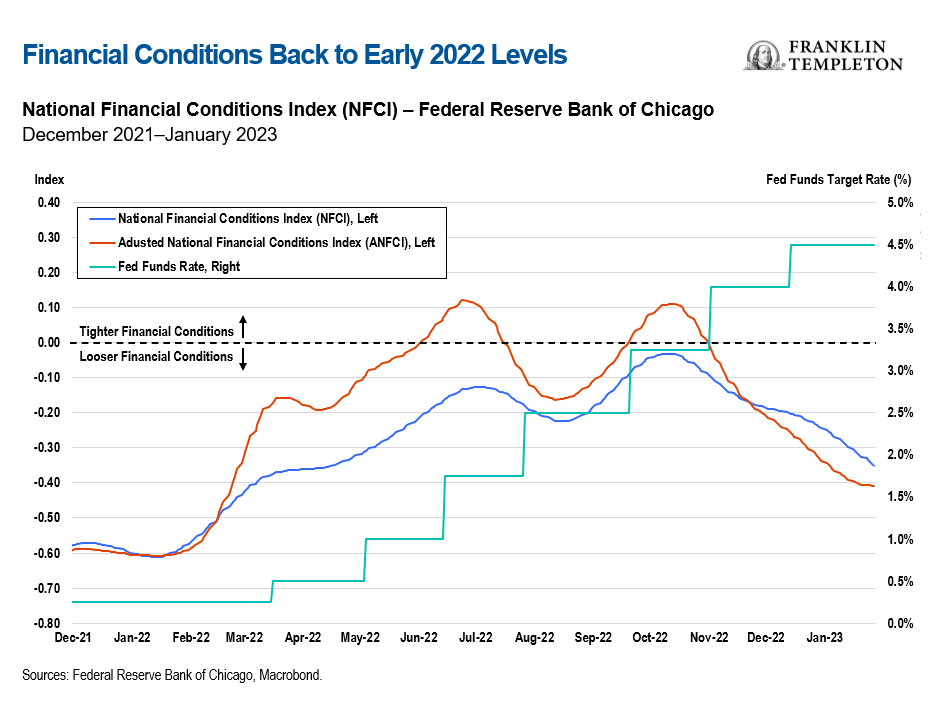

Much like financial conditions have eased back to early 2022 levels (over 400 basis points of rate hikes ago…), the press conference following the Federal Reserve’s (Fed’s) January 31-February 1 policy meeting seems to have turned back the clock to at least pre-Jackson Hole, if not all the way to the Fed’s “inflation is transitory” days.

This was a very dovish press conference—surprisingly so—and financial markets have rightly taken it as such.

The most surprising and dovish part was Fed Chairman Jerome Powell’s repeated arguments that financial conditions have tightened significantly over the past year. The truth is that they had temporarily tightened between August and early October, when the Fed had signaled a more determined anti-inflation stance but have loosened significantly thereafter. At the end of January, financial conditions were back at the early-April 2022 levels, and that was before the rally in US Treasuries and equities that this Fed press conference ignited. This has de facto undone all of the monetary policy tightening to date. In the question-and-answer part of the conference, Powell did not push back against this loosening in financial conditions, and therefore validated it.

Powell went through his stable of hawkish arguments, but he sounded like he was going through the script and did not truly believe it. To me, it all sounded rather perfunctory and half-hearted.

He did say that the labor market is still too tight, but he added that gave him hope that disinflation could be achieved with minimum loss of jobs. He noted that there is no evidence yet of disinflation in core non-housing services—which account for about half of the Fed’s core inflation measure—but at times sounded confident that disinflation in this key category will soon come. He did warn that if the Fed’s expectations of a recession-free, steady but slow decline in inflation bear out, there will be no rate cuts this year. However, he followed it with the disclaimer that forecasting inflation is very hard and the Fed has gotten it wrong so far, which might suggest that perhaps financial markets are right in expecting faster disinflation.

Even more important was what Powell did not say. He did not push back against the loosening in financial conditions, and in responding to a question, he declined to acknowledge that it would make the Fed’s job harder, raising inflation risks and potentially requiring more monetary tightening. Nor did he say that the exceptional strength of the job market makes it unlikely that we will see wage growth fall to levels consistent with the inflation target.

Markets believe that the war against inflation has already been won, and Powell sounded like he wants to believe that, too.

To be sure, there are some reasons to be a bit optimistic. Inflation has declined. Some measures of wage growth, notably the Employment Cost Index, have come down from very elevated levels. Housing inflation will eventually slow as well, once new and lower rental contracts start feeding into the index. And some of the delayed impact of the Fed’s rate hikes still needs to be felt.

That’s why financial markets think the war against inflation has already been won.

And that’s why the Fed can entertain the hope that inflation can be brought to heel with minimal damage to employment and asset prices. After all, as was pointed out in the question- and-answer session of the Fed meeting, we’ve seen a decline in both inflation and wage growth even though the unemployment rate remains at a 50-year record low, and job openings continue to vastly outnumber job seekers.

That hope came through very strongly in some of Powell’s comments. And it’s a hope we all share.

However, there are important reasons to fear that the path ahead will be a lot more challenging.

- The loosening in financial conditions has offset all of the Fed’s rate-hiking effort; this will give a respite to the real estate sector, and support an economy that has already proved quite resilient. This is worth emphasizing—financial conditions have loosened so much that it’s as if the Fed’s rate hikes never happened.

- The labor market remains exceptionally tight. The latest Job Openings and Labor Turnover Survey (JOLTS) numbers show the ratio of vacancies to unemployed is almost back to its high of two openings for every job seeker. While we have not seen a wage-price spiral when inflation was powered to 8%-9% by exogenous shocks, various measures of wage growth are still running in the range of 4%-6%, which might make it a lot harder to push inflation below 4%-5%—considering also that workers have already surrendered a lot of purchasing power.

- And while Powell claimed that short-term inflation expectations are now also well-anchored, the most recent New York Fed survey has them at 5% (one-year ahead), which seems more consistent with current 4%-6% wage growth than with the Fed’s 2% inflation target.

I think markets—and at this stage the Fed as well—are too sanguine on the inflation outlook.

Powell claims that the Fed prefers to run the risk of tightening too much than too little, but the opposite appears to be true. The Fed seems now too tempted by the possibility of achieving the Holy Grail, of bringing inflation down from 9% to 2% while retaining full employment all along, and with minimal, short-lived damage to financial asset prices. It will most likely hike one more time, maybe two, in the coming meetings, and then pause to assess the incoming data. That’s a perfectly sensible strategy. But by validating hopes of a “painless landing,” and giving markets license to rally even more, the Fed exacerbated the risk that after a rapid decline driven by vanishing supply shocks, inflation might rebound and get entrenched at a stubbornly elevated level, say somewhere in the 3%-5% range.

That’s the scenario the Fed says it wants to avoid; but it’s a scenario that the Fed is making increasingly likely.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the portfolio’s value may decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value.

IMPORTANT LEGAL INFORMATION

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market. All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own financial professional or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Distributors, LLC, One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com – Franklin Distributors, LLC is the principal distributor of Franklin Templeton U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.