Timing is a key factor to determine when to claim Social Security benefits.

For married couples, there are other considerations that may be equally important. Understanding how Social Security benefits apply to them is key, especially as it relates to advance planning for the spouse who is likely to live longer.

Survivor benefits

Some couples may not want to discuss the possibility of one spouse pre-deceasing the other. In the case of Social Security, understanding the rules around survivor benefits is a critical component of an effective retirement income plan.

Losing a spouse and transitioning to a one-person household is extremely difficult and challenging for a multitude of reasons. And financial considerations are an important part of that process. For many surviving spouses, the question that looms ahead is whether they can maintain the same standard of living.

Understanding when to claim Social Security can make a difference in the benefits received and could be critical to maintaining the household and meeting expenses.

Planning for survivor benefits while both spouses are alive

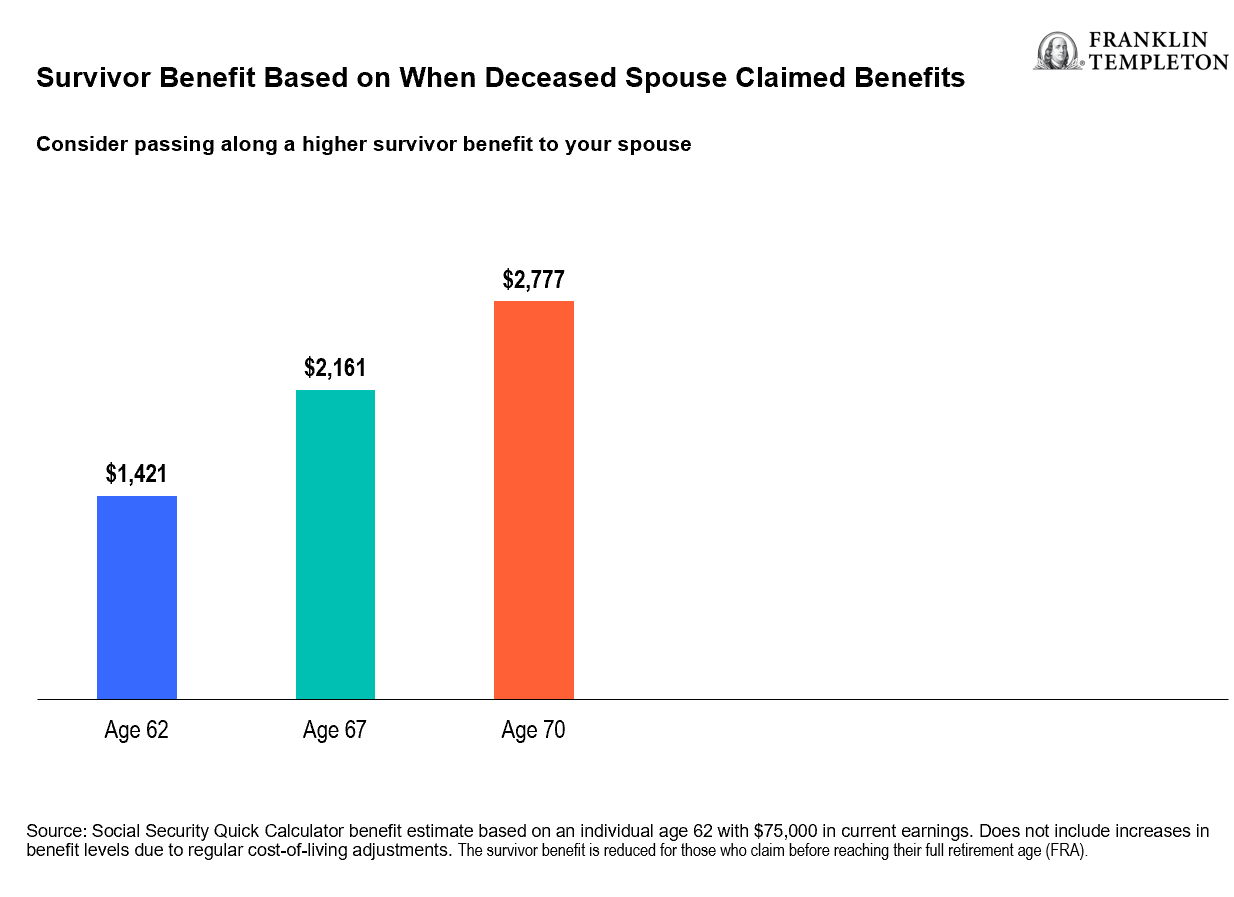

While both spouses are alive, it’s important to consider the estimated longevity of both spouses when making decisions around claiming Social Security retirement benefits. This is especially critical when you have a significant difference in lifetime earnings between spouses. The higher-earning spouse should take that into consideration and, if possible, they may want to maximize their own benefit which could eventually be transferred to the other (lower earning) spouse in the form of a survivor benefit.

