Of all recent economic trends, sluggish employment growth is perhaps the most important for investors to watch, for three reasons.

First, because it’s holding back growth and fueling inflation pressures. Second, because it makes it harder to reduce income inequality. Third, because it undermines future employment growth by slowing the build-up of skills in the labor force and pushing companies toward automation.

What is happening to the US labor market, and why? Below I assess the five key issues:

- Lower labor force participation

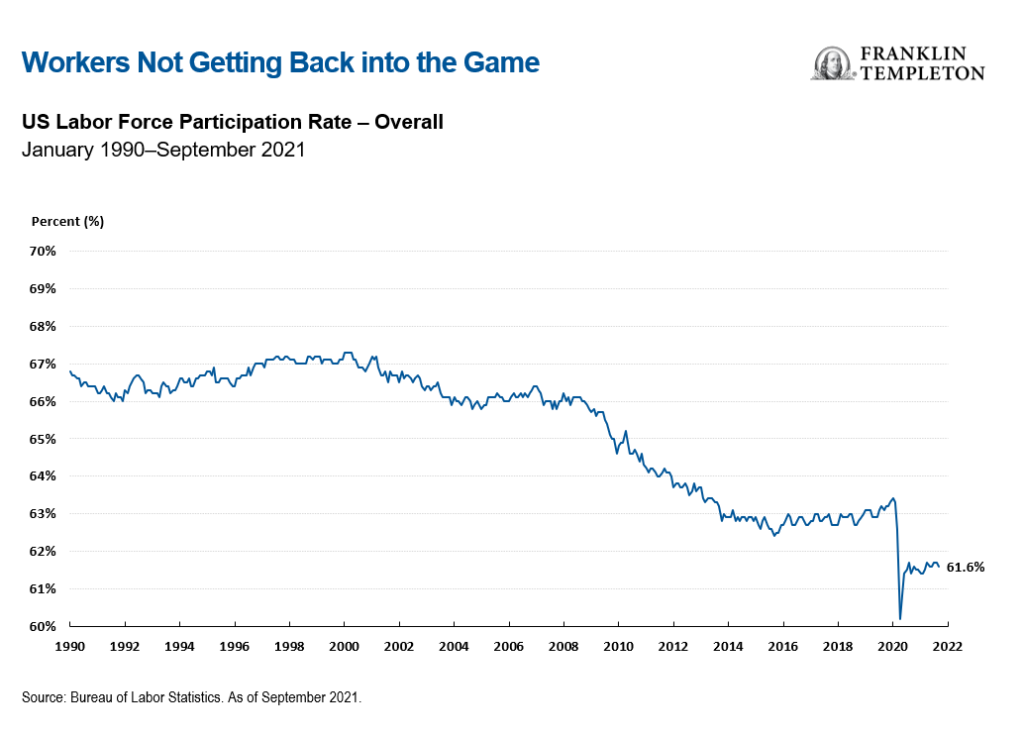

While labor demand has been recovering at a strong pace, many workers don’t seem to want to get back into the game. Labor force participation suffered a prolonged decline between 2000 and 2015, stagnated for a few years, and finally began a timid recovery in 2018-19, but the pandemic lockdowns knocked it down again and now it seems unable to get back up.

This is partly due to older workers who decided to retire earlier (the 65+ age labor force is running approximately 1 million workers below the 2007-2019 trend); but partly to younger workers sitting on the sidelines—the participation rate for people of prime working age (25 to 54 years old) is 1-½ percentage points below the pre-COVID peak.

- Rise in job switching

Much like in real estate, it’s a seller’s market. US job openings hover at around 11 million, and with lots of work opportunities on offer and limited competition, more workers are quitting their jobs: with the exception of the financial services and information industries, quit rates are well above their 2017-2019 average, and they correlate rather well with the abundance of job openings (also measured as excess over the 2017-2019 average). Quit rates are especially high in leisure and hospitality, but well above pre-pandemic levels also in manufacturing, retail trade and wholesale trade.

Quitting pays: wage gains for workers who switched jobs are much higher than for those who stayed in their current positions.

