While the future of estate and gift-tax policy is uncertain given the expiration of the Tax Cuts and Jobs Act (TCJA) at the end of 2025, there are important actions to consider now before the end of the year. Sound estate planning involves much more than planning for potential taxes. For instance, this might include efficient transfer of wealth to heirs, addressing certain risks and satisfying philanthropic goals.

With family gatherings on the calendar in the final weeks of the year, it may be an opportune time to talk about legacy planning with family members and chart a plan for the future.

As year-end approaches, here are several strategies for investors to consider.

Create a “road map” document

Create a road map document to help family members navigate documents and legacy plans in case of an unforeseen event or death. Family members will need to locate investment accounts, key documents, important contacts, online passwords and specific instructions on how to proceed. Creating a document that outlines this information for family members may be a good place to start. Consider consulting a financial advisor for guidance on preparing heirs. (See our “Heir preparation packet”).

Review beneficiary designations and other considerations

Review and update plans and documents, including beneficiary designations on retirement accounts, life insurance policies and annuities. Consider a revocable trust to help heirs avoid probate. In case of incapacitation or a health-related issue, documents such as powers of attorney, health care proxies and living wills are critically important for health- and financial-related decisions.

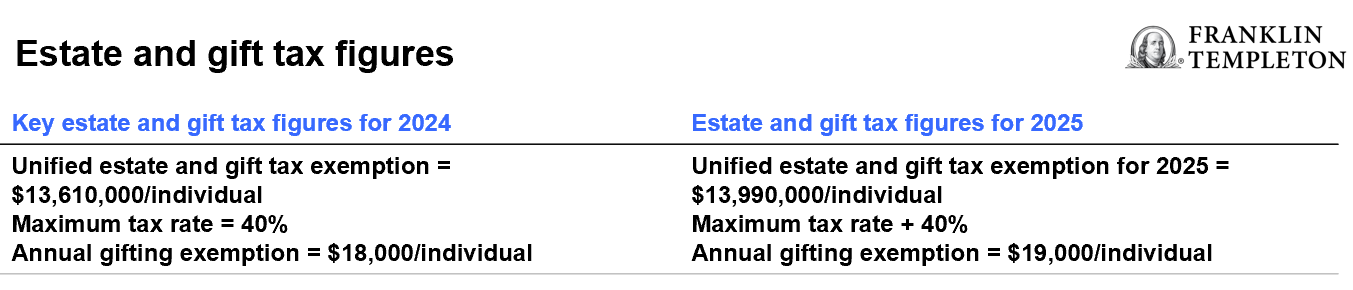

Use it or lose it: The annual gift-tax exclusion

Year-end provides an opportunity to review existing estate plans and consider gifting strategies. The annual gift-tax exclusion for individuals in 2024 is $18,000. To avoid utilizing a portion of the lifetime gift- and estate-tax exclusion (over $13 million for 2024), annual gifts can be made to as many recipients as desired as long as each gift doesn’t exceed $18,000 (or $36,000 for married couples electing split gifts).For gifts exceeding the annual limit, or when making a split gift with a spouse, a gift tax return is required.

