The rising interest in private market investments may be a sign of significant change on the horizon for the workplace retirement savings industry.

With the estimated $24 trillion invested in private market capital in the United States expected to rise, how will the private market impact retirement plans?1

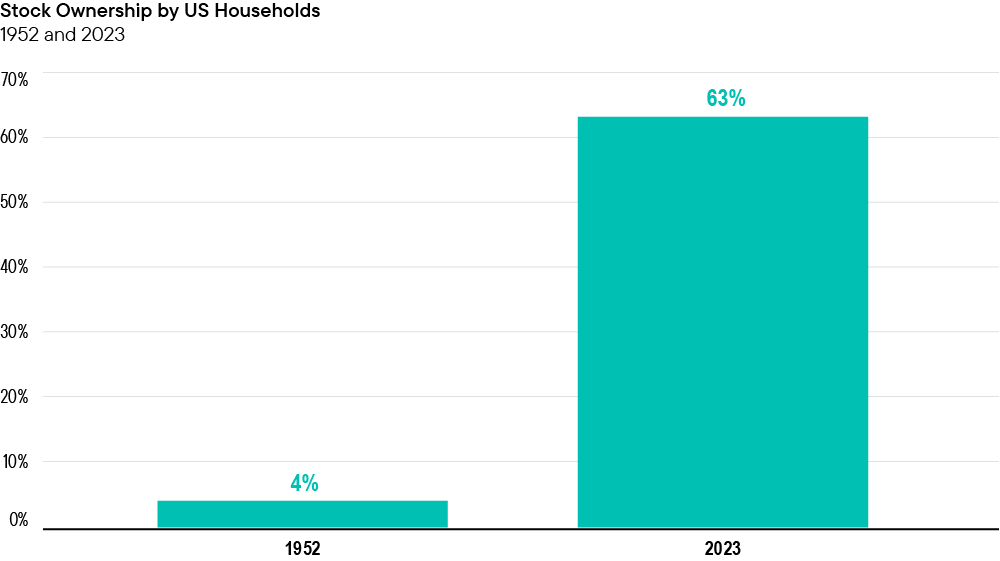

When mutual funds first came onto the scene in the post-World War II era, they transformed the way average Americans accessed the stock market. Before that, investing in stocks was largely reserved for the wealthy, leaving the rest of the population with few opportunities to grow their nest egg through the market. Mutual funds changed all of that by allowing everyday people to pool their money together, gaining access to a diversified portfolio of stocks, bonds, and other securities. This democratization of investing was revolutionary, leading to massive wealth creation for millions of “Main Street” Americans.

Today, only about 5% of US households have private market investments. At Franklin Templeton, we see a parallel between that historic shift and the current opportunity to bring private market investments—such as private equity, private credit, and private real estate—into defined contribution (DC) plans like 401(k)s.

Similar access trajectory for private market investments

Source: Federal Reserve Survey of Consumer Finances.

We envision a future where all retirement investors, particularly those previously limited to public markets, have access to a broader share of global capital markets. Our firm’s leaders had a similar vision 80 years ago, and we are committed to pioneering the widespread adoption of private market assets within defined contribution (DC) plans.

Just as mutual funds opened the door to the stock market for the average investor, we believe that private market assets can offer a new frontier of investment opportunities, helping to drive better retirement outcomes for millions of hard-working Americans.

As Mark Twain once said, “History doesn’t repeat itself, but it often rhymes.” The shift we’re seeing today mirrors the way mutual funds democratized stock market investing in the mid-20th century. Now, it’s private markets that are becoming the new frontier.

The proliferation of mutual funds: Supports wealth creation and the economy!

In the aftermath of World War II, the US economy was on the rise, and with it came an increased interest in the stock market. However, Wall Street was largely the domain of the wealthy and well-connected. Individual stocks were expensive, and many people lacked the resources, knowledge or confidence to participate in the market. Enter the mutual fund—a simple, yet powerful investment vehicle that pooled money from many investors to buy a diversified portfolio of stocks, bonds, or other securities— all managed by a professional.

Mutual funds made it possible for everyday Americans to invest in the stock market with small amounts of money. They offered professional management, diversification to potentially reduce risk, and the ability to buy into a portfolio that would otherwise be out of reach for individual investors. This democratization of investing opened the doors for millions of Americans to build wealth through the stock market, contributing significantly to the growth of the middle class and the overall economy.

