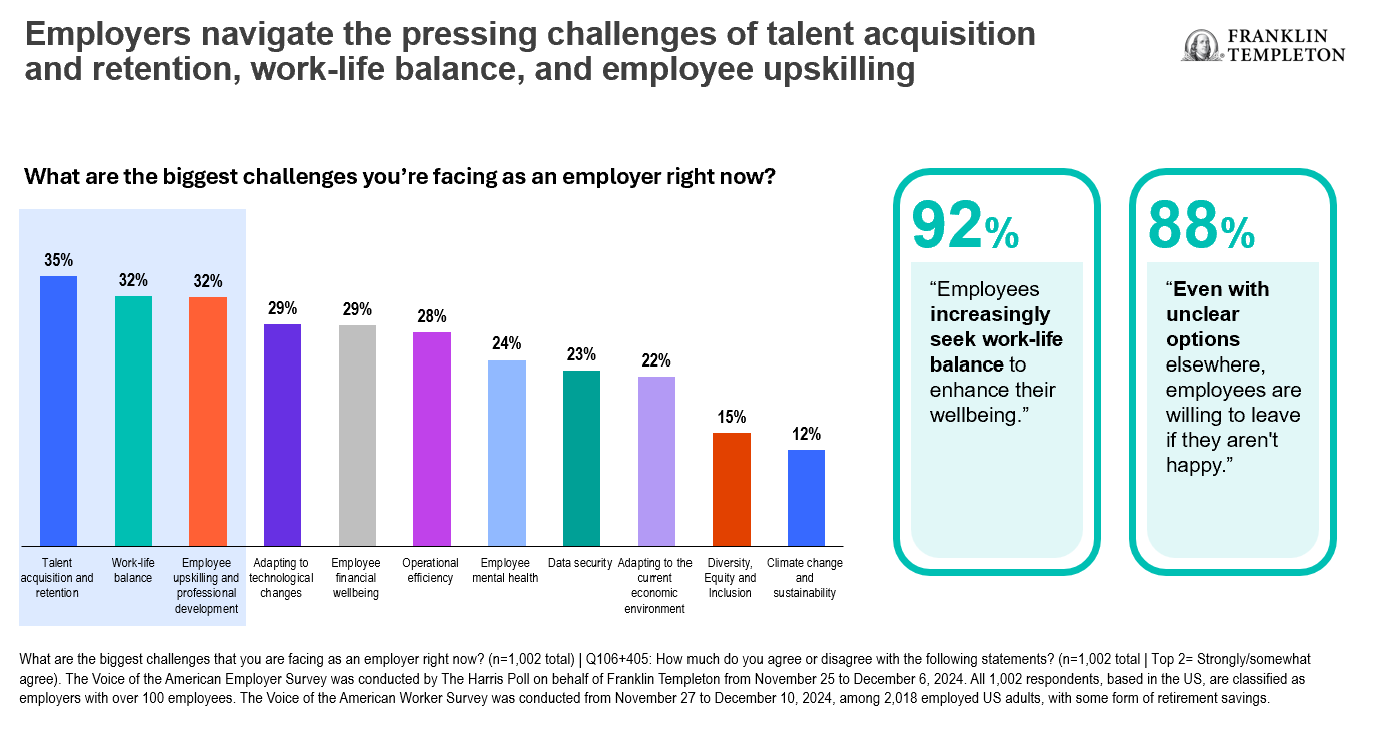

Talent retention, sustaining a competitive edge and managing benefit expansion within budgets are among the top challenges for employers, according to our 2025 Voice of the American Workplace (VOTAW) study. The VOTAW study, conducted in partnership with The Harris Poll, includes the views of both employers and workers and is now in its fifth year.

Workers are navigating unique pressures and discussing their priorities.

To meet the challenges facing companies and workers, a balanced effort between employers and employees is essential. And enhanced communication can help achieve that balance.

Talent retention remains a priority

Attracting top-tier talent has become increasingly competitive across industries. The VOTAW Survey found 81% of employers noted hiring new talent is more difficult than retaining current employees. Most employers surveyed said their competitors are ramping up efforts to attract new workers.

