Investor attention is now focused on the immediate challenge that central banks face in recalibrating policy against rising inflation. That’s a crucial issue. But we should pay even more attention to the perilous multi-year adjustment process that lies ahead, during which markets will have to relearn to price risk without the central banks’ ever-present safety net.

In recent weeks the Federal Reserve (Fed), the Bank of England (BoE), and then the European Central Bank (ECB) have all surprised markets with hawkish turns in rhetoric and, in the BoE’s case, in policy. It really should not have come as such a big surprise. Supply side constraints in the global economy are proving a lot more persistent than policymakers hoped, for at least three reasons: (1) supply chain disruptions continue to plague manufacturing and distribution channels; (2) vaccines have shown limited effectiveness in curbing contagion, limiting the labor supply recovery; (3) and China’s zero-COVID policy threatens further disruptions to global supplies.

On the other side of the ledger, demand remains relatively buoyant, boosted by the lifting of COVID-19 restrictions and by generous fiscal and monetary policy support, even though high inflation is beginning to pose a headwind by eroding purchasing power.

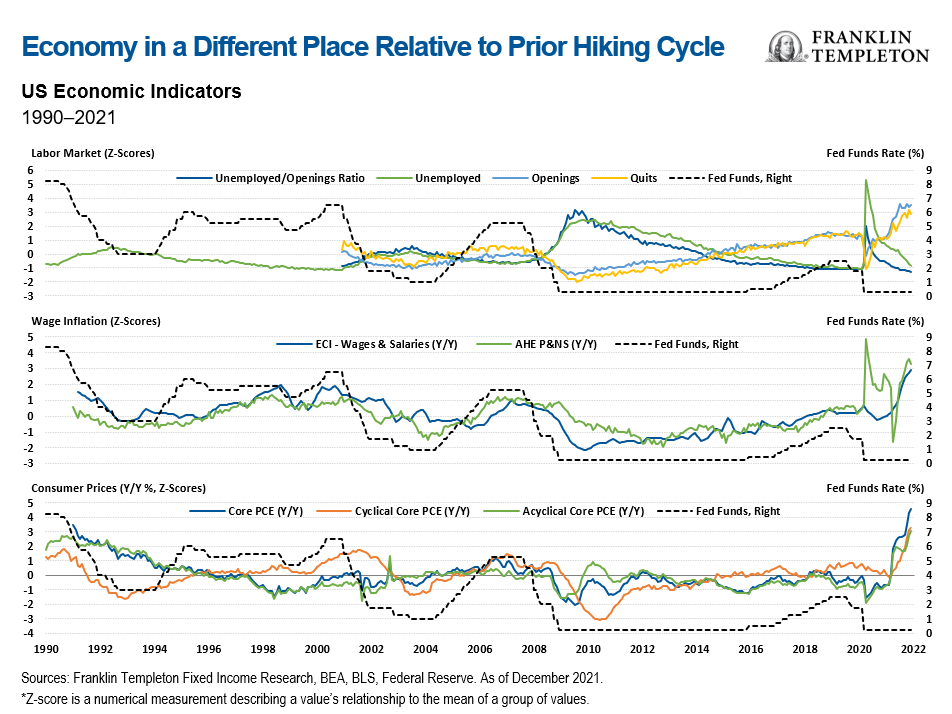

The consequences are playing out as common sense would suggest: inflation has taken off, reaching 40-year records in the United States and Europe. With inflation so high for so long, inflation expectations have de-anchored from central banks’ targets and moved significantly higher; wage pressures have already risen in the United States and might soon do so in Europe. A monetary policy shift seems logical and is long overdue. As my colleague Nikhil Mohan points out in a forthcoming note, most macro indicators including labor market slack, wages and inflation are running considerably hotter now than when the Fed launched the 2004-2006 hiking cycle, which brought policy rates up by 425 basis points to 5.25%.

