Global central banks have raised interest rates to grapple with reemergent inflation, causing bond and equity valuations to decline in synchrony. The historical diversification benefits of traditional stock and bond investments has turned on end. Amid a continued challenging overall environment, we believe many investors will need a more sophisticated toolbox to meet their long-term goals.

In this environment, we believe alternative investments can be used as multi-faceted tools for portfolio construction. Alternative investments, defined as private equity, private credit, real assets—such as real estate and real estate investment trust (REITs)—and hedge funds, have the potential to provide investors with higher returns, higher income, lower volatility and diversification benefits relative to traditional investments.1 Consequently, they can be employed to enhance potential growth, income, defensiveness and/or to provide a hedge against inflation.

Benefits of investing in real estate

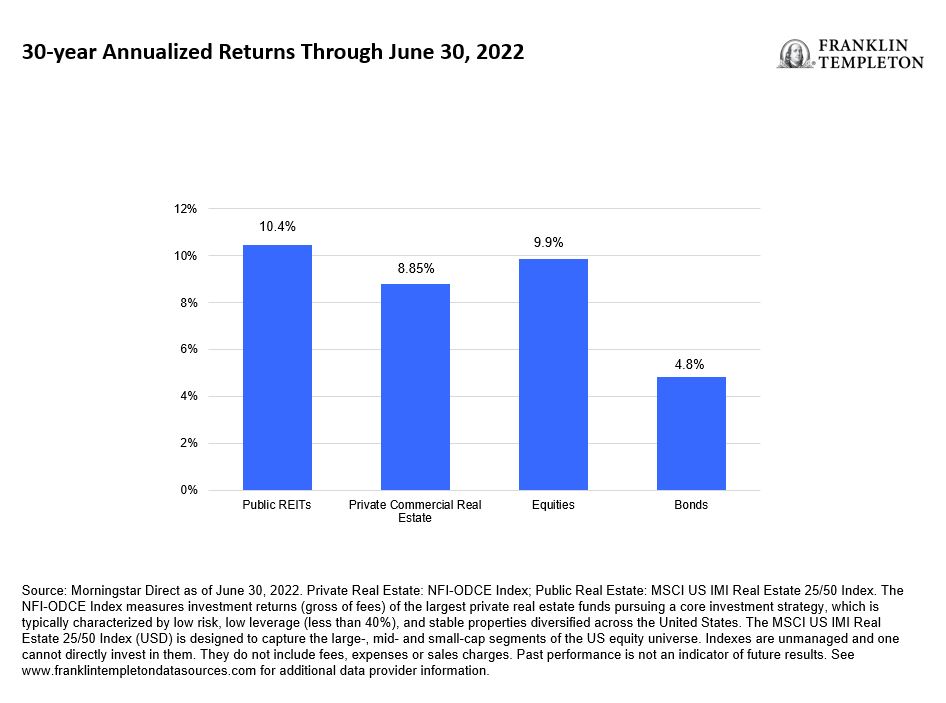

Real assets are tangible, physical assets whose value is derived from their physical use—which includes infrastructure, natural resources and real estate. Of these, real estate is the largest segment of real assets,2 representing a diverse set of opportunities across both categories of use and geography. Real estate has historically been a source of growth and income, diversification and a hedge against inflation. Investors can access real estate in one of three ways: through allocation into publicly traded REIT stocks, unlisted real estate funds or direct assets. Real estate has historically delivered returns on par with equities, with REITs modestly outperforming unlisted real-estate funds (see chart below).

In addition to its historically compelling return profile, real estate has typically offered yields above those of broad stock indexes as well as sovereign debt and high-grade municipal and corporate bonds over full market cycles.3 Real estate cash flows and values have also typically increased over time as the cost of marginal new supply rose and created a natural linkage to the rate of inflation.4 Consequently, real estate has tended to both sustain value relatively well during recessions and perform admirably amid heightened inflation.5

Private real estate vs. publicly traded REITs

An investor can gain exposure to real estate through publicly traded REIT products or via open-end or closed-end private equity funds. The assets underlying each is effectively the same: commercial real estate. Returns on private real estate have modestly lagged public REITs, as measured by the National Council of Real Estate Investment Fiduciaries Fund Index – Open End Diversified Core Equity (NFI-ODCE Index) and the MSCI US IMI Real Estate 25/50 Index, respectively, but could be viewed as comparable assuming some allocation to value-additive strategies.6 However, private commercial real estate tends to be less empirically volatile and exhibits lower correlation to other financial assets. This is because values are determined based on relatively infrequent appraisals, whereas a publicly traded REIT is marked-to-market daily and will reflect the constant turbulence of interest rates, risk premiums and other macroeconomic variables.