Compensation is a leading issue when employers are considering hiring and retaining workers. It’s also a priority for employees. Not surprising, employers in the VOTAW survey reported an increase in employee expectations around compensation in recent years. For employees, compensation is closely followed by work-life balance, benefit offerings, and career advancement as top priorities.

Benefits are part of that compensation, including workplace retirement savings plans such as 401(k)s.

A full 90% of employers view retirement planning as a collaboration between employers and employees. They see retirement plans as critical to building relationships and employee retention. Employers are enhancing resources to help employees with financial planning so they can succeed.

The survey found:

- 92% of employers believe investing in employees’ financial futures drives loyalty and performance

- 87% of employers said retirement plans are a key factor in attracting top talent

Employees see retirement savings as pivotal to achieving long-term financial goals. A company match, access to diverse investments and financial wellness education contribute to the value of workplace savings.

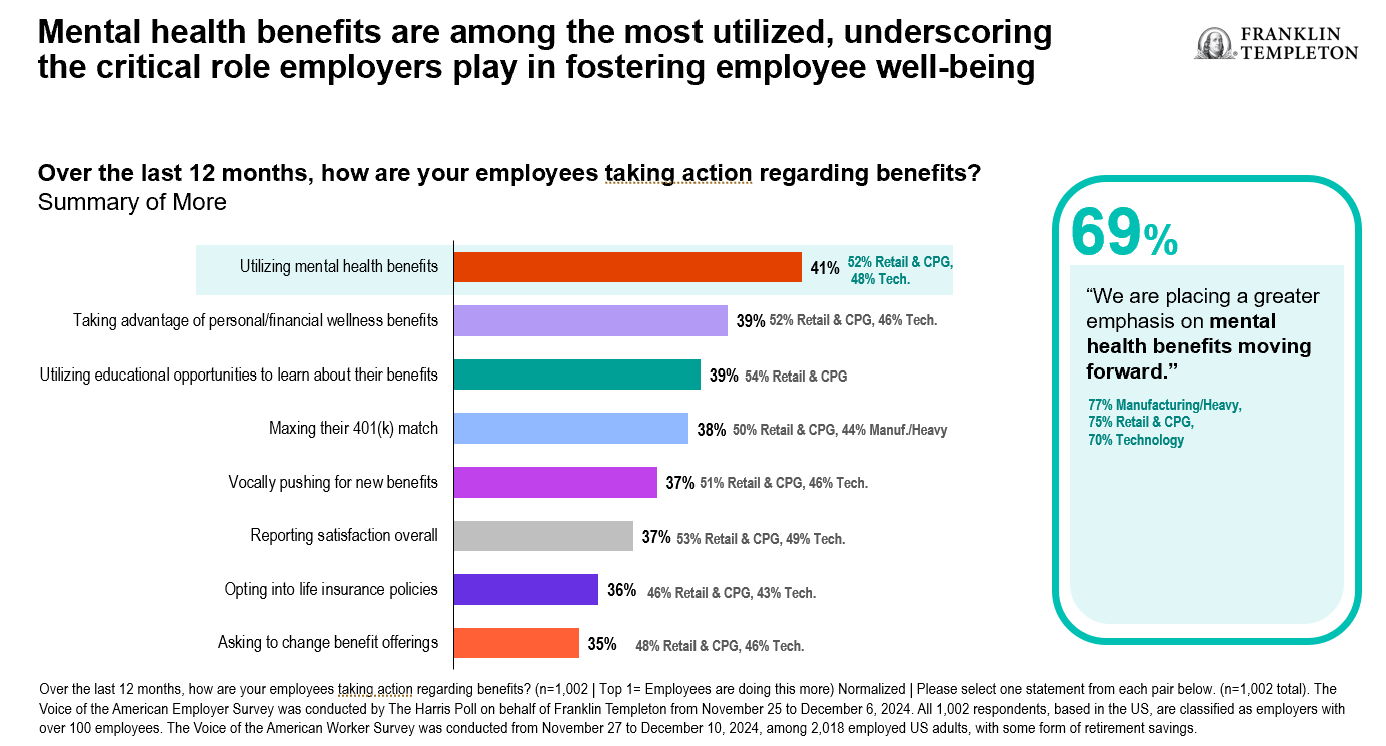

Delivering more benefits

Despite limited resources, employers are continually seeking ways to offer more comprehensive and competitive benefits. They are also responding to benefits that are resonating with workers. The demand for mental health benefits is leading many employers to emphasize this area going forward.