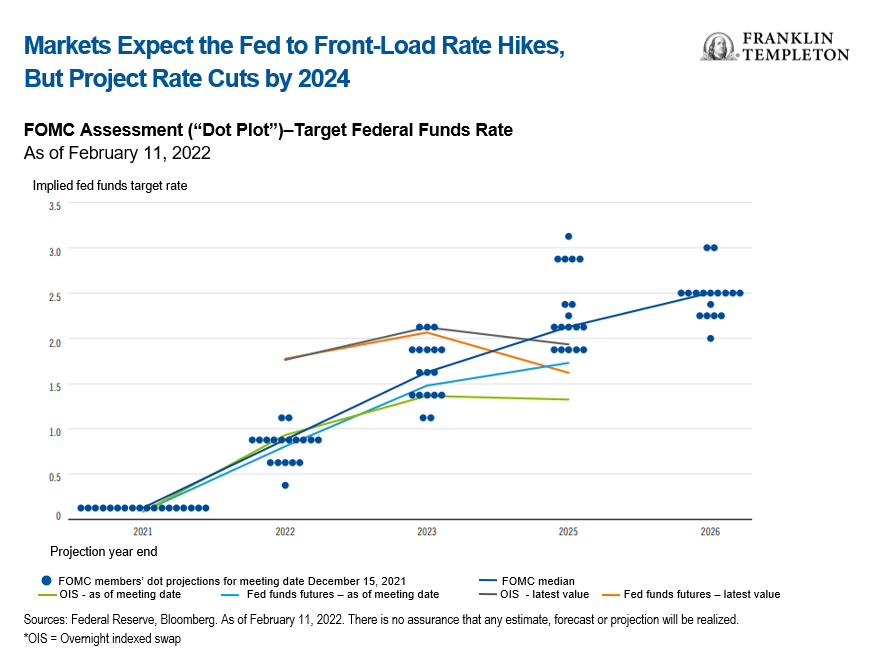

Even with this recent policy shift, reality has not fully sunk in yet. The Fed, based on its “dot plot,” expects to bring inflation back under control while keeping negative real interest rates all along. Most investors seem to agree, as markets appear to be pricing a short hiking campaign, with the fed funds policy rate peaking around 2.2% by 2023, then with rate cuts to follow by 2024. This in turn would imply that investors expect one of two scenarios: (i) a shorter economic expansion relative to any in the past four decades, or (ii) that the Fed will once again blink as long end rates move higher and step back in to support asset prices. In Europe, a significant share of market participants seems horrified by the ECB’s hawkish turn and appears to think that any rate hike this year would be an unforgivable policy mistake.

This reaction is at odds with the macro environment, and highlights the major adjustment needed to get back to some degree of normalcy. Economic growth has bounced back nicely once economies were allowed to reopen; as countries learn to coexist with a much less dangerous version of the virus and the protection offered by vaccines, new lockdowns appear unlikely; labor markets are at or close to full employment. Even if you believe that inflation pressures will eventually self-dissolve, there is no plausible justification for central banks to keep expanding their balance sheets and hold interest rates at zero. And yet, this is exactly what the Fed and ECB are still doing, even as their rhetoric has changed.

And in my view, inflation is unlikely to abate quickly. In the United States, monthly inflation has averaged 0.6% over the last six and 12 months, and 0.5% over the last 18 months. Even if it dropped to 0.3% starting in February, annual inflation would still be running above 5% through September and end the year at 4%—twice the Fed’s target. This might in fact be an optimistic scenario, especially with rental inflation set to remain elevated for much of this year.

Yet, markets still seem to entertain a much more benign view of the inflation outlook. The Bloomberg consensus for year-end US Consumer Price Index (CPI) inflation stands at 3.1%.1 Even before January’s expectations-beating print, this would have required the rather heroic assumption of monthly inflation averaging under 0.3% over 2022. After January’s number, it would require monthly inflation to average just over 0.2% for the remainder of the year. This seems less and less likely; as I’ve noted in previous commentaries, the longer inflation stays high, the more it feeds into price and wage-setting behavior. And with geopolitical tensions on the rise, energy prices appear unlikely to cool off.

Markets seem to still be clinging to the mindset of the last ten years, when inflation was stuck at low levels and the Fed could afford to prioritize asset prices without compromising price stability. But the world has changed. High inflation has become a prominent economic and political problem, and the Fed cannot ignore it.

I suspect the Fed will need to enact a significant policy tightening to bring inflation back under control. A 50 basis-point first hike in March now seems less far-fetched, as St. Louis Fed President James Bullard has indicated. Perhaps more importantly, monetary tightening will likely need to include a meaningful shrinking of its balance sheet—quantitative tightening—as some Fed officials have already foreshadowed. I expect this will cause the yield curve to steepen, with 10-year yields potentially reaching 3% by the end of the year, albeit with significant volatility along the way.

The upswing in inflation is a global trend; indeed, as US inflation spiked to 7.5%, eurozone inflation has already risen well above expectations to 5.1%, the highest ever in the common currency’s history. The ECB acknowledged that inflation will remain high for several months, and though it expects price pressures to abate in the second half of the year, risks are squarely to the upside. Wage pressures have remained well-behaved so far, but this might not last long, with persistently strong inflation and a tight labor market. The ECB therefore will likely raise rates this year, and my guess is that by the second half of the year, nobody will be criticizing the ECB for being too hawkish—the question will be whether it’s still way behind the curve.

As major central banks refocus on inflation control, they will no longer have the luxury to step in with new liquidity injections whenever financial markets sell off. Markets, in turn, will need to re-learn how to appropriately price asset risk in the absence of a reliable central bank-provided safety net. This will not be easy. Over the past decade, central banks have played a dominant role in financial markets, and their constant presence as a large, non-price-sensitive buyer has significantly distorted asset prices. A generation of traders and investors has grown up in this world and knows no other.

Get ready for a rocky multiyear adjustment in financial markets.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Bond prices generally move in the opposite direction of interest rates. Investments in lower-rated bonds include higher risk of default and loss of principal. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without prior written permission from Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The underlying assumptions and these views are subject to change based on market and other conditions and may differ from other portfolio managers or of the firm as a whole. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. There is no assurance that any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets will be realised. The value of investments and the income from them can go down as well as up and you may not get back the full amount that you invested. Past performance is not necessarily indicative nor a guarantee of future performance. All investments involve risks, including possible loss of principal.

Any research and analysis contained in this material has been procured by Franklin Templeton for its own purposes and may be acted upon in that connection and, as such, is provided to you incidentally. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although information has been obtained from sources that Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and may be subject to change at any time without notice. The mention of any individual securities should neither constitute nor be construed as a recommendation to purchase, hold or sell any securities, and the information provided regarding such individual securities (if any) is not a sufficient basis upon which to make an investment decision. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC, member FINRA/SIPC, is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

__________________________________

1. There is no assurance that any estimate, forecast or projection will be realized.