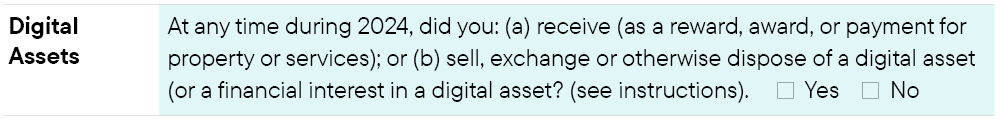

As taxpayers scramble to file taxes themselves, or gather information for their tax preparer, the growth of digital asset ownership has ushered in a new set of tax-related concerns. Understanding taxes on cryptocurrency activities is more important than ever. Since 2020, the IRS has included a question on the 1040 form asking if the taxpayer has engaged in any transactions related to cryptocurrency:

Also, beginning in 2025, the IRS will require digital asset brokers to report certain sales and exchanges of digital assets. This information will be sent to taxpayers for the first time in early 2026 via the new IRS Form 1099-DA.

The IRS treats cryptocurrency as property, and it is generally taxed as any other capital asset. Given the growing popularity of digital assets, it is important to understand the tax implications and be aware of any potential planning opportunities.

IRS weighs in on the tax treatment of digital assets

In 2014, the IRS formally addressed cryptocurrency taxation by issuing Notice 2014-21. The key takeaway from this guidance was confirming cryptocurrency should be treated as property for tax purposes. Specifically stated: “For federal tax purposes, virtual currency is treated as property. General tax principles applicable to property transactions apply to transactions using virtual currency.” The Notice also included answers to 16 Frequently Asked Questions (FAQs).

In 2019, the IRS issued Revenue Ruling 2019-24 and associated FAQs which addressed taxation of “hard forks” and “air drops.” See more detail with the IRS guidance.

A hard fork occurs when a cryptocurrency undergoes a protocol change that is not compatible with the previous version of the blockchain, often resulting in the creation of a new cryptocurrency. Analogous to a required software update, the new version will usually offer some type of benefit such as ease of use, for example.

An airdrop occurs when cryptocurrency is distributed to multiple wallet addresses, usually for free, as an incentive to generate interest or attract users to a new cryptocurrency or blockchain project. Depending on the circumstances, this may result in taxable income when you receive and are able to control the tokens.

Buying and selling cryptocurrency

When you buy and sell cryptocurrency, the transaction follows the same capital gain rules as any other investment. The tax rate depends on your holding period:

- Short-term capital gains: If you hold the cryptocurrency for less than a year, any gains are taxed at your ordinary income tax rate.

- Long-term capital gains: If you hold the cryptocurrency for more than a year, any gains are taxed at a lower long-term capital gains rate.

Example:

- If you bought one unit of cryptocurrency A for $10,000 and sold it for $15,000 after holding it for 18 months, you would report a long-term capital gain of $5,000.

Lastly, if you sell cryptocurrency at a loss, you are subject to the same tax rules governing capital losses. For example, after netting losses against gains excess losses can be used to offset up to $3,000 in ordinary income annually. Any excess losses at that point must be carried to future tax years. One exception for purposes of tax reporting is that digital assets are not subject to the wash sale rule requirements for reporting a capital loss.

Exchanging cryptocurrency

Exchanging one cryptocurrency for another is treated as a sell and a buy. This means you will recognize a capital gain or loss based on the fair market value of the cryptocurrency at the time of the exchange.

Example:

- If you exchange one unit of cryptocurrency A (worth $2,000) for two units of cryptocurrency B (worth $2,000), you will recognize a capital gain or loss based on the difference between the fair market value of A at the time of the exchange and the original cost basis of the cryptocurrency A.

Mining cryptocurrency

This occurs when new coins (i.e. cryptocurrency) are released into circulation. If you earn cryptocurrency by mining it, it’s considered ordinary income unless it is related to business activities, in which case it is treated as self-employment income, subject to payroll taxes. In that case, you can deduct the expenses associated with mining, such as electricity and hardware costs.

Example:

If you mine a unit of cryptocurrency A and the fair market value at the time of mining is $20,000, you will report $20,000 as ordinary income. If you are mining as a business, you can deduct your mining expenses to reduce your taxable income.

Using cryptocurrency to buy goods and services

Using cryptocurrency to purchase goods and services is treated similarly to selling cryptocurrency. You will be subject to capital gains tax based on the difference between the fair market value of the cryptocurrency at the time of the transaction and your cost basis.

