Sustainable investing has seen considerable growth over the last five years and shows no sign of slowing down, as awareness around crucial sustainability topics continues to grow. We have seen a steady pace in sustainable investment asset growth in Europe, North America and Australia. And for Asia, the region has quietly caught up, with more than double the asset growth in this space than any other region.1 In the past year alone, funds associated with climate change saw some of the highest investor inflows, in part boosted by government stimulus steered toward national climate-change goals.

Such robust growth suggests to us a marked shift in both investor and company attitudes toward environmental, social and governance (ESG) factors. There’s debate among market commentators whether integrating ESG considerations in actively managed strategies can lead to beneficial outcomes for the environment—without sacrificing returns for investors. We have found that the two goals are not mutually exclusive and can often be quite complementary.

Global Climate Change Plans Delayed, Not Derailed

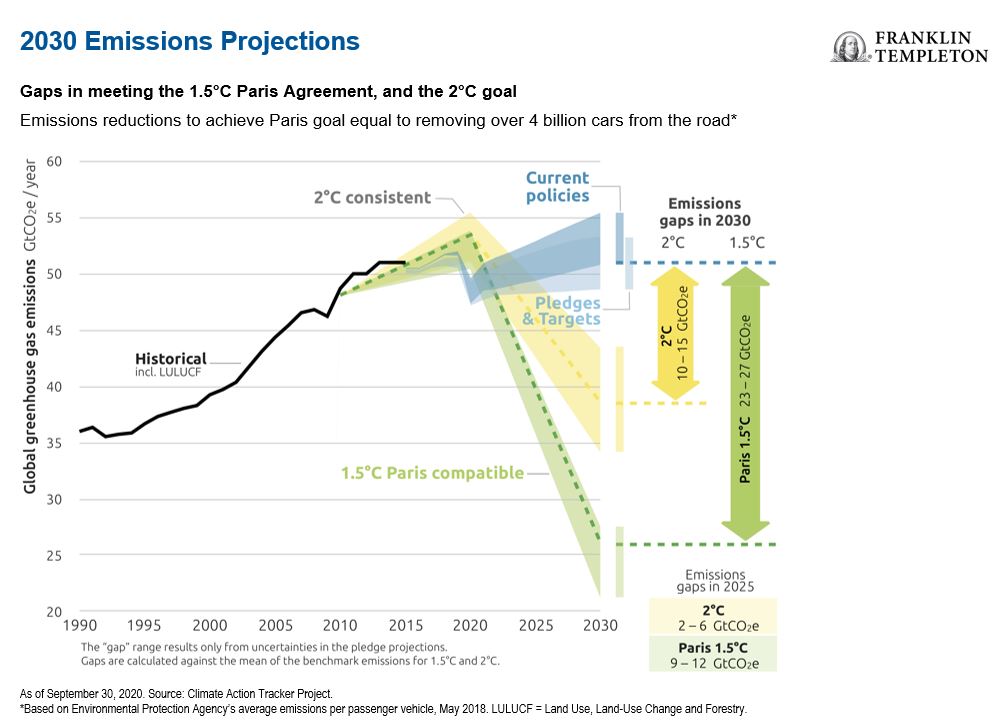

In 2020, public health challenges surrounding COVID-19 meant that political focus in addressing the world’s climate challenges had to take a back seat. Despite a 6% annual drop in carbon dioxide emissions in 2020 brought on by COVID-19 lockdown measures—where, for example, some residents of India were able to see the Himalayan peaks for the first time in decades—pressing global climate issues remain as economic activity resumes. On the whole, the planet faces significant challenges in meeting the objectives of the 2015 Paris Agreement, where governments have signed up to limit global warming to well below 2°C above pre-industrial levels.

Since 2015, greenhouse gas (GHG) emissions have continued to steadily rise.2 Signatories of the Paris Agreement recognize that increased action is needed and major countries like the United States, China, Japan, the United Kingdom and the European Union have committed to new net-zero targets.3

If governments are to meet their nationally defined contribution (NDC) targets, we expect to see increased policy actions going forward, with more comprehensive climate frameworks; for example, taking measures to incentivize companies to reduce GHG emissions. This may include imposing restrictions on burning fossil fuels, carbon taxes, or carbon trading schemes.

