Reaching certain age milestones can be significant for many different reasons. Beyond birthday celebrations and life changes, such as retirement, age milestones are meaningful for financial planning.

Milestones can trigger important tax and financial planning actions that may be missed. Talking with an advisor can help individuals and families plan and stay on track with their financial planning. In fact, age milestones play a large role when planning for Medicare or Social Security and making decisions about charitable giving or in-service non-hardship withdrawals from a retirement plan.

Many aspects of the tax code are linked to age requirements.

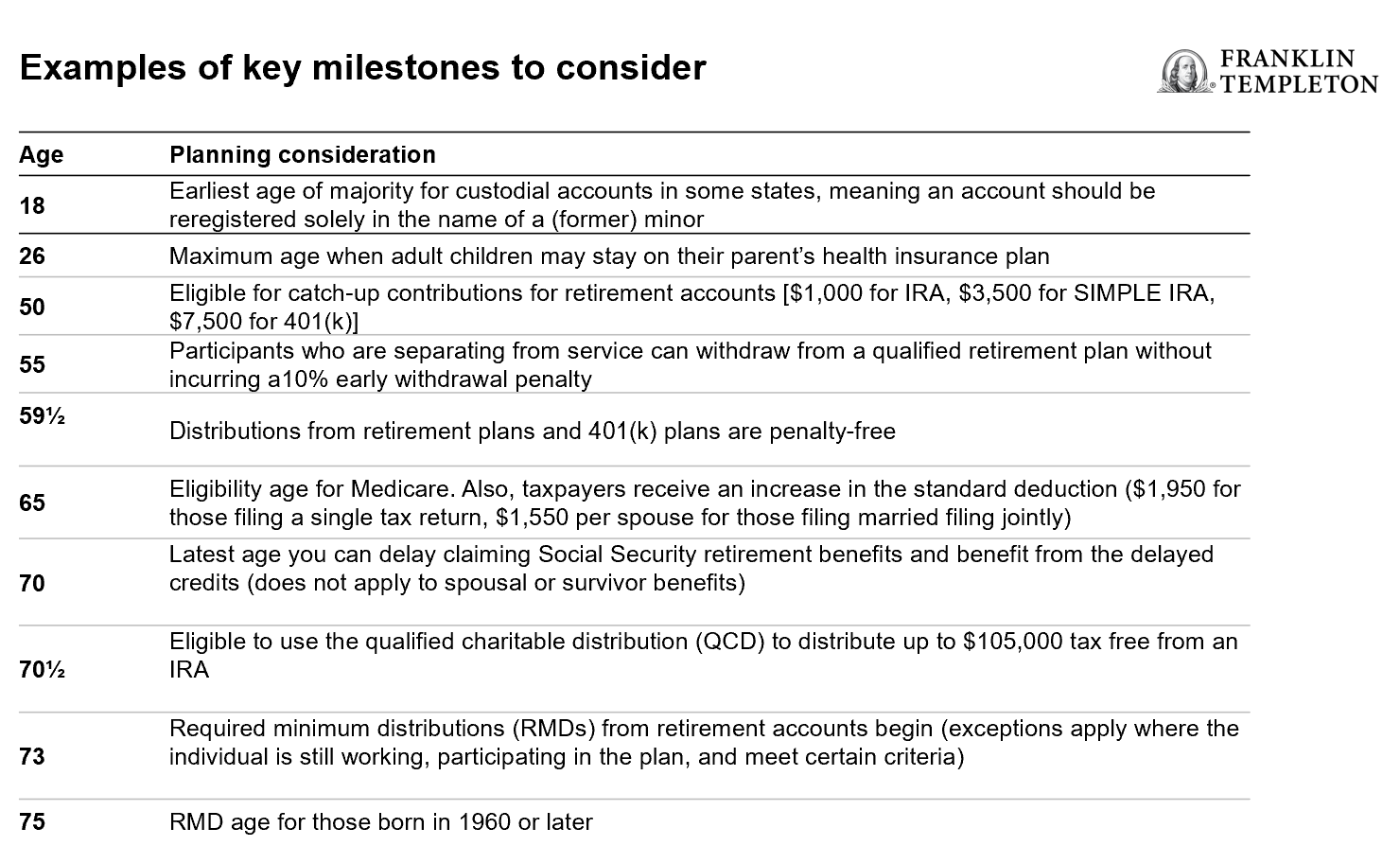

Milestones to watch can begin as early as age 18 for children. Here are some examples.

Many savings accounts, particularly retirement accounts, have rules around withdrawals and even contributions, that are based on age.

Most people recognize age 65 as a key milestone when thinking about retirement planning. But, important birthdays that signal rule changes around retirement savings actually begin at age 50.

For a complete list of significant milestones, see “Important age milestones for financial planning.”

Planning considerations

It is important to understand how age milestones benefit or limit planning opportunities.

Consider Roth conversions before reaching certain milestones

Timing a Roth IRA conversion is key when it comes to certain age-based milestones, such as retirement or claiming Social Security. For example, converting to a Roth IRA shortly before age 65 may negatively impact Medicare premiums. This is because Medicare considers income from two years prior to enrollment at age 65 when calculating the amount of the premium. Those at higher income levels may face higher premiums.

Consider a qualified charitable distribution (QCD) if over age 70½

If you are not relying on a required minimum distribution (RMD) to meet current income needs, and if you are planning to claim the standard deduction, consider donating IRA assets to a qualified charity. A special provision of IRAs allows account owners to donate up to $100,000 tax free each year to charity.

In-service, non-hardship withdrawals

Some 401(k) plans allow in-service, non-hardship withdrawals—without providing proof of hardship—if the participant has reached age 59½ or has met the requirements specified by the plan document. These participants have the option to directly transfer savings to an IRA without penalty or withholding, assuming certain conditions are met. Transferring savings from the employer plan to an IRA may allow access to a broader range of investment choices, for example.

It might pay to delay Social Security

One of the biggest mistakes retirees make is deciding to begin Social Security benefits too soon. In fact, about 60% of workers sign up for Social Security before reaching full retirement age. At this point, the benefit is significantly lower and may be more likely to be subject to a reduction in benefits for those still working. By delaying the start of Social Security benefits, retirees will receive higher benefits. In essence, they receive an 8% raise for every year they delay taking benefits up to age 70.

Take distributions before your RMD age

The original SECURE Act raised the RMD age from 70½ to age 72 effective in 2020. The new law further extends the RMD age to 73 in 2023 and eventually to age 75 in 2033. Even with the RMD age increased, you may consider accelerating income before the tax rates expire at the end of 2025, or if you are in a lower tax bracket. For those that are already subject to RMDs, consider taking larger RMDs than required to “fill up” favorable tax brackets, depending on personal tax circumstances.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Any information, statement or opinion set forth herein is general in nature, is not directed to or based on the financial situation or needs of any particular investor, and does not constitute, and should not be construed as, investment advice, forecast of future events, a guarantee of future results, or a recommendation with respect to any particular security or investment strategy or type of retirement account. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.

Franklin Templeton, its affiliated companies, and its employees are not in the business of providing tax or legal advice to taxpayers. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties or complying with any applicable tax laws or regulations. Tax-related statements, if any, may have been written in connection with the “promotion or marketing” of the transaction(s) or matter(s) addressed by these materials, to the extent allowed by applicable law. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.