Saving for a college education is at the core of a comprehensive financial plan for families with children hoping to advance their education someday.

The use of savings vehicles such as 529 plans support these efforts. In fact, assets in 529 savings plans exceeded $500 billion as of June 30, 2024, according to the College Savings Plan Network.1

Still, as the costs of college continue to rise, the significance of financial aid persists. As a result, most families will rely on some form of federal financial aid to cover the cost of higher education.

Importance of federal aid

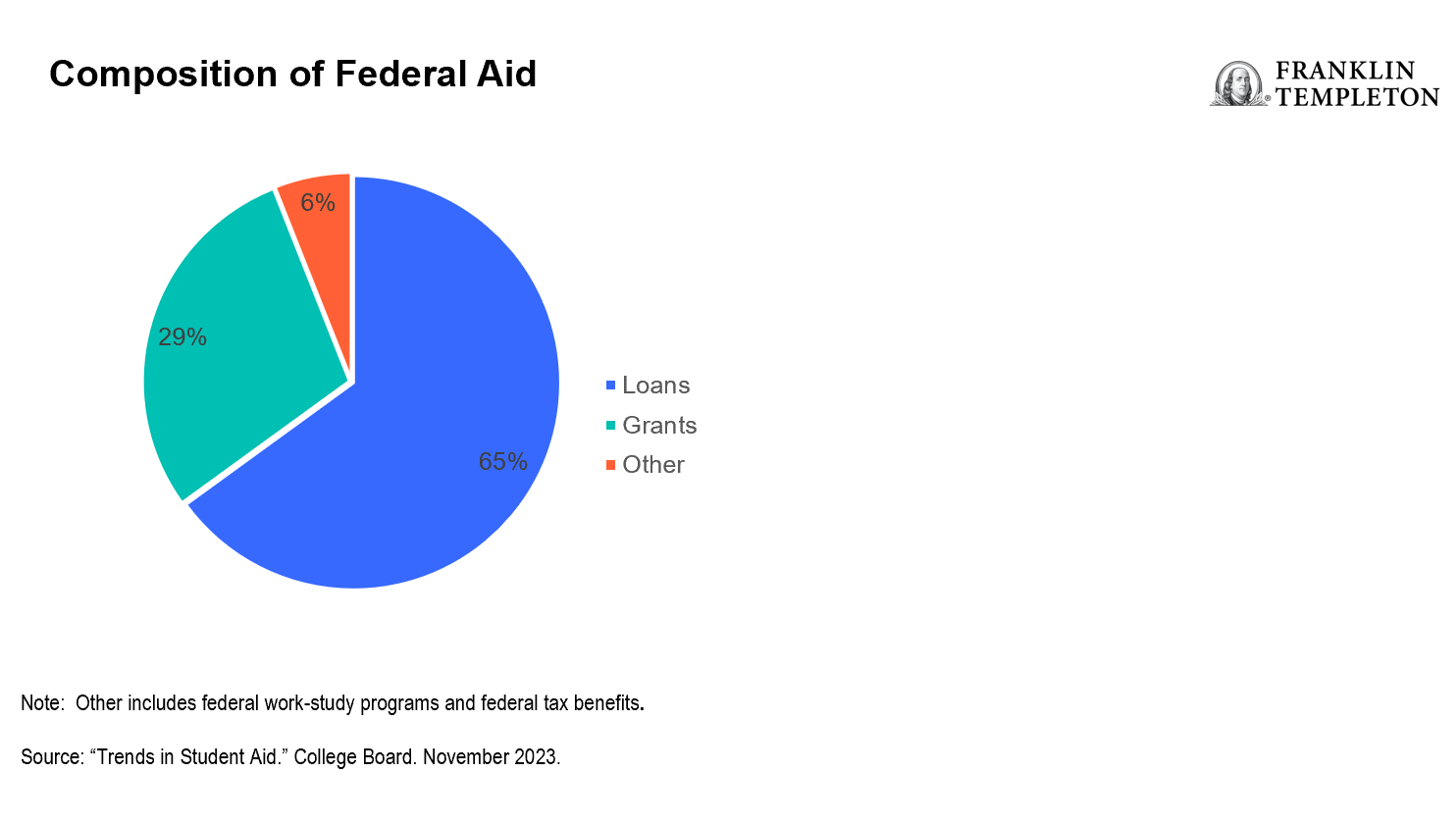

About $130 billion in total federal financial aid will be awarded this year. More than half of undergraduate students receive some type of aid, including federal student loans, according to the College Board (Trends in Student Aid 2023), with the average grant totaling about $10,500.2 It is also important to note that more than half of federal financial aid consists of loans which will have to be generally paid back, unless a loan forgiveness program is applied. In our view, this makes it more important than ever for families to implement a dedicated college savings program.

