Business growth and entrepreneurship continue to drive the economy. While the majority of businesses in the United States are small businesses—defined as those with fewer than 500 employees— they represent nearly half of the country’s private sector employees and are viewed as a significant engine of economic growth.1

Still, many businesses of all sizes face unique challenges, such as tax planning, talent retention, regulatory requirements, offering retirement benefits, and creating succession plans.

In the changing tax landscape, numerous strategies have emerged that offer tax-advantaged opportunities for businesses.

Here are some tax-smart strategies for small business owners to consider.

1. Maximize the deduction for qualified business income (QBI)

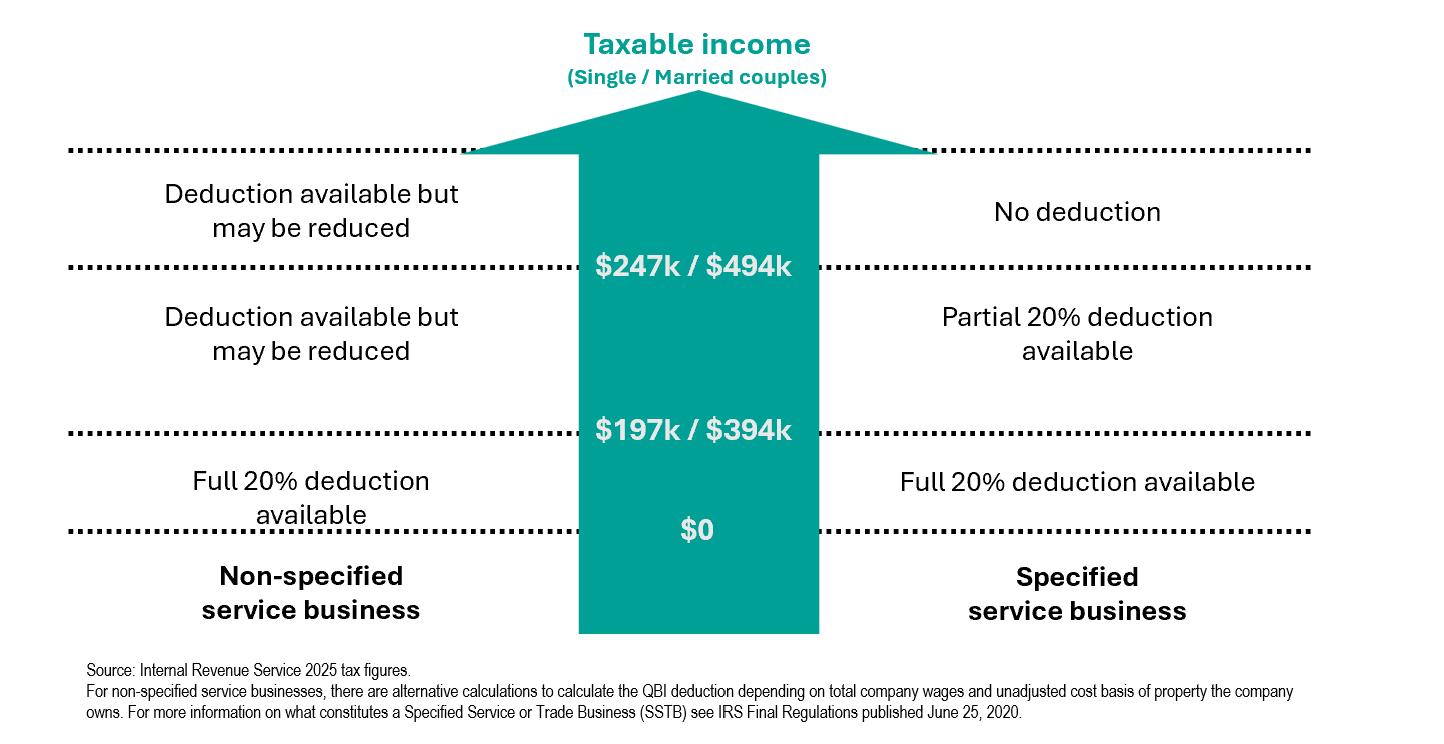

Following the passage of the Tax Cuts and Jobs Act (TCJA) in late 2017, a new provision established a 20% deduction of qualified business income (QBI) from certain pass-through businesses. The amount and availability of the deduction will depend on the type of business and the income level of the business owner. For example, once household income exceeds a certain threshold, service-related industries, such as certain health services, law firms, and other professional services, are excluded from claiming the 20% deduction. For 2025, the threshold is $197,300, or $394,600 for joint filers. Some business owners in these types of fields may be able to manage their income to avoid exceeding the threshold and take advantage of the 20% deduction. For non-service businesses, like a small manufacturing firm, the ability to claim the QBI deduction is always available but may be limited due to a different calculation once the business owner’s income exceeds certain thresholds.

For more information on the QBI deduction, including key income thresholds, refer to this chart:

See the details of the IRS regulation, “Qualified business income deduction.”

