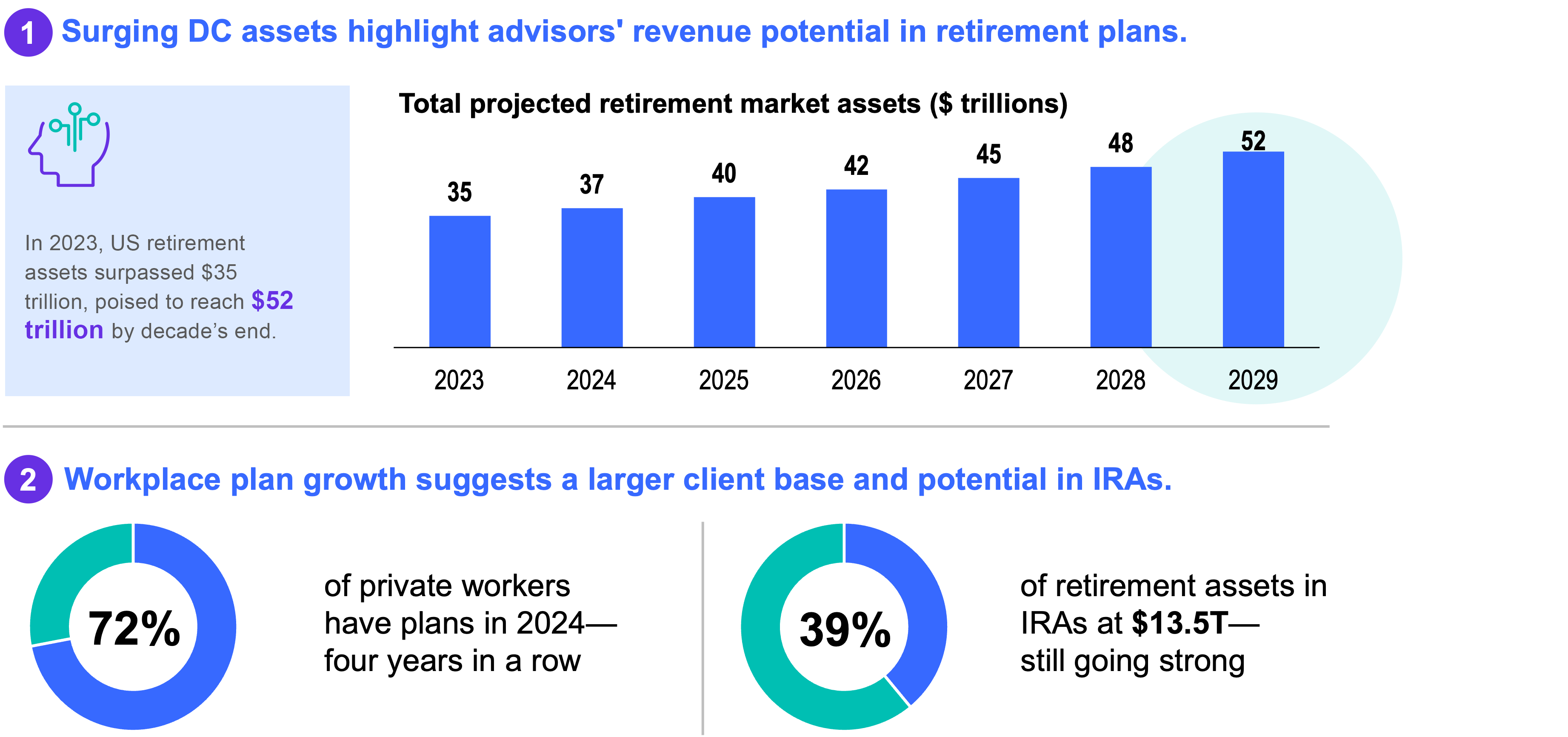

The retirement market is evolving rapidly, presenting significant opportunities for financial advisors. With the US retirement market projected to grow from $35 trillion in 2023 to $52 trillion by the end of the decade,1 we think now is the time for advisors to position your practice to benefit from this growth. This article provides insights into market dynamics, strategies for building and managing a successful 401(k) practice, and ways to address participant concerns.

In 2023, US retirement assets surpassed $35 trillion, and are poised to reach $52 trillion by decade’s end.

Understanding the market dynamics

The US retirement market is witnessing substantial expansion, driven by increasing assets in IRAs and workplace plans. In 2024, 72% of private workers had retirement plans, and IRA assets reached $13.5 trillion.2 This growth offers a prime opportunity for advisors to broaden their client base and revenue streams.

What’s Changing in the Retirement Market?

Sources: (1) Cerulli, “The Cerulli Report—US Retirement Markets 2024.” The US retirement market concluded 2023 with over $35 trillion in assets and is projected to grow to $52 trillion by the end of the decade, highlighting a robust market with significant opportunities for advisors (Cerulli Report, Chapter 1: US Retirement Market Overview, p. 23). (2) “The Cerulli Report—US Retirement Markets 2024.” The US retirement market surpassed $35 trillion in 2023, projected to reach $52 trillion by 2030. IRA assets grew to $13.5 trillion, with an 8.5% projected CAGR. Retirement plan access rose to 72% in 2024, highlighting growth opportunities (pp. 23, 30). There is no assurance that any estimate, forecast or projection will be realized.