Over time, mutual funds became a cornerstone of retirement planning. Employer-sponsored 401(k) plans, which started gaining popularity in the 1980s, often featured mutual funds as the primary investment option. This made it easy for employees to contribute a portion of their salary to a diversified investment portfolio, setting the stage for long-term wealth accumulation. Today, mutual funds manage trillions of dollars in assets, and they remain a key tool for retirement savings for millions of Americans.

What are private market investments?

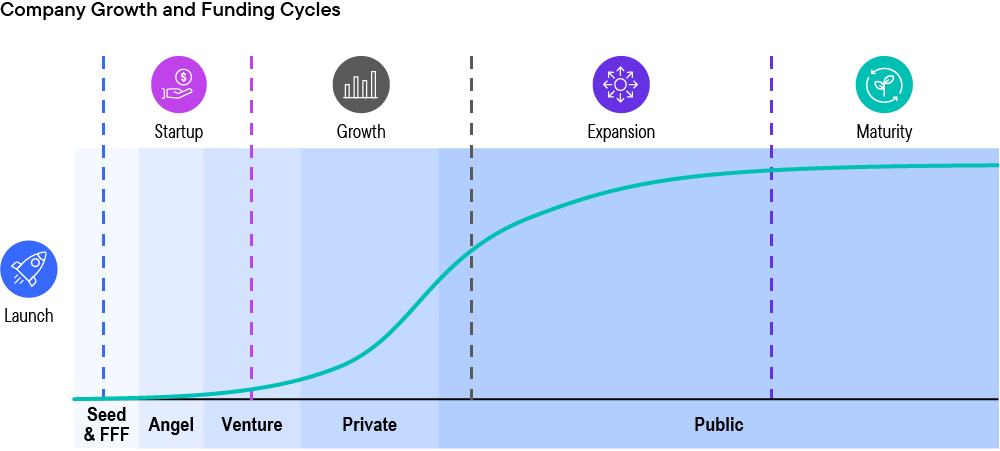

Private market investments include assets like private equity, private credit and real estate that aren’t traded on public exchanges. Historically, these investments have been available only to wealthy individuals and large institutions. They offer opportunities to invest in companies and projects before they go public and can lead to higher potential returns.

Imagine being able to invest in a promising company or real estate project early on and watching your investment grow significantly over time. That’s the potential power of private market investments.

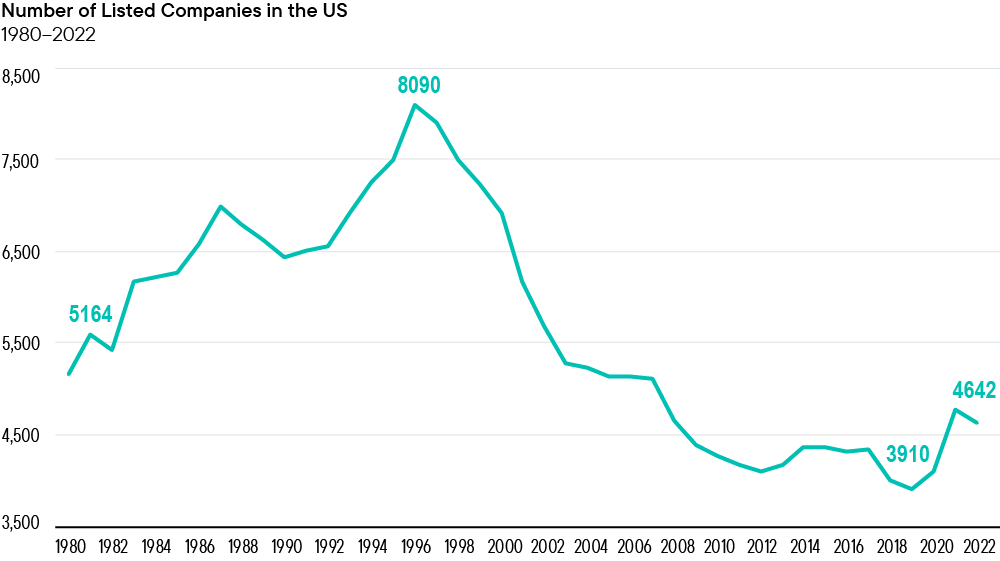

A shrinking public market and a growing private one

It’s important to recognize the landscape of investing is changing. Over the past decade, the number of publicly traded companies in the United States has been steadily decreasing. In fact, since 2000, the number of US public companies has dropped by 27%, according to McKinsey & Co. This trend suggests that more companies are choosing to remain private longer (or forever), which creates a bigger gap in investment opportunities for investors. The investible universe in private markets is simply much larger than public markets. For example, only 13% of US companies with over $100 million in revenue are public, excluding many investors from some 19,000 private companies.2

The Reduction in Listed Companies has been Dramatic

Source: World Bank, World Development Indicators. Most recent data available.

