Having recently completed the National Association of Plan Advisors Retirement Income for 401(k) Plans (RI(k)™ certificate program), I gained greater knowledge of the current state of in-plan retirement income solutions. I also deepened my conviction there is no “one-size-fits-all” approach at the plan level. Product development is in the earliest stages, and advisor, plan sponsor, and investor education efforts are daunting.

Retirement plan advisors are increasingly called upon to provide their clients with comprehensive solutions that ensure a stable and secure retirement. Understanding in-plan retirement income options—both guaranteed and non-guaranteed—is imperative. This article delves into the key aspects of these solutions.

Why should our industry care about in-plan retirement income?

The simple answer is “income.” It is in the name of the enabling legislation—Employee Retirement Income Security Act (ERISA)—that created the defined contribution industry we are a part of. But there is more to it than that:

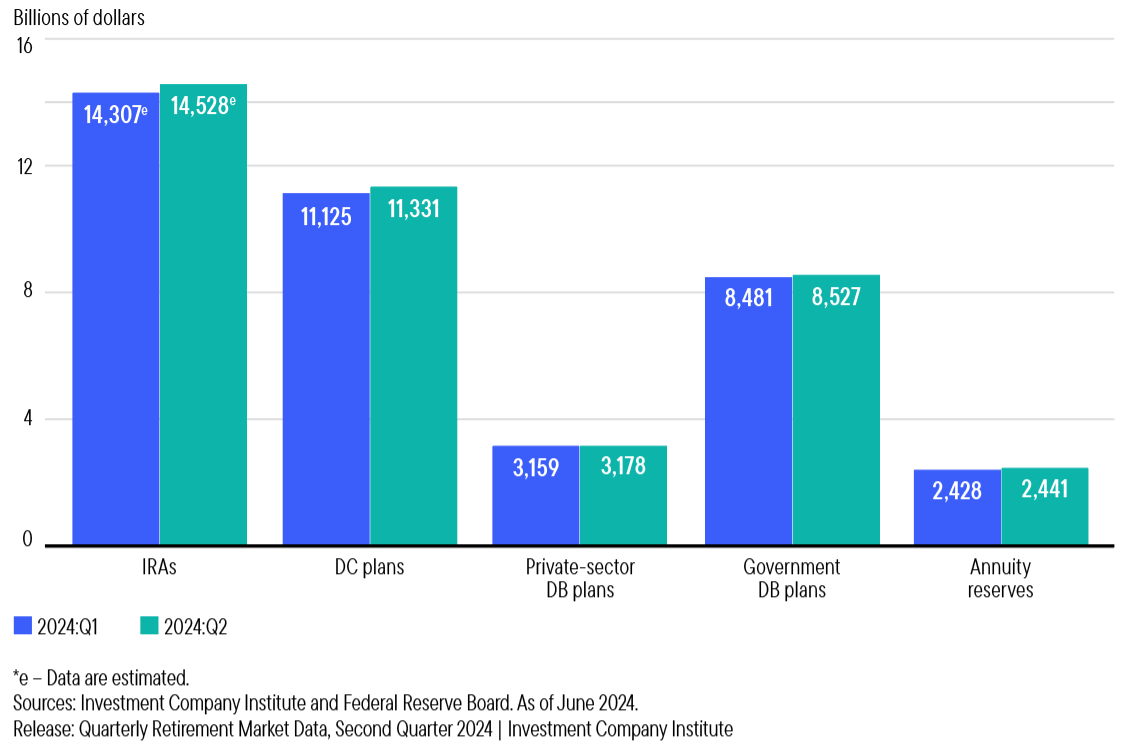

- American workers have accumulated approximately $22 trillion in IRAs and defined contribution accounts. About one-third of these assets are held “in plan.”1

- Current data indicates about 20% of workers with money in defined contribution plans are 60 or older.2 This shows a large demographic in the average plan is near retirement age.

Retirement Assets by Type

Understanding in-plan retirement income solutions

In-plan retirement income solutions are designed to provide a steady stream of income to retirees directly from their retirement plans, such as 401(k)s or 403(b)s. These solutions can be broadly categorized into two types: guaranteed and non-guaranteed. Advisors must grasp the nuances of both to meet individual client needs and risk tolerances.

Guaranteed income solutions

Guaranteed income solutions offer retirees a predictable stream of income, either for life or a specified period. These products are typically backed by insurance companies.