Applications for aid are declining

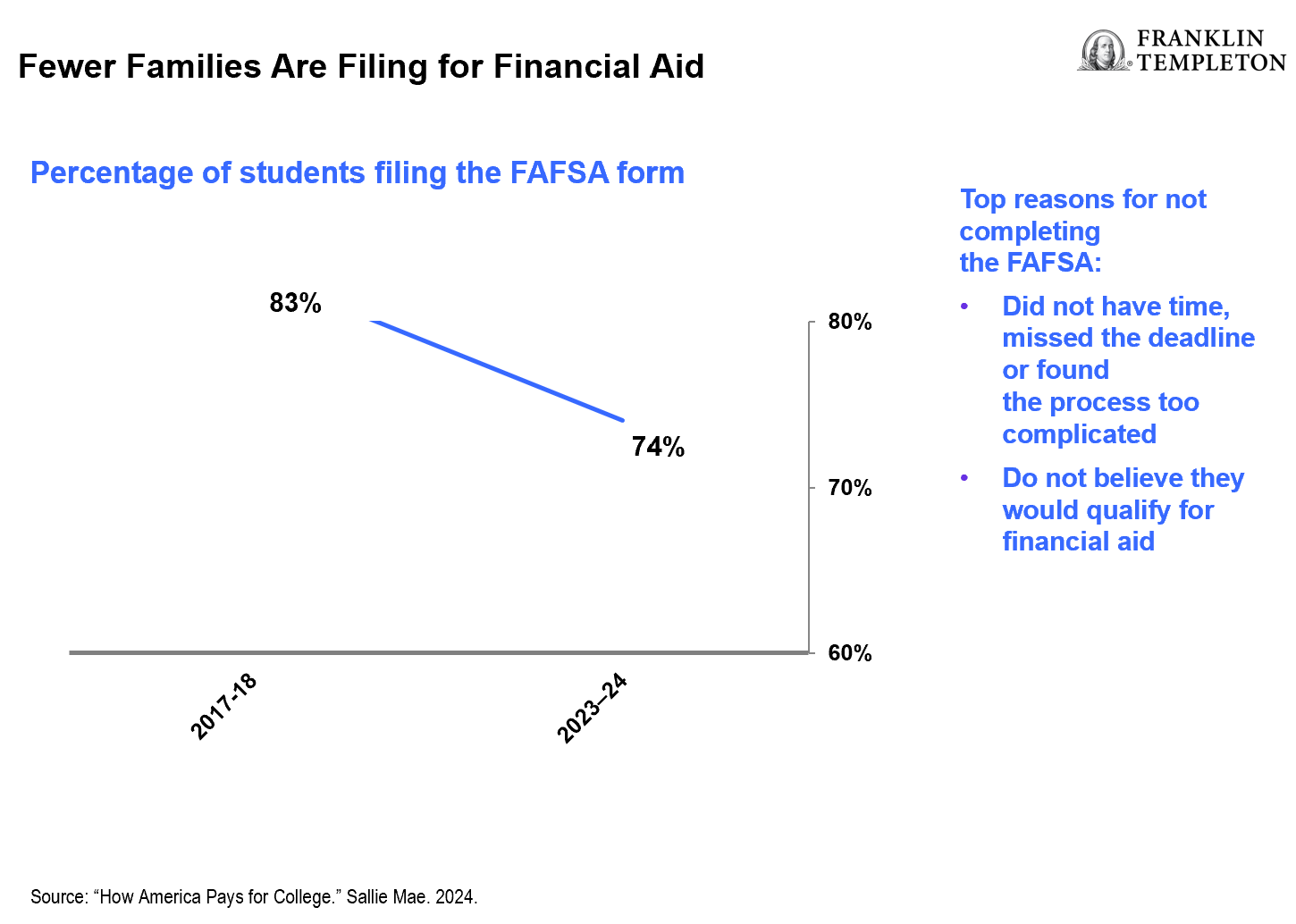

While programs are funded and the need is evident, the number of families applying for the Free Application for Federal Student Aid (FAFSA) has declined.

The data show that some families are not filing the FAFSA form because they don’t believe they will qualify for aid or they don’t have the time. Changes have been implemented to the FAFSA form to address some of the concerns about the complexity of the process.