Private markets assets under management totaled $13.3 trillion in 2023, according to PwC.3 Assets in private markets grew roughly 8% per year over the past five years, the report noted.

We believe without access to private market investments, investors have limited options in capital markets, resulting in missed opportunities for portfolio diversification and alternative sources of risk and return.

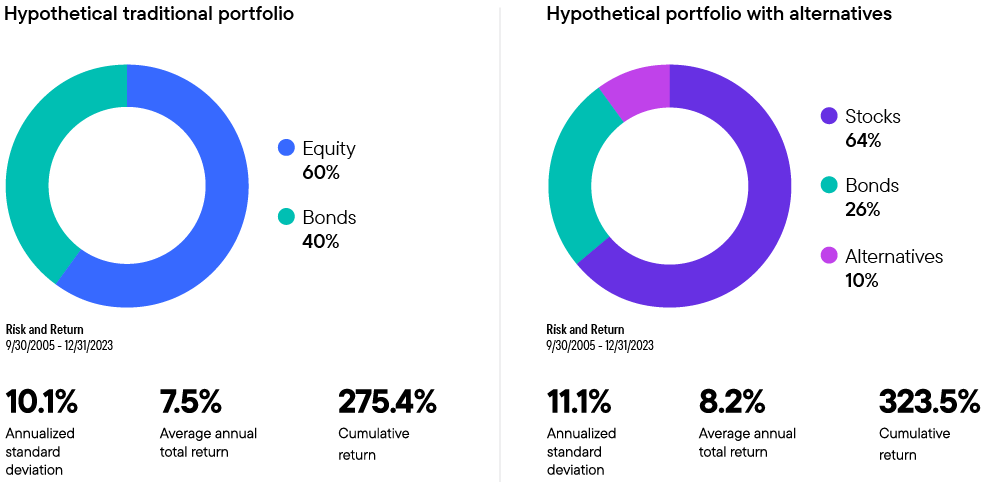

Impact of alternatives on a hypothetical growth portfolio

Note: Hypothetical 18-year portfolio return with and without alternative investments as of 12/31/2023. For illustrative purposes only. Hypothetical portfolio results shown do not represent the performance of an actual investment. Stocks, bonds, private equity, private credit, private real estate, and hedge funds are respectively represented by the S&P 500 Index, Bloomberg U.S. Aggregate Bond Index, Burgiss US Private Equity Funds Index, Cliffwater Direct Lending Index, NFI-ODCE Index, HFRX Equity Hedge USD Index, HFRX Global Hedge Fund USD Index, HFRX Macro/CTA USD Index. Please note that an investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges. Diversification does not assure a profit or protect against market loss. All investments involve risk, including loss of principal. Past performance is no guarantee of future results.

To explore hypothetical example in more detail, see Alternatives by FT.

Why does this matter for your 401(k)?

With fewer public companies available to invest in, sticking solely to traditional public market assets might limit growth potential. Private markets, on the other hand, have shown consistent, strong returns, especially in the period from 2016 through 2023.4 These investments also offer an avenue for diversification that isn’t as readily available in the shrinking public markets. By incorporating private market investments into 401(k) plans, we can provide hard working Americans with access to these lucrative opportunities that were previously reserved for large institutions and the wealthy.

Many individual investors miss out on early-stage growth

The trajectory of early-stage growth often dwarfs that of more mature companies. Private equity investments participate in this stage of a company’s development.

The barriers and the breakthroughs: Creativity and collaboration required!

Admittedly, integrating private market assets into 401(k) plans isn’t without its challenges. Daily liquidity, valuation complexities, fees and concerns around litigation are some of the key barriers. However, these are challenges that can be addressed with innovative solutions and strategic partnerships. For instance, daily valued collective investment trusts (CITs) and semi-liquid vehicles can provide the necessary structure to incorporate private assets into professionally managed solutions like target-date funds or personalized advice solutions.