- Rise in self-employment

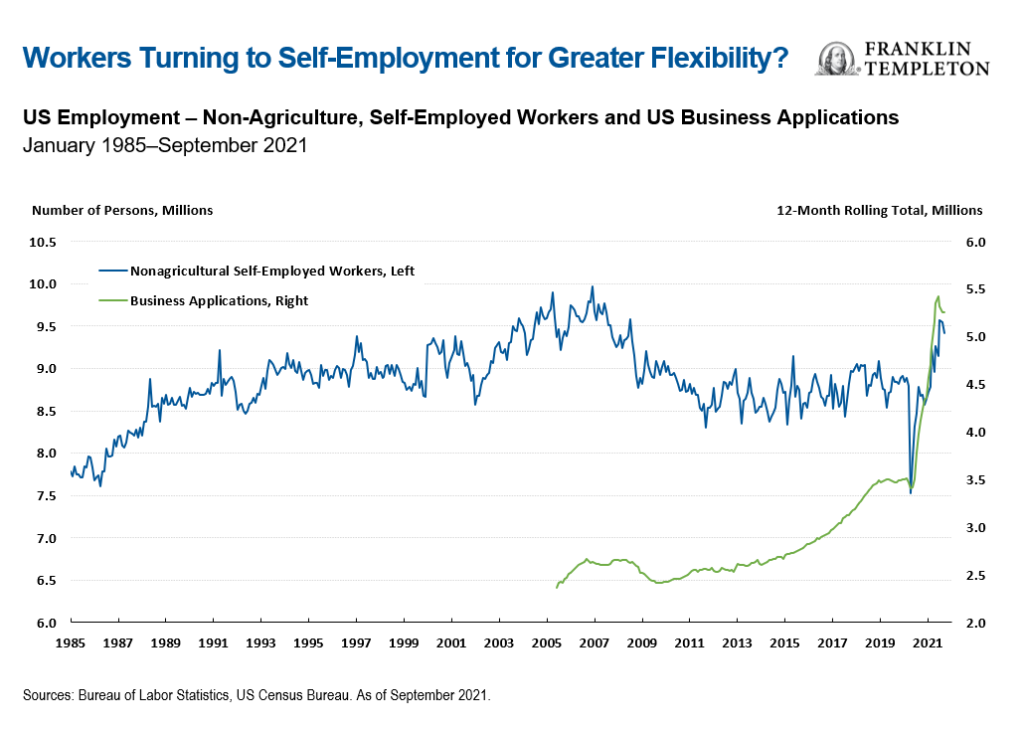

To make matters worse (for companies), self-employment has surged. The US Bureau of Labor Statistics reports a one million increase between November 2020 and September 2021. New business applications have risen sharply.

So even at a time when companies are granting more flexibility in working hours and location, many people prefer to strike out on their own. This upswing in entrepreneurial spirit reduces even further the pool of potential workers that companies can tap.

- What skills gap?

Some analysts and pundits have blamed the slow job recovery on a skills gap, arguing that the pandemic has changed the sectoral composition of the economy so that some skills that would get you a job two years ago are no longer in demand.

This makes little sense given that vacancies are especially high in leisure and hospitality, where most jobs do not require specialized skills. And companies are getting so desperate for workers that they would be happy to offer training to new workers.

- Higher government subsidies

Other factors holding back labor supply might be COVID-related: people worried about catching the virus at work, or reluctant to comply with vaccine mandates, or unable to secure childcare.