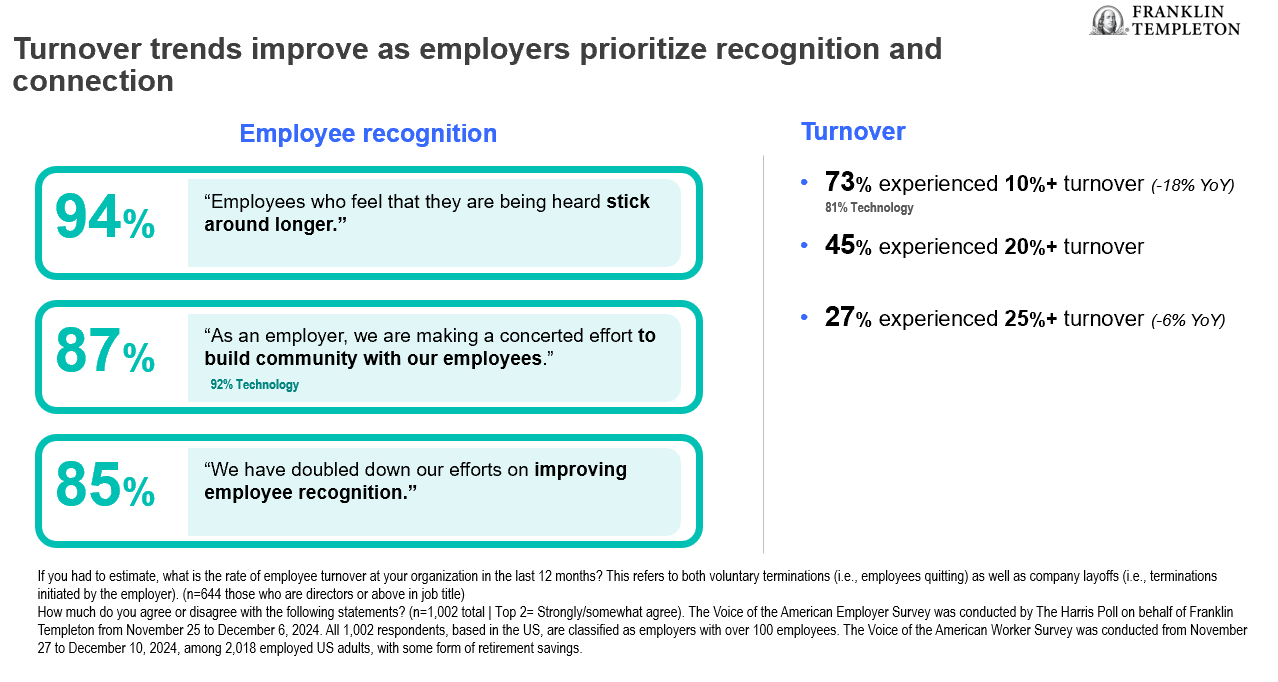

Shifting trends

As companies identify new strategies and benefits to retain workers, turnover trends are shifting. The 2025 survey found 73% of firms experienced 10% or more in employee turnover. This reflected an 18% decline over last year’s survey. The percentage of companies reporting employee turnover of 25% or more declined by 6% year-over-year.