Consider whether large lifetime gifts make sense

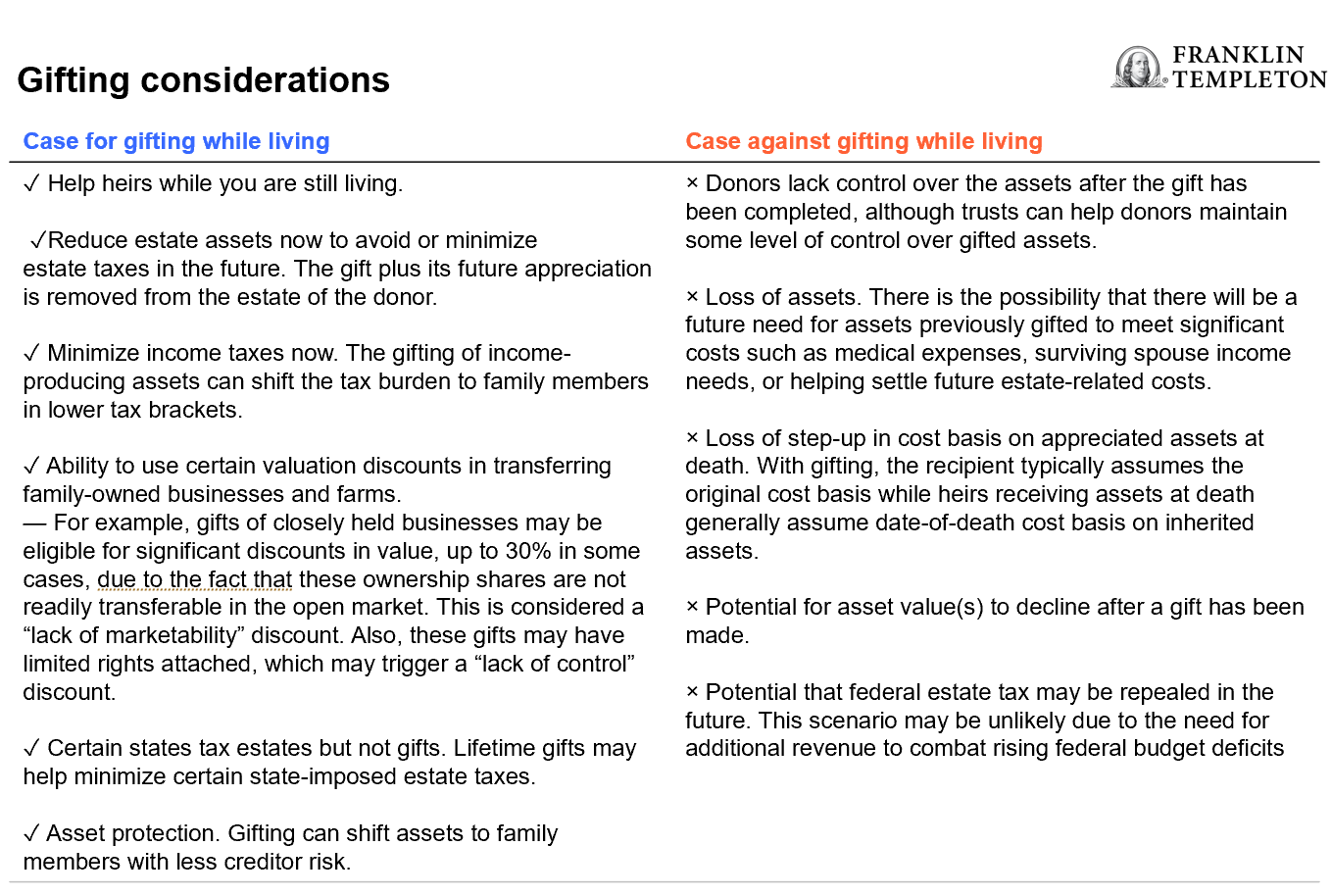

The large lifetime exclusion for gifts and estates allows higher-net-worth families many options on sheltering their net worth from federal gift and estate taxes. However, due to the expiration of the TCJA at the end of 2025, the lifetime exclusion figure is scheduled to be reduced in half. While the risk of an expiration of the current estate and gift tax laws is lower given the results of the election, those with potentially large estates should consult with a qualified estate planning attorney. For example, does it make sense to gift assets now to remove them from an estate or pass them to heirs at death and potentially benefit from stepped-up cost basis. Here’s a chart that highlights some considerations:

Use 529 plans to fund education for family members

Before the end of the year, consider gifts into 529 plans utilizing the annual gift-tax exclusion of $18,000. There is also a special 529-plan exclusion that allows five years’ worth of gifts—up to $90,000, or $180,000 for married couples—to be contributed at once, provided that no other gifts are made within the next five-year period. Another option would be to contribute the annual exclusion ($18,000 or $36,000 for couples) into a 529 before the end of the year and then early in 2025 make a large contribution representing five years’ worth of gifts. By taking this action you have essentially front-loaded six years’ worth of gifts into a 529 in a relatively short period of time.

For federal financial aid purposes, funding a 529 plan may make sense. The federal financial aid calculation treats 529 plans owned by parents more favorably than assets owned by the student (for example, in a custodial minor account). There is an added benefit for non-parents such as grandparents who own 529s. These accounts are not currently factored as assets for determining federal financial aid under the FAFSA process. In addition, recent changes to the FAFSA form do not include distributions from grandparent-owned (and other non-parent-owned accounts) in the income test portion of the FAFSA form. See our article, “Reasons why a grandparent-owned 529 may make sense.”

Lastly, recent tax law changes allow 529 account owners to withdraw $10,000 for K–12 tuition expenses and $10,000 to repay student loans and allow distributions for qualified apprenticeship programs. (Distributions for K–12 expenses are free from federal income taxes, if taken after December 31, 2017. Earnings may be subject to state income taxes in certain states.)

Plan for the 10-year rule

In late 2019, Congress passed the SECURE Act, which eliminated the “stretch” option on distributions from most inherited retirement accounts inherited by non-spouses. Under the new rules, most non-spouse beneficiaries are required to fully distribute inherited account balances by the end of the 10th year following the year the account owner dies. As a result, from a tax perspective, retirement accounts may not be as beneficial to all heirs. Those with large 401(k)s or IRAs may want to review their overall estate plan and consider leaving a greater share of non-retirement assets to higher-income heirs. For example, consider proceeds from a life insurance trust or real estate that may benefit from a step-up in cost basis at death when transferred. See our education piece, “Distribution planning under the SECURE Act.”

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Any information, statement or opinion set forth herein is general in nature, is not directed to or based on the financial situation or needs of any particular investor, and does not constitute, and should not be construed as, investment advice, forecast of future events, a guarantee of future results, or a recommendation with respect to any particular security or investment strategy or type of retirement account. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.

Franklin Templeton, its affiliated companies, and its employees are not in the business of providing tax or legal advice to taxpayers. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties or complying with any applicable tax laws or regulations. Tax-related statements, if any, may have been written in connection with the “promotion or marketing” of the transaction(s) or matter(s) addressed by these materials, to the extent allowed by applicable law. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.