Example:

- If you bought one unit of cryptocurrency A for $10,000 and used it to buy a $15,000 car, you would recognize a capital gain of $5,000.

Receiving cryptocurrency for services

Receiving cryptocurrency as payment for services rendered is considered compensation income. The amount of income is based on the fair market value of the cryptocurrency at the time of receipt. If you later sell the cryptocurrency, you may have a subsequent capital gain or loss.

Example:

- If you receive a unit of cryptocurrency A (worth $2,000) for completing a freelance project, you will report $2,000 as wage income. If you subsequently sell the unit for $2,500, you will recognize a capital gain of $500.

Receiving new cryptocurrency from a hard fork

If new cryptocurrency is received via an airdrop following a hard fork, that is generally considered ordinary income. The amount of income is based on the fair market value of the new cryptocurrency at the time you gain control over it. It’s crucial to review the IRS guidance on hard forks to ensure compliance.

Example:

• If you receive a unit of cryptocurrency B (worth $300) from a hard fork of cryptocurrency A, you will report $300 as ordinary income when you gain control over cryptocurrency B.

Staking your cryptocurrency and earning rewards

Staking your cryptocurrency and earning rewards is similar to mining. In short, staking occurs when a cryptocurrency holder designates it to the blockchain in return for some type of reward, which is considered ordinary income when received. Special rules may apply to specific cryptocurrency assets regarding the timing of when you gain control of the rewards.

Example:

- If you stake 10 units of cryptocurrency A to the blockchain and earn one unit valued at $100 as a reward, you will report $100 as ordinary income when you receive and gain control of the reward.

Tax planning considerations around cryptocurrency

Similar to managing taxes for other capital assets and property, here are some considerations on taking a tax-smart approach with regards to cryptocurrency.

- Filling up the 0% capital gains bracket: This applies to taxpayers who are in the lowest two tax brackets. If your taxable income (total income minus deductions) is less than $48,350 (for single filers) or $96,700 (for couples filing a joint tax return), you may be able to realize capital gains without being taxed. Taxpayers may be able to sell a portion of their appreciated cryptocurrency without triggering capital gains taxes. However, a larger capital gain may push a taxpayer into a higher bracket where capital gains would be taxed.

- Generating capital gains in a year where you claim high deductions: If you have large deductions, such as a significant charitable contribution, consider realizing capital gains in the same year. The deduction may help offset the gains and reduce overall tax liability.

- Tax-loss harvesting: Since many cryptocurrency coins have decreased in value recently from their all-time highs, there may be the opportunity to tax-loss harvest. Selling cryptocurrency at a loss can offset capital gains from other investments, reducing your overall tax burden. One potential benefit is that, unlike stocks and other investments, digital asset transactions are not subject to the wash sale rule. This may offer more flexibility in generating losses.

Consult a tax professional

Understanding the tax implications of your digital asset activities is crucial for compliance and planning. Whether you are buying, selling, mining, or using cryptocurrency, the IRS has rules to follow. Consult with a qualified tax professional who has knowledge of these tax rules.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Blockchain and cryptocurrency investments are subject to various risks, including inability to develop digital asset applications or to capitalize on those applications, theft, loss, or destruction of cryptographic keys, the possibility that digital asset technologies may never be fully implemented, cybersecurity risk, conflicting intellectual property claims, and inconsistent and changing regulations. Speculative trading in bitcoins and other forms of cryptocurrencies, many of which have exhibited extreme price volatility, carries significant risk; an investor can lose the entire amount of their investment. Blockchain technology is a new and relatively untested technology and may never be implemented to a scale that provides identifiable benefits. If a cryptocurrency is deemed a security, it may be deemed to violate federal securities laws. There may be a limited or no secondary market for cryptocurrencies.

Digital assets are subject to risks relating to immature and rapidly developing technology, security vulnerabilities of this technology, (such as theft, loss, or destruction of cryptographic keys), conflicting intellectual property claims, credit risk of digital asset exchanges, regulatory uncertainty, high volatility in their value/price, unclear acceptance by users and global marketplaces, and manipulation or fraud. Portfolio managers, service providers to the portfolios and other market participants increasingly depend on complex information technology and communications systems to conduct business functions. These systems are subject to a number of different threats or risks that could adversely affect the portfolio and their investors, despite the efforts of the portfolio managers and service providers to adopt technologies, processes and practices intended to mitigate these risks and protect the security of their computer systems, software, networks and other technology assets, as well as the confidentiality, integrity and availability of information belonging to the portfolios and their investors.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Copyright © 2025 Franklin Templeton. All rights reserved.

Ref. 4199210