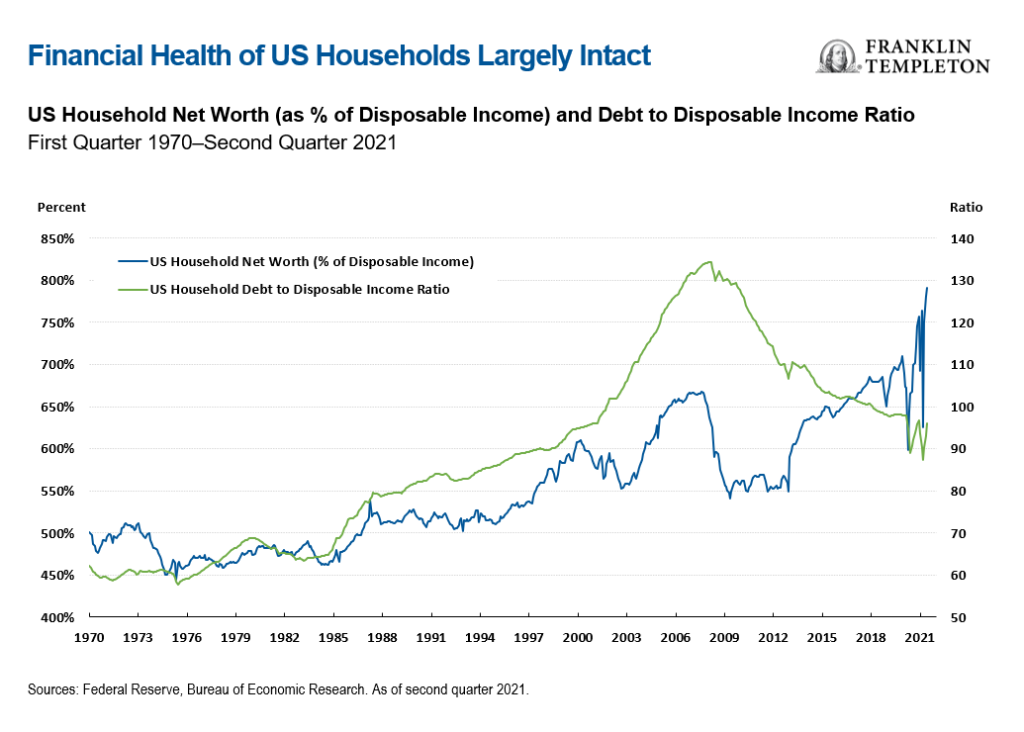

But probably more important is that households came out of the pandemic in a strong financial position, with high levels of financial assets and savings; and many households are still benefiting from generous government support.

Although the supplemental US federal unemployment benefits of US$300/week expired on September 5, state unemployment benefits will remain in place for anywhere between 16-26 weeks. These average US$319, or 26% of the average weekly wage. And 39 million American families are also eligible for the 2021 enhanced child tax credit, so households with two children, for instance, could receive an additional US$500-$600 (US$250 to US$300 per child) per month between July and December. That raises the wage coverage ratio to roughly 36%, and the government plans to augment it and extend it. Congress has also made available some US$46 billion in rental assistance to low-income households, and the Biden administration’s “Build Back Better” plan includes additional assistance in various forms, such as two years of free community college, expanded Medicare and Medicaid, twelve weeks of paid family leave, tax credits and government financing for affordable housing.

Higher inflation has triggered a sizeable 5.9% cost of living adjustment (COLA) for Social Security beginning January 2022 (the highest since the 7.4% increase in 1982), affecting nearly 50 million retirees and their dependents. Retirees’ pensions should be protected from inflation, but this also implies that rising prices will not induce older workers to get back into the labour force.

The Build Back Better plan meanwhile promises more subsidies to households, and some of these subsidies will also discourage work because they would be discontinued when a person takes a job.

In short, generous government support makes it easier—and rational—for more people to decide not to work. A number of people are staying out of the workforce because they can.

Investment implications

All these factors suggest that the labor market response will remain sluggish for quite a while. Over the past couple of decades labor had lost bargaining power, and its share of income has declined in favor of profits. This is now reversing, due also to the retreat of globalization and the government’s friendly attitude toward trade unions. This is not necessarily a bad thing, but in the short term, it is unambiguously inflationary. True, this is not like the 1970s, when wages were often indexed to past inflation; still, today employers have to raise wages to attract workers, and they have sufficient pricing power to pass higher costs down into higher prices.

US policymakers are quietly abandoning the “transitory inflation” argument, and the likelihood of rising prices and interest rates is higher than it’s been in the last several years. This reinforces the investment implications that our Franklin Templeton Fixed Income team has been pushing: limit duration exposure, and look for strong fundamentals to select opportunities in high yield corporate bonds, bank loans, municipal bonds and emerging markets.

For the medium term, the implications are more complex. If weaker labor supply dynamics become entrenched, they will tend to lower potential growth; technological innovation and automation will push in the opposite direction, boosting productivity. The net effect is as uncertain as it is important—with weaker economic growth, higher debt levels and rising social security obligations would jeopardize financial stability and could cause major bouts of volatility in asset prices. Stronger economic growth would have a stabilizing effect, but the combination of faster technological innovation, lower labor force participation and higher government subsidies could entrench and perhaps worsen income inequality.

An acceleration in labor supply would be the best guarantee of stronger and healthier economic growth.

For now though, investors had better prepare for sluggish labor supply, persistent inflation and rising financial volatility.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Bond prices generally move in the opposite direction of interest rates. Investments in lower-rated bonds include higher risk of default and loss of principal. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realized. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.