Public REITs also typically have lower leverage and more frequent use of unsecured corporate debt whereas private real estate can have more than 50% loan-to-value with more frequent use of first-mortgage financing. Private real estate can have a greater potential exposure to value-add opportunities as public REITs are limited by capital return requirements to maintain tax-free REIT status. However, REITs have a diverse universe of investable assets across many subsectors including towers, self-storage, timber and cold storage versus private real estate’s exposure of more traditional subsectors with fewer opportunities in more niche subsectors. Thus, investor preferences should determine which would be more suitable when making allocation decisions.

Reasons to invest in both

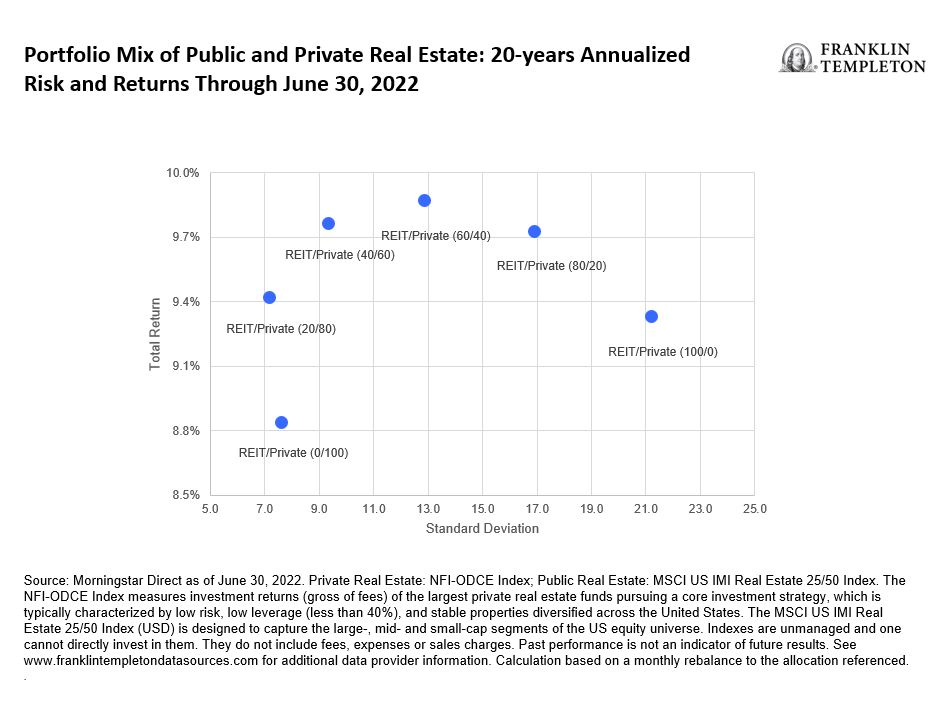

We believe many investors should consider allocations to both private and publicly traded equity strategies to effectively take advantage of the beneficial attributes of real estate. Such an approach can potentially maximize returns, while reducing portfolio risk. The return profiles of combined portfolios exceeded those of both the 100% private and 100% publicly traded equity portfolios.7 In our analysis, this approach can also provide adequate liquidity to ensure access to capital and allow for tactical rebalancing.

Why now is a good time to invest in public real estate

In our opinion, the current environment presents a compelling opportunity to consider allocating to real estate strategies. Inflation is running high and growing increasingly persistent. Concerns about whether central banks have the will to combat and defeat inflation in the face of economic risks and imbalances are warranted. For example, industrial real estate is seeing market rent growth exceeding 20% per annum—and, in some places, well above that average—because demand far exceeds supply, vacancy is at record lows, and the cost of new construction is spiraling higher.8 Apartment rents have surged in response to consumers demanding more living space as lifestyles adjust to a new, more home-centric post-pandemic normal. Pandemic-motivated demand for self-storage has pushed vacancy to record lows and rents to record highs. Inflation is a scourge to financial assets unless, of course, one owns scarce assets that can capture and reflect that inflation.

In response to high inflation, global central banks have embarked on an aggressive policy of tightening monetary policy, which has raised nominal and real interest rates. This has weighed on commercial property values, as the discount rate applied to cash flows has increased substantially in a short timeframe. In our analysis, this creates an opportunity for a well-chosen portfolio of commercial real estate that can seek to mitigate these pressures through collateralized cash flows that are hedged from the risk of inflation-related devaluation.