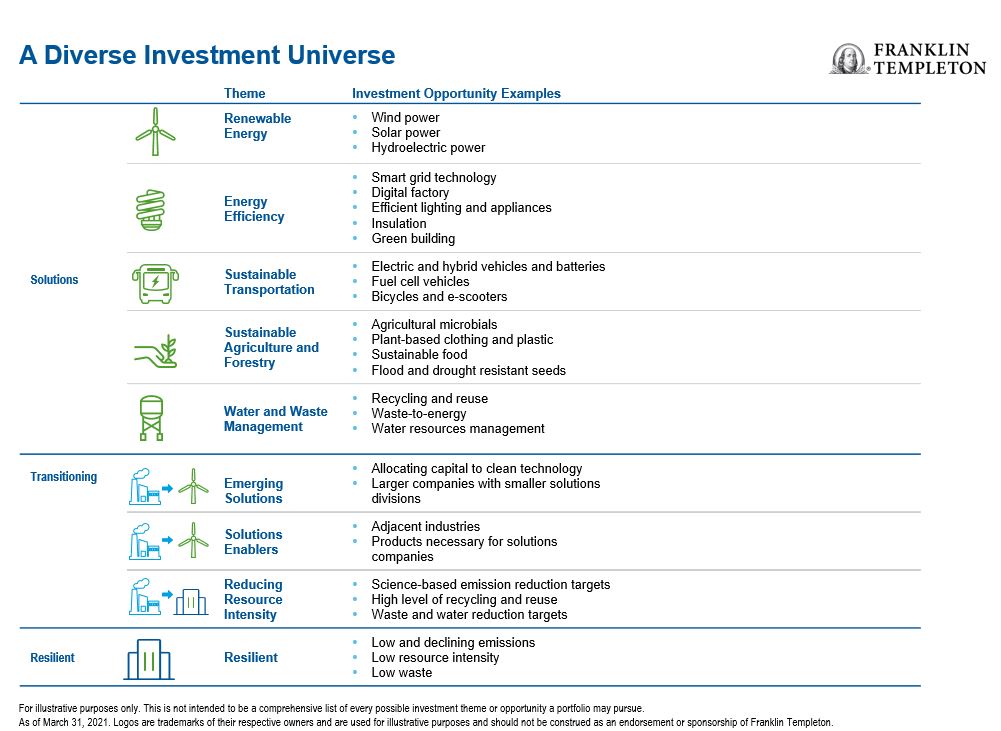

In our view, the beneficiaries of these changes are companies belonging to one or more of three groups: first, those that are developing products that aid in reducing emissions, second, those that adopt new technologies or processes to reduce their own carbon footprint, and third, those that operate in very low carbon-emitting sectors.

An Emissions-Free Future Involves More Than Renewable Energy

Overall, we are seeing real momentum behind the global push to tackle carbon emissions as many nations set out targets to reduce their carbon footprint or reach ”net zero”—when any man-made GHG emissions are balanced out by GHG reduction measures. As bottom-up fundamental, long term and forward-looking investors, we seek out companies that provide an active product or service that directly reduces GHG or offer an alternative source of energy. However, these are not the only companies that should benefit from the transition to a low-carbon future.

The investible universe for climate change represents a much broader opportunity set of activities across a wide range of sectors. This could include companies that are providing a product in sustainable transportation, sustainable agriculture and forestry, water and waste management, or even energy efficiency. It may include companies involved in finished goods such as plant-based clothing or sustainable packaging.

European companies have so far taken the lead on many climate-change issues. However, this has changed in recent years as North American and Asian firms pivot toward more sustainable processes.

Of course, government policies can change, and policy reversal is a risk to investors in this space. In the United States, the previous Trump administration had reversed some of the climate change policies from the Obama era, and exited from the Paris Agreement. Crucially, US companies and states generally did not change course as a result of that action and instead viewed sustainable solutions as a necessity. Upon taking office in 2021, President Biden reinstated the United States into the Paris Agreement, emphasizing green energy and other clean solutions, and as a result we are seeing investment opportunities arise in many other areas.

In the Face of Climate Change Risks

In the United States, we witnessed power shortages in the state of Texas this past winter, and the response from local legislators was to introduce a bill penalizing renewable energy companies—even though much of the state’s energy comes from traditional fossil fuels. In China, some regional governments are seeking to build new coal-fired power plants and appear less supportive of decarbonization efforts amid short-term economic concerns and power shortages.4 There are also concerns about whether lowering greenhouse gasses is worth reducing the economic growth of some parts of the world.5 In our view, the move to lowering GHG emissions (environmental concerns) should take into consideration the need for a just transition, ensuring society can continue to provide support by creating new jobs to replace those that will disappear as the economy evolves.

As active managers, our approach is, and has always been, to integrate ESG into our research processes from day one. Our team of 34 analysts spend a considerable amount of time and effort assessing the relevant ESG issues, and how these may impact future returns for industries and companies, including how well individual management teams adapt to the associated risks and opportunities. In our view, ESG should start with the “G” in governance, as we have found that a focus on good governance by an engaged and driven management team often correlates with strong “E” and “S” practices as well.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC. Member FINRA/SIPC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC. Member FINRA/SIPC is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

What Are the Risks?

All investments involve risks, including possible loss or principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size and lesser liquidity.

Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

Impact investing and/or Environmental, Social and Governance (ESG) managers may take into consideration factors beyond traditional financial information to select securities, which could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. Further, ESG strategies may rely on certain values-based criteria to eliminate exposures found in similar strategies or broad market benchmarks, which could also result in relative investment performance deviating.

_________________________________________

1. Source: Morningstar, 2021. From 2016 to 2020, Asia’s sustainable investment assets grew by 447% compared to North America (193%), Europe (179%) and Australia and New Zealand (108%).

2. Source: Climate Action Tracker Project, 2020.

3. Source: Climate Home News, Which Countries Have a Net Zero Carbon Goal?, June 2019.

4. Source: Macro Polo, Beijing Lines Up the Pieces for Peaking Emissions by 2030, April 7, 2021.

5. Source: The Conversation, Developing Countries Can Prosper Without Increasing Emissions, September 22, 2017.