Moreover, just as mutual funds required regulatory frameworks and investor education to gain widespread adoption, private market investments will need similar efforts. But we believe the potential rewards of diversification make it worth the effort.

Breaking through traditional barriers with creativity, collaboration and hard work

At Franklin Templeton, we have already made significant strides in this area. With more than $280 billion in private assets under management and a growing presence in the wealth management sector, we are strategically positioned to lead this movement. We are developing innovative solutions with strategic partners. We simply can’t do it alone, which is why we are strongly committed to thinking outside of the proverbial box and aligning with other major players in the asset management industry. These products are designed to meet the needs of both plan sponsors and participants, offering diversification while managing liquidity and valuation challenges.

The future is now!

The future of workplace retirement investing

Our vision is simple: We want to make private assets more accessible to more savers. We believe that hard-working Americans deserve the same diversified investment opportunities that have traditionally been available only to large institutions and the wealthy.

The inclusion of private market investments in 401(k) plans is about more than just expanding access—it’s about driving better retirement outcomes for millions of Americans. Just as mutual funds changed the investment landscape in the 20th century, we believe that private markets can redefine retirement planning and the pursuit of financial independence in the 21st century.

In the end, we’re not just talking about keeping pace with history—we’re talking about making it.

Just as mutual funds provided access to the stock market to a broader audience, private market investments in 401(k) plans have the potential to transform retirement savings, giving more people the opportunity to accumulate the kind of wealth that was once out of reach. And that’s a future worth striving for.

An opportunity for advisors

Many advisors are already allocating to alternative investments for their clients seeking higher returns and diversification. In a 2023 CAIS-Mercer survey, 83% of advisors said alternative investments help them in a competitive field, 78% said these investments help clients meet goals, and 59% noted it helps them grow their business.5

As with any type of investment, advisors will need to educate clients. Understanding begins with the advisor. Here are some key considerations for advisors.

- The role of private market investments in risk management

- How managers focus on liquidity issues

- Why private market investments may be suited for long-term strategies such as retirement plans

Next steps for advisors

- Consider what education and training will be needed as you plan to reach out to clients about the use of private market investments

- Consult with your Franklin partner for resources and guidance

- Explore solutions that support increased access to private market investments, particularly for retirement plan participants

WHAT ARE THE RISKS?

Equity securities are subject to price fluctuation and possible loss of principal. Diversification does not guarantee profit or protect against loss.

Investments in many alternative investment strategies are complex and speculative, entail significant risk and should not be considered a complete investment program. Depending on the product invested in, an investment in alternative strategies may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. Diversification does not guarantee a profit or protect against a loss.

Risks of investing in real estate investments include but are not limited to fluctuations in lease occupancy rates and operating expenses, variations in rental schedules, which in turn may be adversely affected by local, state, national or international economic conditions. Such conditions may be impacted by the supply and demand for real estate properties, zoning laws, rent control laws, real property taxes, the availability and costs of financing, and environmental laws. Furthermore, investments in real estate are also impacted by market disruptions caused by regional concerns, political upheaval, sovereign debt crises, and uninsured losses (generally from catastrophic events such as earthquakes, floods and wars). Investments in real estate related securities, such as asset-backed or mortgage-backed securities are subject to prepayment and extension risks

An investment in private securities (such as private equity or private credit) or vehicles which invest in them, should be viewed as illiquid and may require a long-term commitment with no certainty of return. The value of and return on such investments will vary due to, among other things, changes in market rates of interest, general economic conditions, economic conditions in particular industries, the condition of financial markets and the financial condition of the issuers of the investments. There also can be no assurance that companies will list their securities on a securities exchange, as such, the lack of an established, liquid secondary market for some investments may have an adverse effect on the market value of those investments and on an investor’s ability to dispose of them at a favorable time or price. Past performance does not guarantee future results.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2024 Franklin Templeton. All rights reserved.

Endnotes

___________________________________

1. Source: “Are you harnessing the growth and resilience of private capital?” EY. April 4, 2024.

2. Sources: iCapital, Hamilton Lane, Capital IQ. As of February 2023.

3. Source: “Global M&A Trends in Private Capital.” PwC. June 25, 2024.

4. Source: “Are you harnessing the growth and resilience of private capital?” EY. April 4, 2024.

5. Source: “The State of Alternative Investments in Wealth Management.” CAIS-Mercer. December 2023.