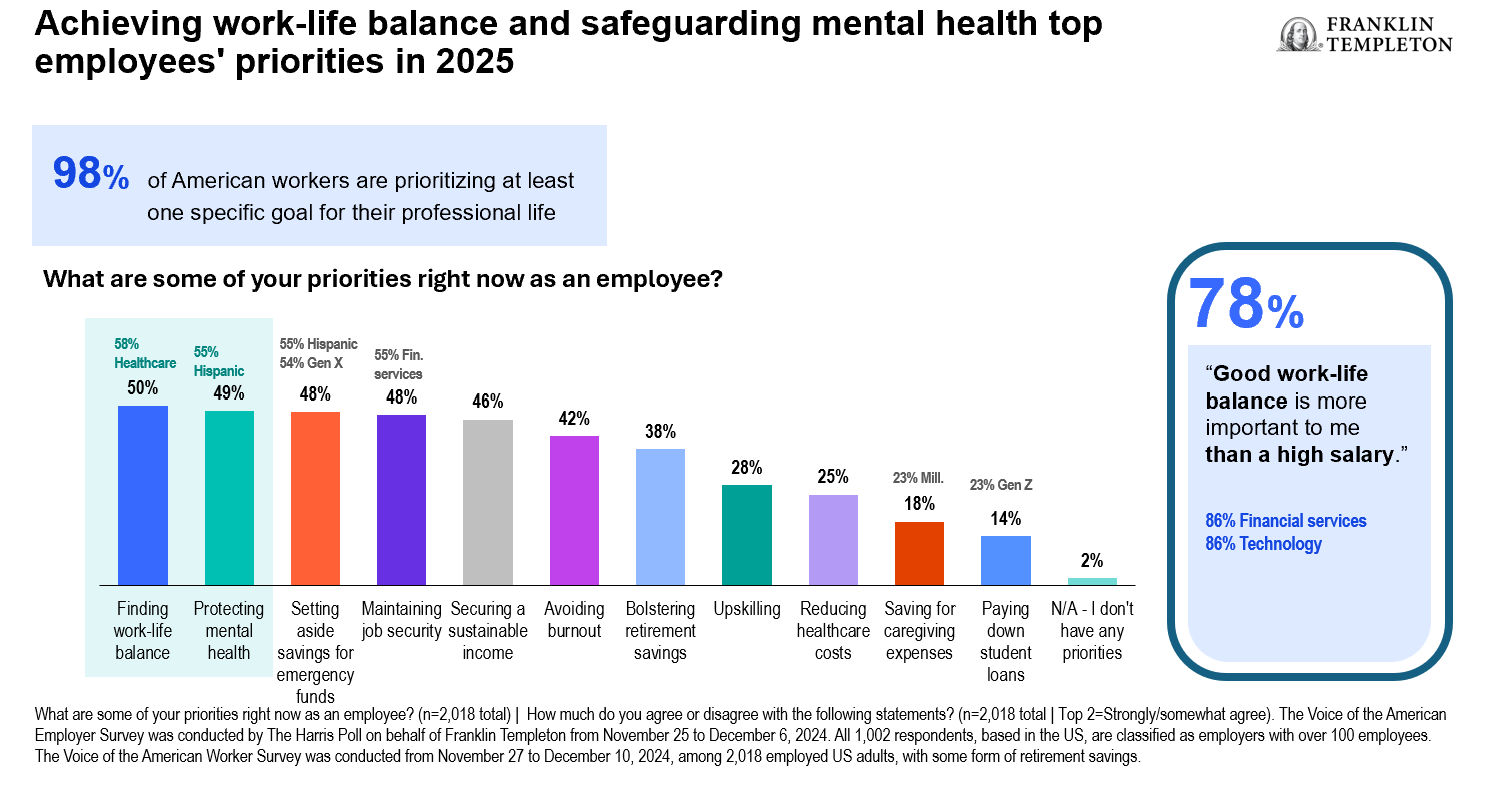

Work-life balance remains key for employees

Achieving work-life balance and safeguarding mental health are the leading priorities for employees in 2025. Here are some highlights of our survey findings:

- Mental health benefits are among the most utilized

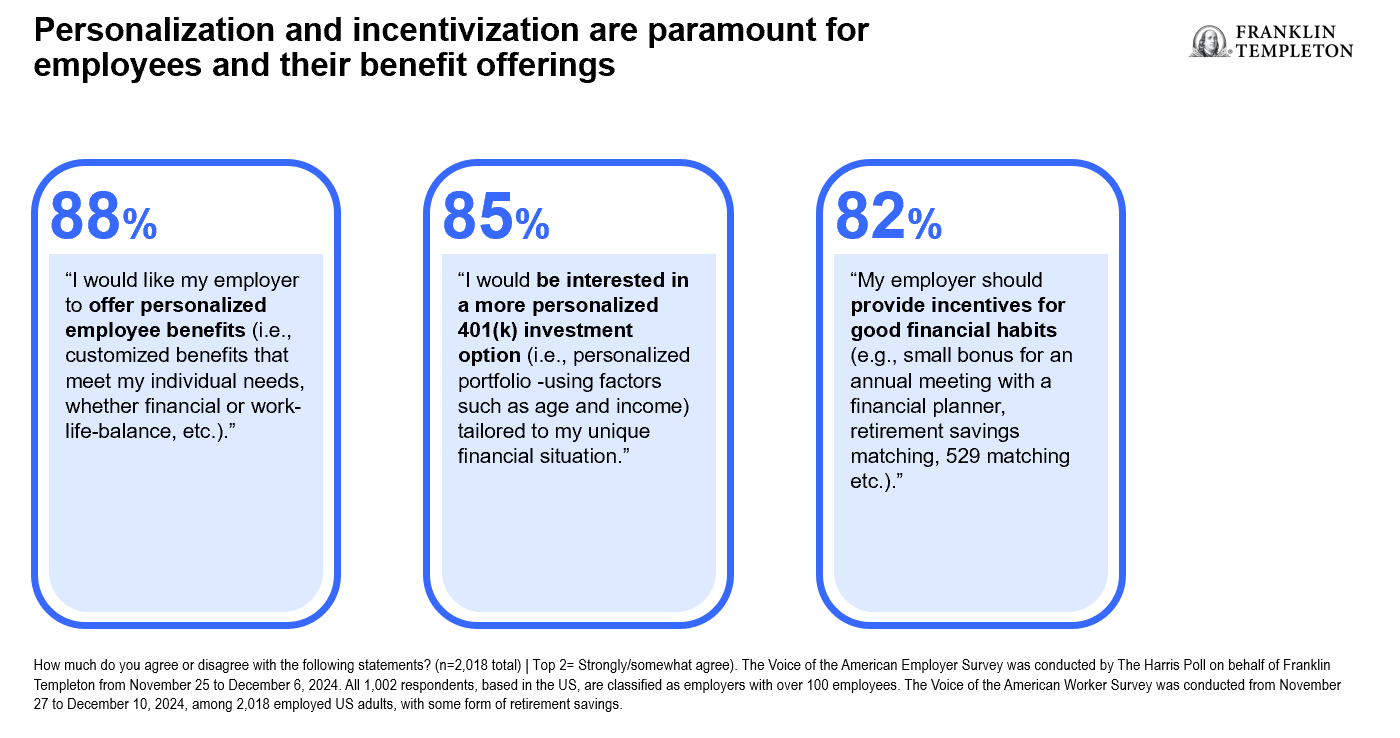

- Personalization and incentivization are paramount for employees and their benefit offerings