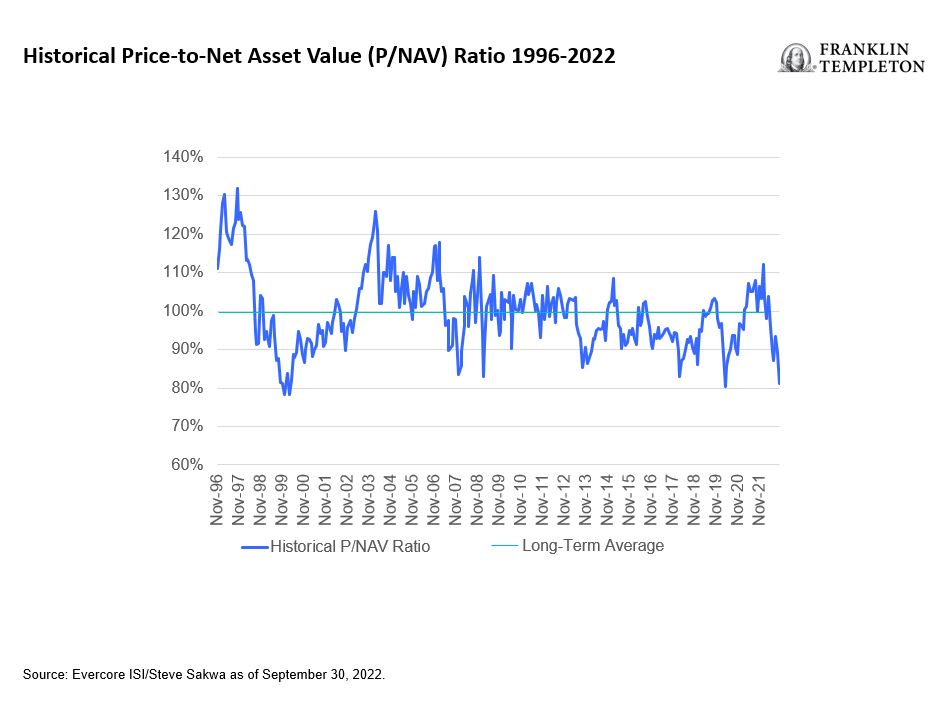

We’ve seen a valuation contraction in publicly traded commercial real estate, as asset values have been remarked to reflect higher interest rates. Notably, publicly traded REITs trade at an average 20% discount to net asset value (a measurement of the private market value of the embedded real estate), which has historically marked a nadir for the relative valuation of public real estate (see chart below). The combination of inflation-linked cash flows and the prevailing discount to private market value make the current environment for publicly traded commercial real estate attractive, in our view. The uncertainty surrounding the macro outlook contributes to our view that active management is especially important to discern which opportunities offer high quality, in demand, supply constrained assets and prudent capital structuring and allocation.

WHAT ARE THE RISKS?

All investments involve risks, including the possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stocks historically have outperformed other asset classes over the long term but tend to fluctuate more dramatically over the short term. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds adjust to a rise in interest rates, the share price may decline.

The risks associated with a real estate strategy include, but are not limited to various risks inherent in the ownership of real estate property, such as fluctuations in lease occupancy rates and operating expenses, variations in rental schedules, which in turn may be adversely affected by general and local economic conditions, the supply and demand for real estate properties, zoning laws, rent control laws, real property taxes, the availability and costs of financing, environmental laws, and uninsured losses (generally from catastrophic events such as earthquakes, floods and wars).

Investments in alternative investment strategies are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Depending on the product invested in, an investment in alternative investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment.

Additionally, investments in private securities and obligations may be thinly traded, have no ready market or exchange and require private negotiation, and which may be restricted as to their transferability. These factors may limit the ability to sell such securities at their fair market value.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

1. These asset types also carry risks different from traditional investments, please see the disclosures at the end of this document for an explanation of the risks associated with private assets.

2. Sources: Harvard Business School Online, “What are Alternative Investments,” July 8, 2021. McKinsey & Company, “Private Markets Rally to New Heights: McKinsey Global Private Markets Review 2022,” March 2022.

3. Source: Bloomberg as of 11/30/22.

4. Source: Forbes, “What History Teaches Us About Inflation And Commercial Real Estate,” 7/18/22.

5. Sources: NAREIT, “Historical Real Estate Performance Before, During, and After U.S. Recessions, 11/8/22 and CRE, “Is Commercial Real Estate an Inflation Hedge?” 2011.

6. Source: Morningstar Direct as of June 30, 2022. The NFI-ODCE Index measures investment returns (gross of fees) of the largest private real estate funds pursuing a core investment strategy, which is typically characterized by low risk, low leverage (less than 40%), and stable properties diversified across the United States. The MSCI US IMI Real Estate 25/50 Index (USD) is designed to capture the large-, mid- and small-cap segments of the US equity universe. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or a guarantee of future results.

7. See footnote 6.

8. Source: JLL Research, “Industrial Market Overview: Q2 2022,” 2022.