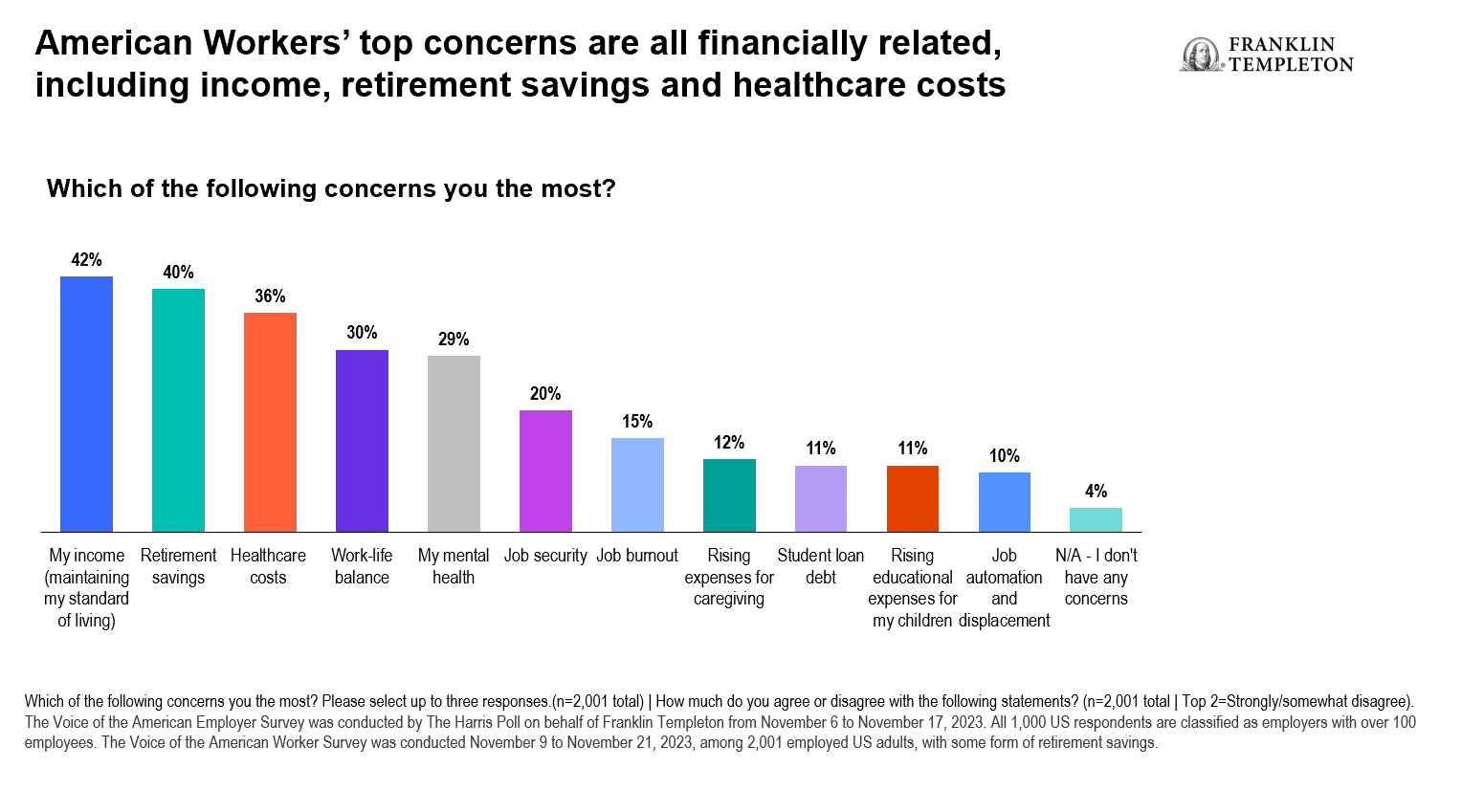

Workers are under a lot of financial stress, and financial independence is a major concern. Workers in our survey cited their top financial concerns as income or maintaining their standard of living (42%), retirement savings (40%) and healthcare costs (36%).

Achieving financial independence has become a bigger focus in recent years, along with paying off debt.

For the first time in our survey’s history, financial health has surpassed mental and physical health in terms of importance, growing by 15% year-over-year in the latest survey.

Nearly two thirds (61%) of workers said, “My financial independence is in jeopardy due to the current economic situation” as they lengthen their time horizons to achieve financial milestones. Important goals feel out of reach. Key concerns like expenses (66%), healthcare costs (64%), are making financial milestones challenging and (86%) of workers say they have at least one thing getting in the way of their ability to retire.

Retirement anxiety prevails among workers—concerns about running out of money are prompting a determination to work as long as possible to bridge the financial gap. More than half (55%) of respondents said they plan to work in retirement. Retirement concerns are dominated by healthcare costs, surpassing expenses like housing and food, as 58% say that they are more concerned about healthcare than housing in retirement.

What this means for businesses: The data show that workers are increasingly concerned about their financial health. This is likely due to the increasing cost of living, as well as the uncertainty of the job market. We think employers need to be aware of this trend and take steps to address the concerns of their workers. One way to do this is to provide financial resources to help workers manage their finances, such as educational opportunities on financial topics and access to financial advice.