The initial year of attendance may be an opportune time for families to file for federal financial aid for several reasons:

- Some families assume they won’t get aid. However, recent data suggest roughly one million students missed out on Pell grants because they didn’t file a FAFSA.

- Some non-need-based grants from schools require a FAFSA submission. By not filling out the FAFSA, these students will not have the opportunity to potentially access these grants.

- It may also be a good idea to have a completed FAFSA on file each year if the family financial situation changes dramatically due to loss of employment or another unforeseen circumstance.

Understanding recent changes to financial aid

Legislation signed into law a few years ago is driving several changes to the application. A major catalyst to the changes grew from concerns of families about the application process being complicated and lengthy. The changes to the form and process are designed to make it simpler to follow and more understandable. Our post, “The new FAFSA: What every advisor and parent should know,” has more background on the changes coming to FAFSA.

- First, the good news is that the number of questions on the form has been reduced from over 100 to around 40, and some applicants may have to answer much fewer questions.

- There is a new eligibility formula for aid as the Student Aid Index (SAI) replaces the Expected Family Contribution (EFC); this change is designed to make the aid award more intuitive to parents and students.

- The cost of attendance (COA) has been re-defined, expanded and standardized to make it more consistent across different educational institutions.

- There is a requirement that tax information must be provided electronically using the FAFSA data retrieval system which should streamline the process. There is no longer an option to manually provide tax return details.

- For 529 accounts owned by non-parents (such as grandparents), distributions from these accounts for qualified education expenses will no longer have a negative impact on the next financial aid filing.

- Untaxed income such as contributions to 401(k)s are no longer reported on the FAFSA form.

- The new calculation does not account for families with multiple children in college at the same time; this may result in less financial aid for these families.

- For divorced or separated parents, the parent who provides more financial support must complete the FAFSA regardless of who the student lives with.

- Certain families with small business or farm ownership must now report those assets on the FAFSA.

New update on timing of FAFSA form for 2025-2026 school year

Next steps for families on financial aid

- Students and parents should each create an FSA ID at Studentaid.gov. This is the important first step to unlock a financial aid package.

- Identify financial support: Determine which parent provides more financial support in cases of divorce or separation.

- Update financial records: Ensure all necessary tax forms are filed and accessible.

- Know the deadlines: Be aware of state and college deadlines.

- Get an estimate of federal financial aid by accessing studentaid.gov/aid-estimator/

- Once available for the upcoming academic year complete and submit the FAFSA as soon as possible—those who file earlier are more likely to qualify for more aid.

For more information, speak with your financial professional.

WHAT ARE THE RISKS?

All investments involve risk, including possible loss of principal.

Investors should carefully consider the 529 plan’s investment goals, risks, charges and expenses before investing. To obtain the Program Description, which contains this and other information, talk to your financial professional or call Franklin Distributors, LLC, the manager and underwriter for the 529 plan at (800) DIAL BEN/342-5236 or visit franklintempleton.com. You should read the Program Description carefully before investing and consider whether your, or the beneficiary’s, home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in its qualified tuition program.

Franklin Templeton’s 529 College Savings Plan is offered and administered by the New Jersey Higher Education Student Assistance Authority (HESAA); managed and distributed by Franklin Distributors, LLC, an affiliate of Franklin Resources, Inc., which operates as Franklin Templeton.

Investments in Franklin Templeton’s 529 College Savings Plan are not insured by the FDIC or any other government agency and are not deposits or other obligations of any depository institution. Investments are not guaranteed by the State of New Jersey, Franklin Templeton, or its affiliates and are subject to risks, including loss of principal amount invested. Investing in the plan does not guarantee admission to any particular primary, secondary school or college, or sufficient funds for primary, secondary school or college.

Franklin Templeton, its affiliates, and its employees are not in the business of providing tax or legal advice to taxpayers. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties or complying with any applicable tax laws or regulations. Tax-related statements, if any, may have been written in connection with the “promotion or marketing” of the transaction(s) or matter(s) addressed by these materials, to the extent allowed by applicable law. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax professional.

This material has been provided for informational purposes only and should not be construed as investment advice or a recommendation of any particular investment product, or strategy.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

© 2024 Franklin Distributors, LLC. Member FINRA/SI

____________________

1. Source: The College Savings Plan Network. Data as of June 30, 2024.

2. Source: “Trends in Student Aid.” The College Board. November 2023.