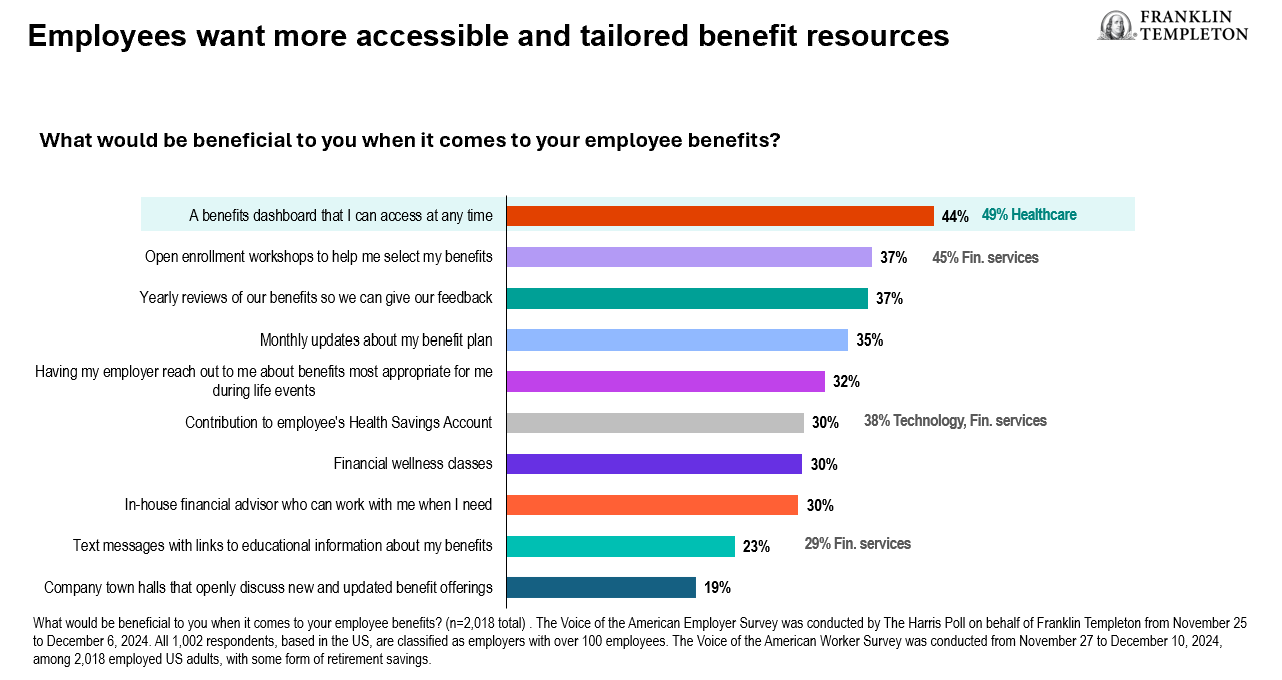

- Employees want more accessible and tailored benefits resources

- Flexibility is important as employees navigate economic challenges.

Employees stress mental health

Employees are prioritizing work-life balance and mental health above all issues. The VOTAW survey found 50% of workers cite work-life balance as their top priority and 78% noted that good work-life balance is more important than a high salary. Also, 76% of workers stated that mental health support has become an increasingly important benefit. In fact, while financial and physical well-being also gained momentum with employees since the 2022 survey, mental health took the lead as the most important priority.