Diverging views

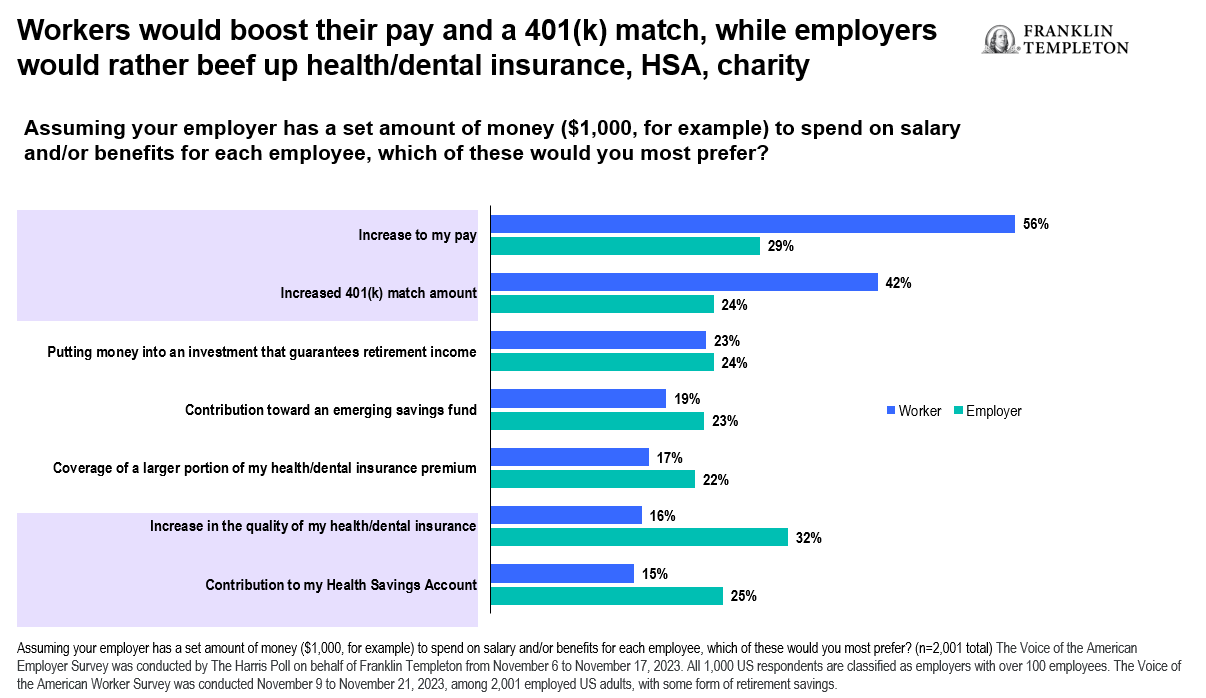

Employee expectations continue to rise across the benefits spectrum, and compensation remains a priority. Most workers in our survey (70%) reported their salary is not keeping up with inflation. They are the least satisfied with their compensation package. Their recommendation for employers: Prioritize compensation, including pay and a 401(k) match, and work-life balance for enhanced retention.

If given the option for an enhanced benefit, workers expressed a clear preference for increased pay and 401(k) match, while employers assume they would prefer improved health and dental insurance, health savings accounts (HSAs), and charitable contributions.

Regardless of the disconnect, employers are providing access to resources like financial wellness platforms (49%), yet workers are not always leveraging these resources (28%). Workers admit that they struggle to understand the benefits available to them (72%). Nearly one third (29%) admit they struggle to understand the monetary value of employer-provided benefits.

What this means for businesses: Understanding employee preferences is crucial for organizations seeking to attract and retain top talent. Our takeaway is that organizations must work to effectively communicate the resources they make available and focus on articulating the holistic value of total compensation and benefit packages.

Emerging trends

Workers expressed interest in some emerging trends in benefits including:

- Pet insurance

- Loan repayment assistance

Personalized benefits are also becoming a growing trend. In the survey, 84% of workers cited an interest in more personalized offerings in their 401(k) plans and comprehensive benefit packages, including customized benefits that meet individual needs.

For additional information, please contact the Franklin Templeton Retirement Sales Department at (800) 530-2432.

The Voice of the American Employer Survey was conducted by The Harris Poll on behalf of Franklin Templeton from November 6th to November 17th, 2023. All 1,000 respondents, based in the United States, are classified as employers, defined as having at least some influence over company benefits and/or hiring at organizations with over 100 employees. Respondents represent a mix of industries, company size, role, age, and race.

This presentation also references a qualitative study conducted by The Harris Poll on behalf of Franklin Templeton from August 15th to August 25th, 2023, among 15 American employers. All interviewees were full-time employees working in human resources, who have influence over employee benefits, and included those with titles such as HR Manager, HR Director or HR Vice President, among others.

This was a blind study, as Franklin Templeton was not mentioned in order to avoid bias.

The Voice of the American Worker Survey was conducted by The Harris Poll on behalf of Franklin Templeton from November 9th to November 21st, 2023, among 2,001 employed US adults. All respondents had some form of retirement savings. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Findings from 2020 reference a study of a similar nature that was conducted by The Harris Poll on behalf of Franklin Templeton from October 16 to 28, 2020, among 1,007 employed US adults, study from 2021 also references a similar survey conducted among 1,005 employed adults from October 28th to November 15th, and a study from 2022 also references a similar survey conducted among 1,000 employed adults from October 17th to October 27th.

Franklin Templeton is not affiliated with The Harris Poll, Harris Insights & Analytics, a Stagwell LLC Company.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2024 Franklin Templeton. All rights reserved.