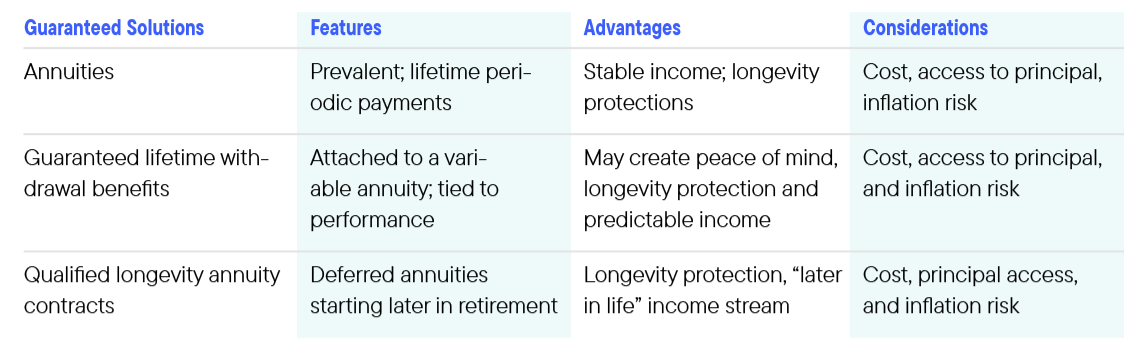

Common guaranteed solutions

- Annuities: Annuities are the most prevalent form of guaranteed income solutions. They can be purchased within a retirement plan and provide periodic payments that can last for the retiree’s lifetime. Key types include fixed annuities, providing stable payments, and variable annuities, which offer payments that may fluctuate based on investment performance.3

- Guaranteed lifetime withdrawal benefits (GLWBs): GLWBs are features often attached to variable annuities. They guarantee a minimum level of income regardless of the annuity’s investment performance, with the possibility of income increases if the underlying investments perform well.4

- Qualified longevity annuity contracts (QLACs): QLACs are deferred annuities designed to start providing income later in retirement, often at age 85. They help manage longevity risk by ensuring income is available when other retirement funds might be depleted.5

Advantages of guaranteed solutions

- Peace of mind: Retirees can rely on a stable income, which may reduce the anxiety associated with market volatility.

- Longevity protection: These products often include features that ensure income for life to protect against the risk of outliving one’s savings.

- Simplified planning: Predictable income streams may simplify budgeting and financial planning for retirees.

Considerations and challenges

- Cost: Guaranteed products, especially those with lifetime income guarantees, can be expensive. Advisors must weigh the cost against the benefits for each client.

- Inflexibility: Once an annuity is purchased, accessing the principal can be difficult or incur penalties. The lack of liquidity needs to be considered in the broader context of a retiree’s financial situation.

- Inflation risk: Fixed income solutions may not keep pace with inflation, potentially eroding purchasing power over time.

Non-guaranteed income solutions

Non-guaranteed income solutions do not offer the same level of income security as their guaranteed counterparts. Instead, they attempt to provide flexibility and potential for growth based on investment performance.

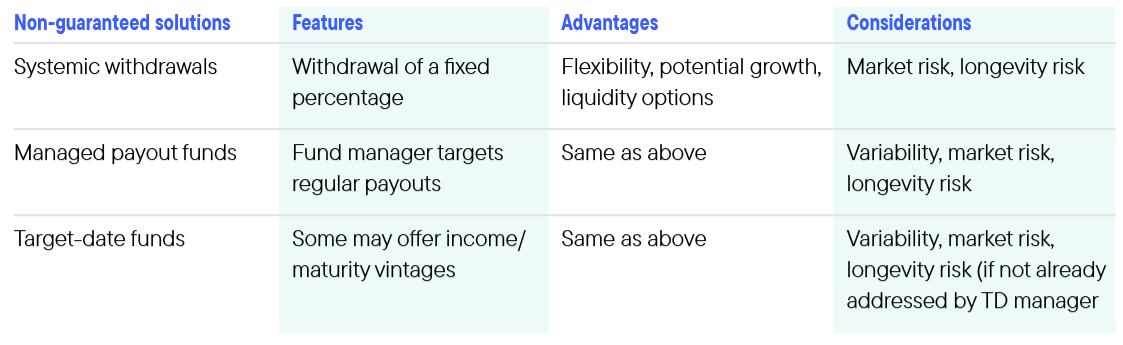

Common non-guaranteed solutions

- Systematic withdrawals: This approach involves withdrawing a fixed percentage or dollar amount from retirement accounts periodically. While it provides flexibility, the income is subject to market performance and the risk of depleting funds.6

- Managed payout funds: These mutual funds are designed to provide regular payouts to investors. The payout amount can vary based on the fund’s performance and the withdrawal strategy employed by the fund manager.7

- Target-date funds (TDFs): While used for accumulation, TDFs can offer income by gradually shifting from growth-oriented investments to income-generating ones as the target date approaches and beyond.

- There are hybrid TDF solutions in development. These have elements of traditional TDFs with guaranteed income “bolted on” to the glide path. Many of these solutions give savers optionality to turn the income stream on as a guarantee by a designated age or convert their income “units” into accumulation “units”.

Advantages of non-guaranteed solutions

- Flexibility: Retirees maintain control over their investments and can adjust withdrawals.