Financial independence is a persistent goal

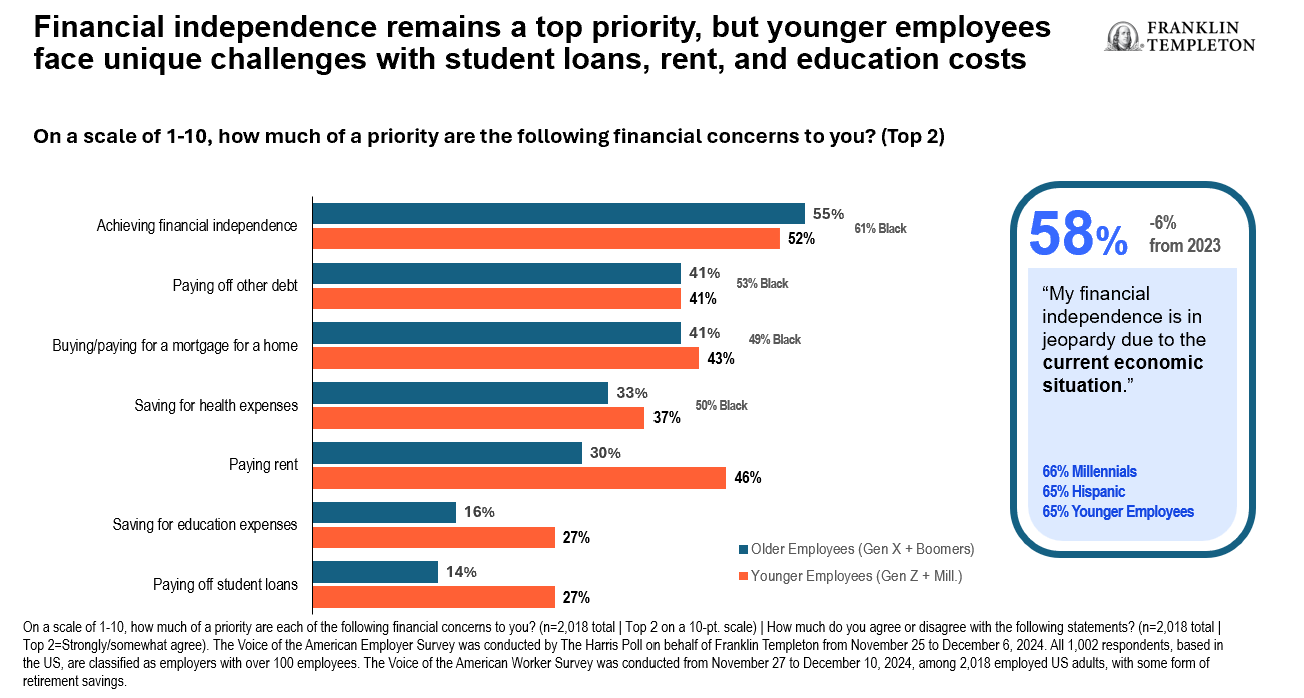

As in past surveys, having enough money to live comfortably in retirement is the top priority, followed by financial independence. Among employees, 91% see their financial goals as a pathway to independence, not just security. Housing costs emerged as a concern, especially among younger workers. Among Gen Z and Millennials, employees face specific challenges with student loans, rent and education costs.

Employees want flexibility

Flexibility in benefits is key as employees prioritize evolving needs. The majority (91%) of employees want to see benefit offerings that keep pace with modern challenges and evolve with their needs (89%). They also want more personalized benefits and enhanced communication about their benefits to understand them better.

Employers are seeing the interest grow for personalized benefits. The survey found nearly 90% of employers anticipate voluntary benefits will gain appeal in the future, alongside traditional benefits.

Enhancing communications is an underlying theme among employers. For example, employees are looking for more benefit education and employers are listening. A full 86% of employees said they want to learn more about their benefits, and 78% said their employers are doing a good job communicating about benefit offerings.

Striking a balance

This year’s survey found that employers and employees are gaining a deeper understanding of goals and communicating the value of benefits being offered.z

Work-life balance and mental health are top priorities for workers. Financial independence remains a key goal, but younger employees face unique challenges like student loans and housing costs. As employees seek more personalized and flexible benefits, employers should seize this opportunity to ensure that employees fully understand the benefits available to them. A review of current tools and communications to best articulate available employee resources is key.

Employers and employees must collaborate to best understand and leverage the most impactful benefit offering for each employee. Employees are increasingly seeking education on their financial benefits, and companies are responding by enhancing communication and providing more resources. Pay, 401(k) match, and health insurance are critical for retention, with a growing emphasis on foundational benefits and employee engagement in understanding and maximizing these offerings. Direct feedback from employees on what resources would best help them understand what’s available will continue to improve the relationship between employers and employees.

For additional information, please contact the Franklin Templeton Retirement Sales Department at (800) 530-2432.

For more details, see our 2025 VOTAW Survey.

About the survey

The Voice of the American Employer Survey was conducted by The Harris Poll on behalf of Franklin Templeton from November 25 to December 6, 2024. All 1,002 respondents, based in the United States, are classified as employers, defined as having at least some influence over company benefits and/or hiring at organizations with over 100 employees. Respondents represent a mix of industries, company size, role, age, and race. Findings from 2023 reference a study of a similar nature that was conducted among 1,000 respondents of the same qualifications by The Harris Poll on behalf of Franklin Templeton from November 6 to 17, 2023.

This survey also references a qualitative study conducted by The Harris Poll on behalf of Franklin Templeton from August 15 to August 25, 2023, among 15 American employers. All interviewees were full-time employees working in human resources, who have influence over employee benefits, and included those with titles such as HR Manager, HR Director or HR Vice President, among others.

This was a blind study, as Franklin Templeton was not mentioned in order to avoid bias.

The Voice of the American Worker Survey was conducted by The Harris Poll on behalf of Franklin Templeton from November 27 to December 10, 2024, among 2,018 employed US adults. All respondents had some form of retirement savings. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. Findings from 2020 reference a study of a similar nature that was conducted by The Harris Poll on behalf of Franklin Templeton from October 16 to 28, 2020, among 1,007 employed US adults, study from 2021 also references a similar survey conducted among 1,005 employed adults from October 28 to November 15, study from 2022 also references a similar survey conducted among 1,000 employed adults from October 17th to October 27, and a study from 2023 also references a similar survey conducted among 2,001 employed adults from November 9 to November 21.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S.: Franklin Resources, Inc. and its subsidiaries offer investment management services through multiple investment advisers registered with the SEC. Franklin Distributors, LLC and Putnam Retail Management LP, members FINRA/SIPC, are Franklin Templeton broker/dealers, which provide registered representative services. Franklin Templeton, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

Copyright © 2025 Franklin Templeton. All rights reserved.

Ref. 4216659