In addition, 4.1 million Americans are estimated to reach the age of 65—traditional retirement age—in 2025.3 That’s more than 11,000 per day! As this trend has been in place for a while and likely will continue, pre-retirement “money in motion” conversations are abundant. Given the propensity of retirees to work with existing advisor relationships, being the advisor of a workplace retirement plan creates opportunity.

Building and managing a 401(k) practice

Establishing and managing a 401(k) practice can offer advisors many potential benefits, such as capitalizing on the growing need for 401(k) plans, deepening client relationships, creating new revenue opportunities and differentiating your business. To be successful, it is important to understand the needs of key decision-makers, such as CEOs, human resource professionals and compliance/legal teams. Additionally, leveraging service providers and asset managers can help you build a better practice and drive plan success.

Navigating the 401(k) landscape

The 401(k) landscape is complex, requiring astute navigation. Financial advisors must remain current on market trends and legislative shifts to furnish the soundest advice to their clients. Engaging with service providers and asset managers may yield invaluable support in participant engagement, compliance, fiduciary duties and the introduction of innovative investment solutions.

- Experienced professionals: Those who have been in the retirement plan industry for years or decades diligently update their knowledge and maintain relevant designations. This ongoing education ensures they remain proficient in the latest industry practices and regulatory requirements.

- New entrants and recommitters: Those newly committing or recommitting to the retirement plan business must consider the commitment required to service this business. Overpromising and underdelivering may lead to significant challenges, especially given the industry’s stringent fiduciary responsibilities.

Leveraging service providers and asset managers

Service providers and asset managers can play a vital role in supporting retirement plans. They offer tools for participant engagement, compliance support, fiduciary services and innovative investment solutions. Collaborating with these partners can enhance your practice and drive retirement plan success.

- Teamwork is key: The most successful retirement plan practitioners understand that success in the retirement plan business is a team effort. Knowing which partners to rely on is knowledge built over time.

Addressing participant concerns

Participants in retirement plans often face challenges such as financial stress, investment barriers and preparedness concerns.4 Advisors can add significant value by offering personalized solutions, financial wellness tools and benefit solutions tailored to each client’s unique needs.

- Leveraging wealth management tools: Planning tools from the wealth management sector can effectively address these challenges by creating customized strategies that alleviate financial stress, overcome investment barriers and improve overall preparedness.

- Scalable personalization: A key challenge for advisors is efficiently distributing personalized and wellness solutions to a large number of participants simultaneously, rather than addressing each client individually. Developing scalable methods and leveraging technology can help meet this demand without compromising the quality of service.

Keys to success in the retirement plan business

In order to succeed in the retirement plan business, advisors need to concentrate on prospecting and closing opportunities, identifying client needs and delivering exceptional service. The formulation of client service policies can aid in the avoidance of overpromising and the establishment of long-term relationships.

Strategic steps for success

To excel in the complex 401(k) landscape and deliver exceptional value to clients, consider these actionable steps:

- Expand your knowledge. Stay informed about market trends and legislative changes to provide the best advice to your clients.

- Build strong partnerships. Collaborate with service providers and asset managers to offer comprehensive solutions.

- Enhance client engagement. Use personalized solutions and financial wellness tools to address participant concerns and improve outcomes.

- Focus on compliance. Ensure you are familiar with your firm’s compliance and legal policies to navigate the evolving regulatory landscape.

Partner with Franklin Templeton

Whether you are a retirement plan industry veteran or novice, your Franklin Templeton Retirement team is available to enhance your practice. Visit our Retirement Plans Made Easy page to explore our comprehensive plan solution capabilities, including plan administration, fiduciary services, and investment menu oversight—all conveniently offered in a turnkey solution.5

Invest in the future of your practice

One of the most frequent requests for help we receive is for help training and retaining the next generation of 401(k) advisors. Our award-winning ACES: A Commitment to Education & Service program is designed to help you build and preserve your retirement plan business. We are excited to announce a redesign to this program so be sure to click the link above.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Any information, statement or opinion set forth herein is general in nature, is not directed to or based on the financial situation or needs of any particular investor, and does not constitute, and should not be construed as, investment advice, forecast of future events, a guarantee of future results, or a recommendation with respect to any particular security or investment strategy or type of retirement account. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.

Franklin Templeton, its affiliated companies, and its employees are not in the business of providing tax or legal advice to taxpayers. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties or complying with any applicable tax laws or regulations. Tax-related statements, if any, may have been written in connection with the “promotion or marketing” of the transaction(s) or matter(s) addressed by these materials, to the extent allowed by applicable law. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2024 Franklin Templeton. All rights reserved.

___________________________

Endnotes

1. Source: Cerulli Report—US Retirement Markets 2024. There is no assurance that any estimate, forecast or projection will be realized.

2. Ibid.

3. Source: “How Many People Are Retiring Every Year for the Next 4 Years?” GOBankingRates. April 24, 2024.

4. Source: PLANSPONSOR Defined Contribution Survey 2023.

5. Compared to sponsoring a plan on your own. This webpage is provided for general information purposes and highlight the collective benefits of pooled employer plan (PEP)and multiple employer plans (MEPs). MEP’s and PEP’s allow employers to band together under a turnkey fully bundle retirement plan. Individual plans may vary.

Ref. 3781958