- Growth potential: Non-guaranteed solutions may allow for continued investment growth to fight inflation.

- Liquidity: Funds remain more accessible compared to annuities, providing retirees with the ability to respond to unexpected expenses.

Considerations and challenges

- Market risk: Income is directly tied to investment performance.

- Longevity risk: There is a risk of outliving the retirement savings if withdrawals are not carefully managed.

- Planning complexity: Non-guaranteed solutions require ongoing management and adjustments to sustain income levels.

Strategic considerations for advisors

We believe advisors may want to consider several factors when recommending in-plan retirement income solutions to their clients. Here are some questions to consider:

- What role should the client’s risk tolerance play in decisions around allocating to guaranteed and non-guaranteed income options?

- Is there value allocating to multiple sources of retirement income?

- What is the best way to fight inflation during retirement that may last for decades?

- How should essential expenses, discretionary spending and legacy goals be balanced?

- How should potential regulatory and tax changes be factored into one’s retirement income plan?

Conclusion

As the landscape of retirement planning continues to evolve, advisors must be adept at navigating both guaranteed and non-guaranteed in-plan retirement income solutions. By understanding the nuances and strategic applications of each, they can create robust, tailored strategies that provide clients with financial security and peace of mind in their retirement years.

Next steps

We believe a “one-size-fits-all” approach at the plan level does not serve plan participants or plan sponsors well. Instead. an “all-of-the-above” approach may provide the optionality and flexibility needed as in-plan income solutions continue to evolve.

- Visit Workplace Personalization | Franklin Templeton to learn more about our approach to personalized retirement income.

- Talk to your Franklin Templeton Defined Contribution Team about our guaranteed and non-guaranteed retirement income solutions

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. Principal invested is not guaranteed at any time, including at or after a fund’s retirement target date; nor is there any guarantee that the fund will provide sufficient income at or through the investor’s retirement. The investment risk of the retirement target fund changes over time as its asset allocation changes. Investments in underlying funds are subject to the same risks as, and indirectly bear the fees and expenses of, the underlying funds.

Equity securities are subject to price fluctuation and possible loss of principal. Small- and mid-cap stocks involve greater risks and volatility than large-cap stocks.

Fixed income securities involve interest rate, credit, inflation and reinvestment risks, and possible loss of principal. As interest rates rise, the value of fixed income securities falls. Low-rated, high-yield bonds are subject to greater price volatility, illiquidity and possibility of default.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Alternative strategies may be exposed to potentially significant fluctuations in value.

Active management does not ensure gains or protect against market declines.

Variable annuities are long-term, tax-deferred investment vehicles designed for retirement purposes. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. Withdrawals made prior to age 59½ are subject to a 10% IRS penalty charge and/or surrender charges. Investments in a variable annuity are subject to market risks, including loss of principal. Guarantees are based on the claims-paying ability of the insurer. Variable annuities are sold by prospectus only. Any information, statement or opinion set forth herein is general in nature, is not directed to or based on the financial situation or needs of any particular investor, and does not constitute, and should not be construed as, investment advice, forecast of future events, a guarantee of future results, or a recommendation with respect to any particular security or investment strategy or type of retirement account. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.

Any information, statement or opinion set forth herein is general in nature, is not directed to or based on the financial situation or needs of any particular investor, and does not constitute, and should not be construed as, investment advice, forecast of future events, a guarantee of future results, or a recommendation with respect to any particular security or investment strategy or type of retirement account. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.

Franklin Templeton, its affiliated companies, and its employees are not in the business of providing tax or legal advice to taxpayers. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties or complying with any applicable tax laws or regulations. Tax-related statements, if any, may have been written in connection with the “promotion or marketing” of the transaction(s) or matter(s) addressed by these materials, to the extent allowed by applicable law. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2024 Franklin Templeton. All rights reserved

Endnotes

1. Source: “What Is an Annuity? Definition, Types, and Tax Treatment,” Investopedia.com. As of August 20, 2024.

2. Source: “How Guaranteed Lifetime Withdrawal Benefits (GLWB) Work,” Annuity.org. August 21, 2024.

3. Source: “Qualified Longevity Annuity Contract: What Is A QLAC?,” Forbes Advisor. As of July 26, 2023.

4. Source: “How Guaranteed Lifetime Withdrawal Benefits (GLWB) Work,” Annuity.org. August 21, 2024.

5. Source: “Qualified Longevity Annuity Contract: What Is A QLAC?,” Forbes Advisor. As of July 26, 2023.

6. Source: “Systematic Withdrawal Plan (SWP): What It Means, How It Works,” Investopedia.com. As of April 17, 2024.

7. Source: “Managed payout funds? Yes, they too are a possible retirement income option,” Pensions & Investments. As of July 24, 2023.

Ref. 3515170