2. Avoid the $10,000 cap on deducting state and local taxes

Currently, taxpayers are limited to an annual tax deduction of $10,000 in state and local taxes. This amount applies to both single filers and married couples filing a joint tax return (for married couples filing separate tax returns, each spouse can deduct up to $5,000 in SALT). However, there may be an option for certain pass-through business owners to circumvent the $10,000 cap based on the amount of state taxes paid through the company. Over 30 states have implemented pass-through entity (PTE) taxes, which generally allow business owners/partners to elect to pay state income taxes at the business level as a means of avoiding the SALT cap. The payment of the PTE tax by the business entity reduces the amount of business income that flows through and is subsequently reported on the federal income tax return. This results in less income subject to taxation, which is effectively a workaround to the $10,000 cap. These types of new state laws have accelerated since the IRS issued Notice 2020-75 in 2020, which provides guidance that entity level tax payments imposed by states are deductible for federal income tax purposes.

Given the complexity and variability of rules depending on the state, the decision to opt in to a state PTE tax requires careful analysis and consideration based on individual circumstances. Business owners should consult with a qualified tax advisor.

3. Establish a workplace retirement plan

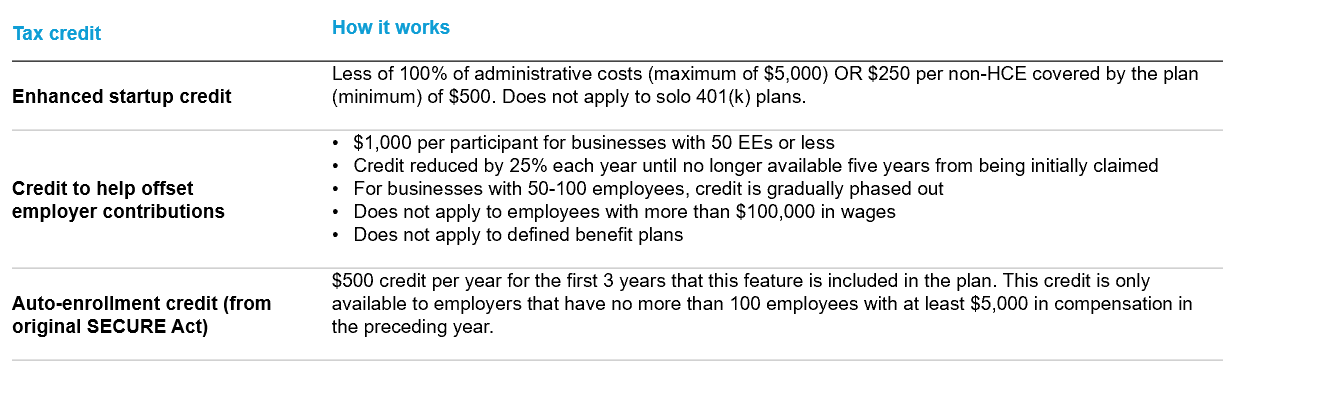

The incentives for business owners to sponsor a retirement plan have never been better. Recent retirement legislation has introduced several tax credits to help business owners offset the cost of establishing and maintaining a plan. In addition to valuable tax credits, a retirement plan offers tax-favored contributions for owners and employees. Lastly, under the Employee Retirement Income Security Act (ERISA), assets held within certain qualified retirement plans receive protection from potential creditors.

Tax credits available to small business owners

For more information see the IRS article on “Retirement plans startup costs tax credit.”

4. Transform business losses into tax-free retirement income

A net operating loss (NOL) may occur during a tax year in which business deductions exceed income, resulting in negative income. While prior tax law allowed a pass-through business owner to apply an NOL against prior tax years, current law requires the loss be carried forward to future tax years if it cannot be utilized to offset income in the current tax year. This is where a Roth IRA conversion may be appealing. Unlike net capital losses, where taxpayers are limited to utilizing a maximum $3,000 annually to offset ordinary income, there are fewer restrictions on how an NOL can be used to offset ordinary income. For example, taxpayers carrying forward NOLs may use those losses to offset a portion of additional income from a Roth IRA conversion. The rules on calculating and utilizing NOLs are complicated, so it is critical to consult with a qualified tax professional. For more information see “Apply a net operating loss to a Roth IRA conversion.”

Other tax considerations for business owners

In addition to these specific strategies, there are many other options for business owners to manage their tax bill including, for example:

- Deferring or accelerating income, depending on personal tax circumstances. For example, delaying invoices to defer income into the next year.

- Taking advantage of bonus depreciation on the purchase of qualified property. For 2025, this allows an owner to accelerate expensing of the property based on 40% of the purchase price for this tax year instead of claiming a depreciation allowance over the lifetime of the asset. There are discussions in Congress on increasing bonus depreciation back to 100%, where it was until 2023, but it is uncertain on whether it will make its way into a final tax bill this year. For more information see the IRS FAQ on “Additional first year depreciation deduction.”

- Hiring a spouse or other family member may have benefits. For example, a spouse may be able to participate and save in a workplace retirement plan or a child can fund a Roth IRA based on earnings from work.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Any information, statement or opinion set forth herein is general in nature, is not directed to or based on the financial situation or needs of any particular investor, and does not constitute, and should not be construed as investment advice, forecast of future events, a guarantee of future results, or a recommendation with respect to any particular security or investment strategy or type of retirement account. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.

Franklin Templeton, its affiliated companies, and its employees are not in the business of providing tax or legal advice to taxpayers. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties or complying with any applicable tax laws or regulations. Tax-related statements, if any, may have been written in connection with the “promotion or marketing” of the transaction(s) or matter(s) addressed by these materials, to the extent allowed by applicable law. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Copyright © 2025 Franklin Templeton. All rights reserved.

Endnote

______________________

1. Source: “Frequently Asked Questions About Small Business.” Small Business Administration. March 7, 2023.

Ref. 4499608