The survivor benefit is based on the amount the deceased benefit was receiving, potentially reduced depending on whether the surviving spouse claims the benefit prior to reaching full retirement age (FRA). Additionally, similar to other benefits, survivor benefits may be reduced if claimed prior to FRA and the individual is still working.1

(Right-click on chart to enlarge/open in new window).

What to know about survivor benefits

1. You can claim benefits as early as age 60.

Unlike spousal benefits which can be claimed as early as age 62, surviving spouses can claim benefits as early as age 60. (Note that a surviving spouse with a disability can claim benefits as early as age 50). However, the surviving spouse will receive a reduced benefit if they make a claim prior to reaching their FRA. For example, claiming at age 60 will result in a benefit reduction of 28.5%. The maximum benefit is limited to what the deceased spouse was receiving prior to passing away.

2. You have to be married for at least nine months to receive survivor benefits.

There may be exceptions to this general rule including, if you adopted the deceased spouse’s child during the marriage and before the child reached age 18. Or, the deceased spouse was reasonably expected to live for at least nine months but died of an accident. See the Social Security article, “How do I become entitled to widow’s or widower’s benefits” for more details.

3. If you remarry you may forfeit your survivor benefits.

If you remarry prior to age 60, you forfeit your survivor benefits. If you remarry at age 60 or older, you retain the survivor benefit based on the earnings record of your previous, deceased spouse.

4. Claiming your own benefit or the spousal benefit early will not impact your survivor benefit.

After the first spouse passes away, the survivor receives the higher of their own retirement benefit or the survivor benefit available to them. They must file for the survivor benefit in order to switch over.

5. Surviving spouses who haven’t claimed their own retirement benefit have the option of claiming the survivor benefit and letting their own benefit grow due to delayed retirement credits.

This option is unique to survivors. For example, when a living spouse files for spousal benefits, they will receive the higher of their own benefit (based on their earnings record) or the spousal benefit. A living spouse cannot choose to receive spousal benefits and let their own benefit grow due to delayed retirement credits. However, survivors have this flexibility. For example, a surviving spouse could claim the survivor benefit and wait until age 70 to switch over to their own benefit. For an individual’s own retirement benefit, there is an 8% increase in benefits for each year delayed, up to age 70. Or, a surviving spouse may elect to receive their own benefit as early as age 62 and then switch over to the survivor benefit as late as their FRA. Note that survivor benefits, unlike your own retirement benefit, do not increase past your FRA.

6. Other family members may qualify for survivor benefits.

Depending on circumstances, other family members may be eligible for benefits. For example, an unmarried child of the deceased that is younger than age 18 or a parent age 62 or older who was listed as a dependent on the deceased’s tax filings. See the Social Security web site discussion of survivor benefits for more information.

WHAT ARE THE RISKS?

Any information, statement or opinion set forth herein is general in nature, is not directed to or based on the financial situation or needs of any particular investor, and does not constitute, and should not be construed as, investment advice, forecast of future events, a guarantee of future results, or a recommendation with respect to any particular security or investment strategy or type of retirement account. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.

Franklin Templeton, its affiliated companies, and its employees are not in the business of providing tax or legal advice to taxpayers. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties or complying with any applicable tax laws or regulations. Tax-related statements, if any, may have been written in connection with the “promotion or marketing” of the transaction(s) or matter(s) addressed by these materials, to the extent allowed by applicable law. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

Please visit www.franklinresources.com to be directed to your local Franklin Templeton website.

________________________________________

1.If you are still working and have not reached FRA, the timing of claiming benefits can have an impact on the amount of Social Security benefits you receive. For 2024, your Social Security benefits are reduced by $1 for each $2 in earnings above $22,320. A higher earnings amount ($59,520 for 2024) applies during the year of attaining FRA. If retirement benefits are withheld because of earnings, benefits will be increased starting at FRA to take into account benefits that were withheld.