In the latest episode of the Alternatives Allocations podcast series, I was joined by Patrick McGowan, Head of Alternative Investments, at Sanctuary Wealth Management. Patrick and I discussed advisor adoption, structural tradeoffs, due diligence and the increasing demand for alts. We discussed the importance of education focusing on the merits of the asset classes, and the tradeoffs from one product structure to the next. We compared investment structures: the traditional drawdown structure where capital is raised during a subscription period, and capital is called over time; and the perpetual structure (registered funds), where they are generally available, and capital is put to work as it is received.

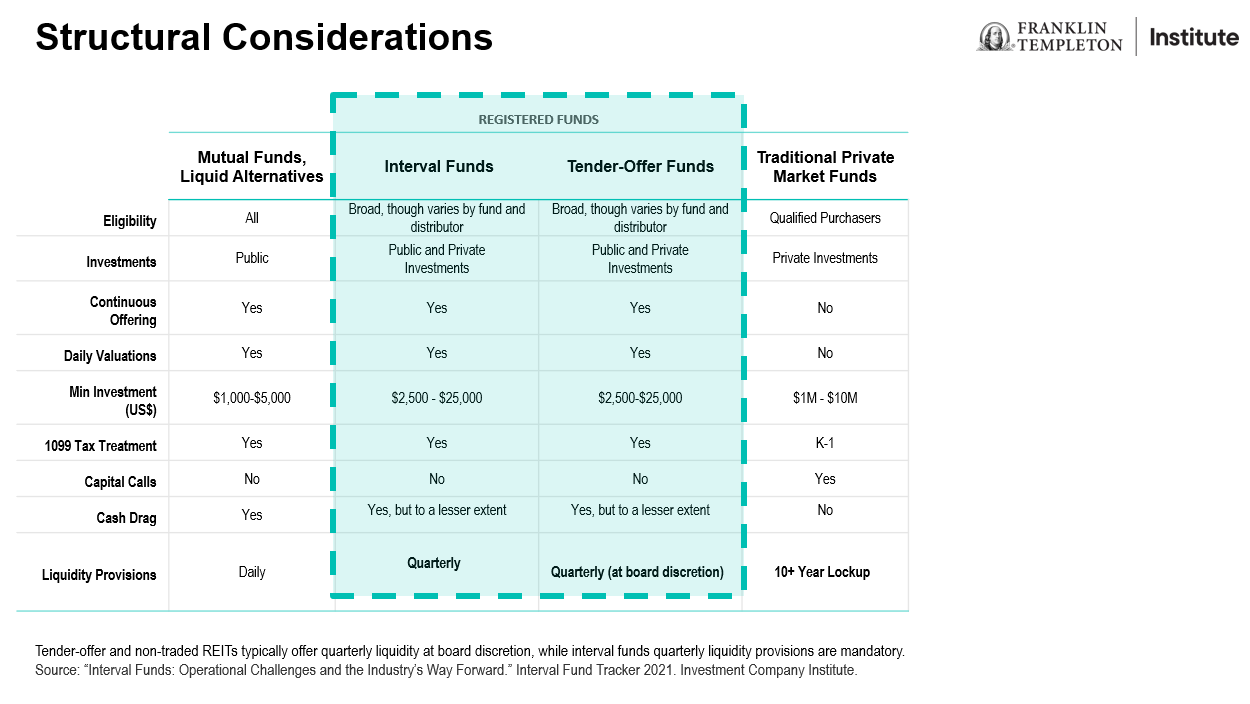

As Patrick noted, registered funds (interval and tender-offer funds) are available to a broader group of investors, at lower minimums, and more flexible features. However, he also noted that certain strategies fit better into a drawdown structure as opportunities need to be sourced over time. The important thing is that advisors and investors understand the structural tradeoffs of the various options, and they determine which is most appropriate for their clients.

Patrick and I also delved into the importance of due diligence in evaluating funds. Patrick emphasized the importance of matching the objective of the fund with each client’s goals. He stressed the importance of understanding the underlying holdings, historical track record, and fees among other issues. Due diligence may be conducted by the home office, third-party providers, and/or by advisors themselves.

I asked Patrick where he saw the biggest opportunities in the coming year. He stated, “I do think that there is a lot of interest and there will be continued interest in managers in areas like direct lending and private credit and real estate lending. There are these huge opportunities, multi trillion-dollar opportunities for private lenders to get involved there.”

The bottom line is the alternative investment landscape is expanding dramatically, with more institutional-quality managers, bringing more products to the market across the array of strategies. Advisors should select the most appropriate options to fulfill their clients’ needs and goals.

To listen to this episode, or any other podcast, please visit Alternative Allocations Podcast | Franklin Templeton.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Investments in many alternative investment strategies are complex and speculative, entail significant risk and should not be considered a complete investment program. Depending on the product invested in, an investment in alternative strategies may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. An investment strategy focused primarily on privately held companies presents certain challenges and involves incremental risks as opposed to investments in public companies, such as dealing with the lack of available information about these companies as well as their general lack of liquidity. Diversification does not guarantee a profit or protect against a loss.

An investment in private securities (such as private equity or private credit) or vehicles which invest in them, should be viewed as illiquid and may require a long-term commitment with no certainty of return. The value of and return on such investments will vary due to, among other things, changes in market rates of interest, general economic conditions, economic conditions in particular industries, the condition of financial markets and the financial condition of the issuers of the investments. There also can be no assurance that companies will list their securities on a securities exchange, as such, the lack of an established, liquid secondary market for some investments may have an adverse effect on the market value of those investments and on an investor’s ability to dispose of them at a favorable time or price. Past performance does not guarantee future results.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.