As part of its year-end deliberations to avoid a government shutdown, Congress passed legislation to eliminate two provisions that have reduced or eliminated Social Security benefits for certain public employees. The bill was signed into law on January 5, 2025.

The Social Security Fairness Act will eliminate the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO), which have impacted public pension workers trying to claim Social Security benefits. The WEP affects a worker’s own Social Security retirement benefits, while the GPO may impact spousal or survivor benefits.

Since these provisions were introduced decades ago, the number of individuals affected by the rules has grown. Today, nearly three million individuals receive reduced Social Security benefits annually, according to the Congressional Research Service.1

The WEP was introduced with legislation in 1983 to address emerging solvency issues associated with Social Security. Both the WEP and GPO (established in 1977), were intended to modify Social Security benefit formulas for people who received compensation not subject to Social Security payroll taxes from receiving overly generous payments based on their earnings covered by Social Security.

WEP and GPO only apply for workers in certain states where public employers don’t participate in the Social Security system, such as public-school teachers in 15 states. These states include Alaska, California, Connecticut, Georgia, Illinois, Kentucky, Louisiana, Massachusetts, Maine, Missouri, Nevada, Ohio, Rhode Island and Texas. There are additional states where other public employees may be impacted.

The law eliminates these provisions effective at the beginning of 2024, so impacted program beneficiaries will receive retroactive adjustments to their benefit payments. Retirees affected by the change may receive benefits that would have been due to them in 2024. The Social Security Administration is expected to announce how these retroactive benefits will be paid.

The legislative change is not without criticism, however. The Congressional Budget Office (CBO) estimates that eliminating the WEP and GPO will cost the federal government more than $200 billion over the next 10 years. Certain lawmakers have expressed concern about the impact of these new changes on the overall solvency of the Social Security Trust Fund.

Pension income may have reduced benefits prior to these changes

Public employees (such as schoolteachers) slated to receive a pension, may have faced challenges if they hoped to include Social Security in their retirement planning. If an individual worked in a job that does not withhold Social Security payroll taxes, receiving a pension may result in the reduction or elimination of their Social Security benefits (assuming they also worked in a job covered by Social Security and were eligible for benefits).

Background on the WEP

The WEP ensured that workers employed in jobs that were covered by Social Security as well as public-sector employment not covered by Social Security were treated the same as government workers in jobs that did not pay into Social Security during their entire working careers. Under this provision, Social Security benefits may be reduced but not totally eliminated. For more information on how the reduction in benefits is calculated, see the Windfall Elimination Provision online calculator. If a worker had at least 30 years of employment in a job covered by Social Security and also received a public pension, the WEP did not apply.

Prior to the WEP, those who worked primarily in a job not covered by Social Security but had some employment history with a job that was covered, were considered long-term, low-wage workers. They received a Social Security benefit based on a higher percentage of their earnings due to how benefits are calculated.

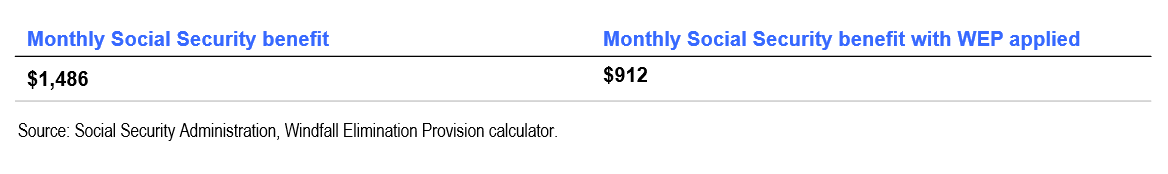

Consider this example of how the WEP reduced a retiree’s Social Security benefit:

- A 67-year-old retiree receiving $5,000 per month in pension income from public employment where Social Security payroll taxes were not withheld

- This retiree also worked in the private sector for 10 years earning an average of $100,000 annually

In this example, the retiree’s monthly Social Security check was reduced by $574, resulting in a loss of nearly $7,000 in annual income.

Background on the GPO

The GPO provision affected individuals who earned a pension where the public employer did not withhold Social Security and who are now applying for Social Security spousal or survivor benefits based on the spouse’s earnings history. In this case, benefits would be reduced by two-thirds of the amount of the pension income. For example, consider a retiree who receives a public pension of $750 per month and applies for Social Security spousal benefits. The monthly check for Social Security spousal benefits would be reduced by two-thirds of the monthly pension amount, which in this case would be $500.

Legislation becomes law: Looking ahead

From a planning perspective, retirees who have been receiving reduced payments may want to revisit their income plans going forward to account for a change in their benefit amount. For example, while individual circumstances may vary widely, estimates from the National Education Association (NEA) suggest the average benefit would increase by $360 per month. Current workers may want to modify their retirement plans to account for this higher benefit amount in the future and adjust their financial planning strategies.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal.

Any information, statement or opinion set forth herein is general in nature, is not directed to or based on the financial situation or needs of any particular investor, and does not constitute, and should not be construed as investment advice, forecast of future events, a guarantee of future results, or a recommendation with respect to any particular security or investment strategy or type of retirement account. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.

Franklin Templeton, its affiliated companies, and its employees are not in the business of providing tax or legal advice to taxpayers. These materials and any tax-related statements are not intended or written to be used, and cannot be used or relied upon, by any such taxpayer for the purpose of avoiding tax penalties or complying with any applicable tax laws or regulations. Tax-related statements, if any, may have been written in connection with the “promotion or marketing” of the transaction(s) or matter(s) addressed by these materials, to the extent allowed by applicable law. Any such taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com. Investments are not FDIC insured; may lose value; and are not bank guaranteed.

Copyright © 2024 Franklin Templeton. All rights reserved.

_______________________________

1. Source: “Social Security: The Windfall Elimination Provision (WEP),” Congressional Research Service, February 2024 (Data as of 2023).

Ref. 3718908